Getting logistics right

|

| Byron Patching |

Vietnam today exemplifies the opportunities that can be harnessed by successful distribution. The nation’s shift from a centrally-planned economy to a market economy has transformed the country into a lower middle-income nation regarded as one of the most dynamic young markets in Southeast Asia.

The country’s population reached about 95 million in 2017, up from about 60 million three decades ago, and is expected to expand to 120 million by 2050. Significantly, it is a young population that is increasingly drawn to urban centres.

Examples of Vietnam’s rapid social change can be found in a number of significant indicators. According to the World Bank, in 1993 only 14 per cent of the population used electricity as their main source of lighting in rural areas. By 2016 this grew to 99 per cent. Similarly, in 1993, 36 per cent of the population had access to sanitation facilities. By 2016, it was 77 per cent. Rural access to clean water has also improved dramatically, up from 17 per cent in 1993 to 70 per cent in 2016. Access to these services in urban areas is above 95 per cent today.

Now, a united government whose policies are helping drive the nation’s resurgence, has enabled Vietnamese people to focus their energy in productive and enterprising ways. Vietnam’s economy is performing well, buoyed by global growth and domestic reforms.

Growth after rebuilding

The World Bank Market Overview confirms that Vietnam’s GDP increased by 7.1 per cent year-on-year between 1993 and 2016, from $13.2 billion to $205.3 billion. This growth is in large part due to Vietnam’s new-found status as a key manufacturing hub in Asia, especially for Chinese, Japanese and South Korean companies. Vietnam has lower manufacturing wages, averaging around $2,900 a year in 2016, with a focus on the hubs of Hanoi and Ho Chi Minh City.

The solid growth is boosting job creation and income growth, leading to broad-based welfare gains and poverty reduction. The economic growth has sparked the emergence of a growing middle class, characterised by expanding demand for consumer products. Demand has shifted from basic goods to high-end, value-added, and aspirational ones.

Vietnamese households are spending their new-found wealth on fridges, tables, chairs, motorbikes, cars, mobile phones, and other consumer goods. Wholesale and retail businesses are the biggest drivers of Vietnam’s economic growth, with e-commerce undergoing rapid expansion.

Consumer demand for value-added goods is most definitely on the rise, but this demand, coupled with Vietnam’s challenging topography, is driving the need for a world-class supply chain.

|

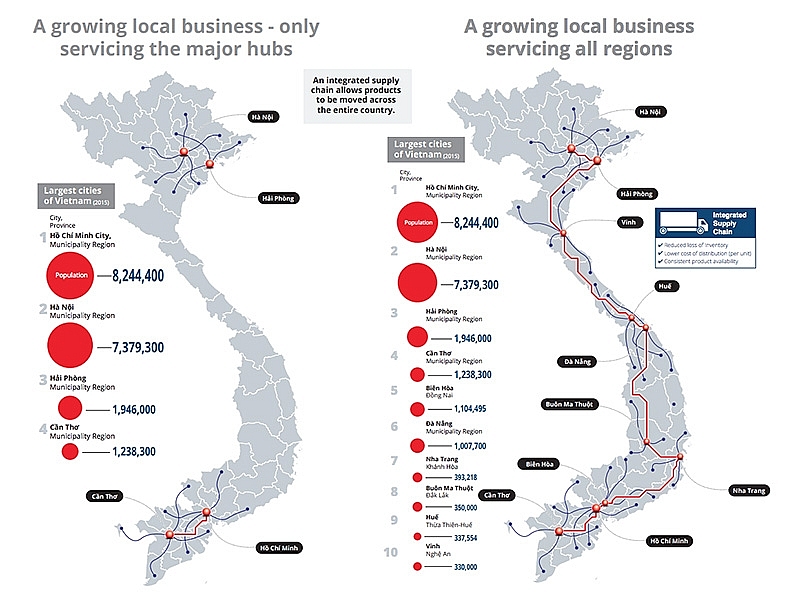

| World-class networks mean greater access to goods throughout the country, rather than focusing on Vietnam’s major centres. This takes growth pressure off the bigger cities, creating greater economic opportunities across regional areas. |

The heart of supply chains

Vietnam is a long, narrow country with challenging natural topography and features. Its size, together with rising consumer demand, has led to an exponential increase in products moving around the country, not to mention in trade flows. The result is that dramatic supply chain innovation is critical in meeting current distribution demand, as well as forging viable pathways for future growth.

Due to the rapid retail expansion in Vietnam, suppliers that once delivered to two or three local stores now need to deliver to hundreds if not thousands of stores spread throughout Vietnam. In addition, there are more and more large-format and mini stores opening every year so the pressure to deliver across the country is increasing.

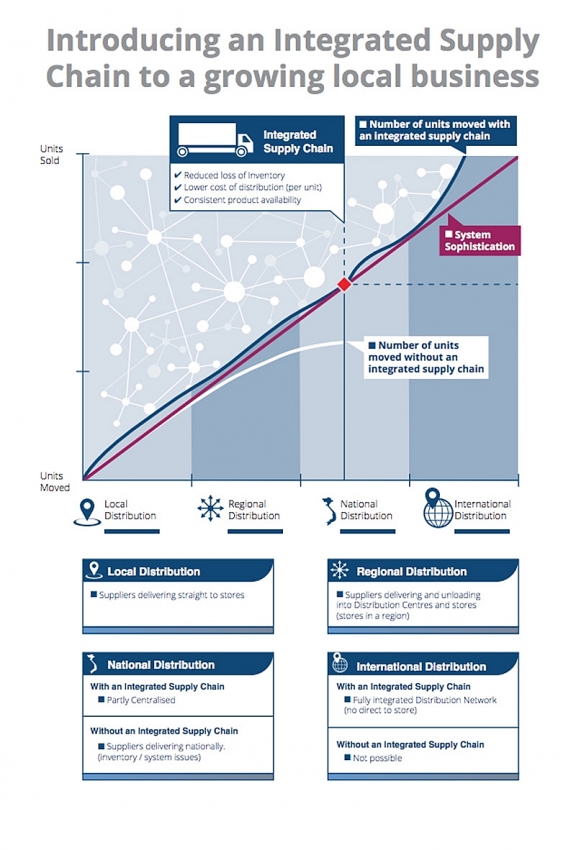

Due to the expansion of the delivery destinations, Vietnam is ready to progress to a national integrated supply chain model. The integrated model features centralised distribution centres for retailers with suppliers delivering to large distribution centres rather than directly to store.

Other features of the integrated model are enhanced warehouse and transport systems, and stock replenishment systems. In addition, larger freight vehicles are needed to reduce the number of transport movements whilst increasing the volume of products provided through each delivery.

The movement towards integrated supply chains is driving structural shifts in logistics operations related to property, people, system, freight, and supporting infrastructure.

Businesses in developed countries have refined their network designs through years of maturation to a system that now affords significant gains over potential competitors and creates substantial cost-savings and revenue opportunities. It is now Vietnam’s opportunity to bring its logistics network up to international standards.

Effective transport and logistics are critical factors to successful nation-building. As retailers open more stores, the growth in the volume of business affords them better buying power with suppliers. This, in turn, enables better efficiencies, driving further expansion either nationally or even across borders to neighbouring markets. Naturally, these businesses are also generally more competitive, enabling them to create more value for customers, and lower prices, whilst expanding their range.

As the new generation of consumers becomes more affluent and savvy, retail trends now evolving in developed markets can be expected to also spread in East Asia. These trends – smaller order sizes, shorter delivery windows, increasing customer service expectations – will make it imperative for organisations wishing to make a successful entry into the Vietnamese market to get their distribution network design just right.

|

| There’s an exciting opportunity in Vietnam to learn from these evolutionary steps to quickly move to a centralised system of supply chain and to do so very efficiently. These efficiencies improve profitability and reduce inventory, creating savings that can be passed on to customers and promote competition. |

World-class expertise with local knowledge

Given the obvious benefits of implementing efficient supply chains at the earliest stage in Vietnam’s new age, it is clear that a world-class understanding of every aspect of supply chain design and optimisation is critical.

Equally important is local knowledge of the cultural realities at play. The success of any supply chain strategy in Vietnam depends on achieving a deep understanding of local nuances, commercial strategies, and governmental policy-setting objectives.

World-class supply chain expertise applied to the Vietnamese market is critical to enabling retailers, businesses and logistics operators to evolve rapidly. By adopting international best practices coupled with local knowledge, entrants into the Vietnamese market have an opportunity to leapfrog many evolutionary lessons and implement world-class systems from scratch.

Vietnam has an opportunity to leapfrog developed market supply chain evolution and head directly to the world’s best practices.

One of the problems with improving the performance of a supply chain is the already embedded investment in legacy buildings, infrastructure, and systems.

As Vietnam is growing so quickly, there is an opportunity to move straight to the world’s best practices in the areas of industrial property, building fitout, and systems in particular. In addition, there is an opportunity to move to more progressive commercial relationships with suppliers that directly address the integrated supply chain model.

By adopting international best practices, coupled with local knowledge, entrants into the Vietnamese market have an opportunity to leapfrog many evolutionary lessons and implement world-class systems from scratch.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Hermes joins Long Thanh cargo terminal development (February 04, 2026 | 15:59)

- SCG enhances production and distribution in Vietnam (February 04, 2026 | 08:00)

- UNIVACCO strengthens Asia expansion with Vietnam facility (February 03, 2026 | 08:00)

- Cai Mep Ha Port project wins approval with $1.95bn investment (February 02, 2026 | 16:17)

- Repositioning Vietnam in Asia’s manufacturing race (February 02, 2026 | 16:00)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

- Navigating venture capital trends across the continent (February 02, 2026 | 14:00)

- Motivations to achieve high growth (February 02, 2026 | 11:00)

- Capacity and regulations among British areas of expertise in IFCs (February 02, 2026 | 09:09)

- Transition underway in German investment across Vietnam (February 02, 2026 | 08:00)

Mobile Version

Mobile Version