Financial stability key to green finance for plastics industry

|

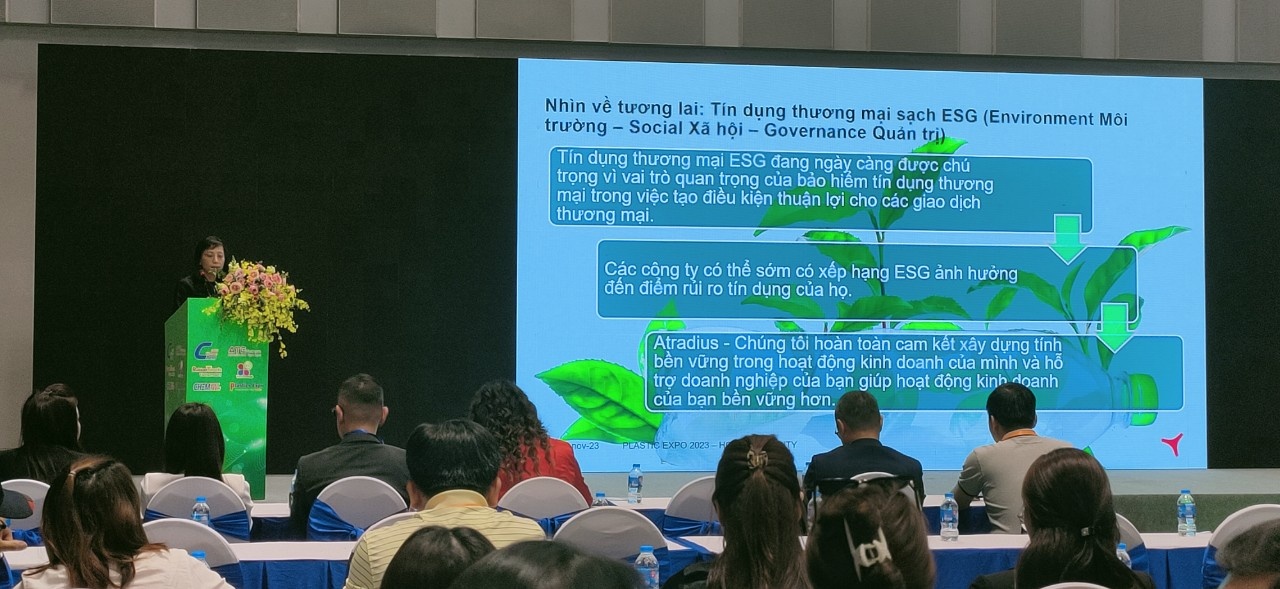

These insights were shared at a media roundtable on the importance of financial stability in attracting investment to the plastics sector held by Atradius, a major global provider of trade credit insurance (TCI) and information services. The discussion was organised on the last day of the 2023 Vietnam Plastic Expo at the Saigon Exhibition and Convention Center on November 17.

Representatives from Atradius Vietnam, the Vietnam Saigon Plastics Association (VSPA), and the media attended the event.

The plastics industry had been experiencing an annual growth rate of 12-15 per cent over the past five years. However, the industry experienced an on-year decline of 12.2 per cent in exports in the first nine months of 2023.

Chung Tan Cuong, chairman of the VSPA said, “One of the key growth factors over the next few years will be to acquire more green investment. Plastics firms will need to focus more on providing comprehensive and transparent data for investors to evaluate their businesses to access these green resources. Merely producing eco-friendly products won't be enough."

Many firms are actively addressing potential liquidity challenges through in-house retention and customer credit risk management, often in collaboration with financial institutions. One such option that has gained traction is TCI, which helps businesses mitigate risks and ensure financial stability. Atradius, the world’s second-largest credit insurer with a 25 per cent global market share, has been working with VSPA to understand and address the challenges firms have in securing green finance.

“We often refer to TCI as a shield that helps sales teams confidently sell to their clients. With TCI, plastic businesses will be able to minimise trade risk and foster sustainable growth. Moreover, TCI can enhance a company's creditworthiness, making it easier to secure financing, including green loans,” said Vu Thi Duc Hanh, country manager of Atradius in Vietnam.

Atradius, with its expertise in TCI and financial solutions, can provide insights into payment practices, cash flow management, and liquidity solutions, enabling plastic businesses to adopt strong credit risk management strategies, especially when considering and working with new customers.

| M&A still in vogue despite economic headwinds Vietnam’s mergers and acquisitions (M&A) market has maintained its appeal amid a challenging economic environment. Huong Trinh of BDA Partners spoke with VIR’s Thanh Van about the appetite of foreign investors in Vietnam’s M&A market. |

| M&A builds up steam in finance sector There are financial sector rumblings in mergers and acquisitions in Vietnam, with vast interest from overseas due to the nation’s robust growth prospects and rising profile as a prime investment destination in the region. |

| Key drivers remain same for cross-border M&A transactions For the last 12 years, RECOF Vietnam has been fostering cross-border deals initiated in Vietnam. VIR’s Bich Ngoc talked with Masataka “Sam” Yoshida, head of the Cross-border Division of RECOF Corporation, on his assessment of Japan’s capital flows into Vietnam. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Banking sector targets double-digit growth (February 23, 2026 | 09:00)

- Private capital funds as cornerstone of IFC plans (February 20, 2026 | 14:38)

- Priorities for building credibility and momentum within Vietnamese IFCs (February 20, 2026 | 14:29)

- How Hong Kong can bridge critical financial centre gaps (February 20, 2026 | 14:22)

- All global experiences useful for Vietnam’s international financial hub (February 20, 2026 | 14:16)

- Raised ties reaffirm strategic trust (February 20, 2026 | 14:06)

- Sustained growth can translate into income gains (February 19, 2026 | 18:55)

- The vision to maintain a stable monetary policy (February 19, 2026 | 08:50)

- Banking sector faces data governance hurdles in AI transition (February 19, 2026 | 08:00)

- AI leading to shift in banking roles (February 18, 2026 | 19:54)

Tag:

Tag:

Mobile Version

Mobile Version