Dai-ichi Life Vietnam ties up with banking partners

To facilitate the goal, the life insurance company has automated insurance business processes, diversified premium payment channels, and made heavy investments in service and product quality to optimise the customer experience by applying modern technology and online solutions.

With support from Dai-ichi Life Group and Dai-ichi Life Asia Pacific, Dai-ichi Life Vietnam has implemented the coordination project to build Financial Ecosystem with banking partners since the third quarter of 2022. It aimed to bring the best experiences to the banks' customers and consultants by unlocking the strengths of each partner.

Saigon-Hanoi Bank (SHB) is the first partner of Dai-ichi Life Vietnam. The two sides have formed a comprehensive partnership with a three-year roadmap (2022-2025), starting with the development of priority features for customers on the SHB SAHA e-banking app in September 2023.

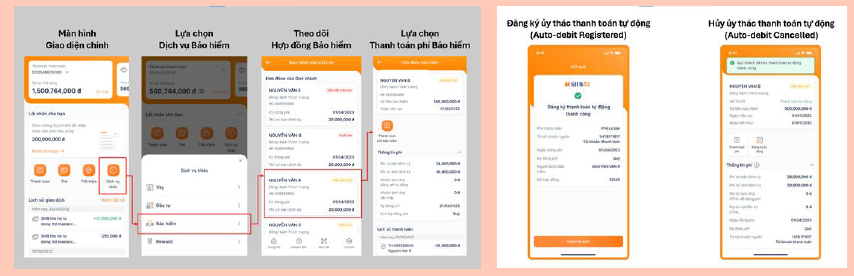

Dai-ichi Life Vietnam and SHB are two of the pioneers in deploying the "Insurance Dashboard" on the bank's digital channel. Accordingly, customers can enjoy an improved digital experience, easily manage their insurance contracts, and perform services through one touchpoint in the SHB SAHA app. Specifically, in the first phase until the end of 2023, SHB and Dai-ichi Life Vietnam have coordinated to deploy features on the SHB SAHA application.

Customers can proactively track the list of contracts, pay their own insurance premium, and track payment history. Also, customers can pay insurance premiums for the first year and periodically for subsequent years of insurance contracts in which they are not the contract owner or participate through other channels. They can register or cancel registration for automatic premium payments.

|

| Customer's journey on using the dashboard of SHB SAHA |

In addition, Dai-ichi Life Vietnam and SHB are evaluating the effectiveness of the solution to build insurance management features on SHB's Customer Relationship Management system, creating a favourable experience for the bank's consultants.

In 2024, Dai-ichi Life Vietnam and SHB will focus on solutions to improve the quality of consulting and customer service, along with optimal and personalised financial and protection solutions for customers of both sides.

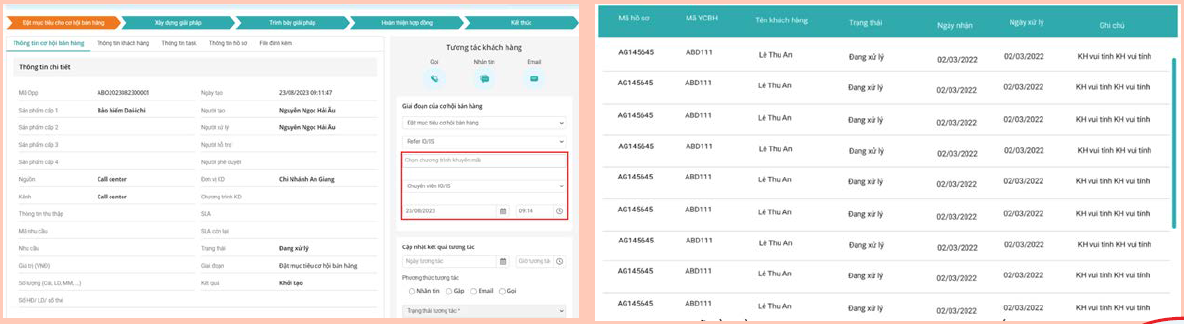

An Binh Commercial Joint Stock Bank (ABBANK) is the second partner of Dai-ichi Life Vietnam to co-develop a financial ecosystem for sales teams since May 2022. The two sides have embarked on integrating ABBANK's CRM system and the Life Insurance Customer Referral System of Dai-ichi Life Vietnam.

Accordingly, ABBANK's referral staff only needs to log in to the CRM system to perform insurance operations. This helps ease login and data entry operations on Dai-ichi Life Vietnam's referral system.

Thus, the bank's referral staff can introduce potential life insurance customers. Meanwhile, the bank's managers can approve information about potential customers before referring them to Dai-ichi Life Vietnam's financial consultants.

It also helps track processing information, consulting customers, and closing life insurance contracts for Dai-ichi Life Vietnam's financial consulting team.

|

| The interface of ABBNK's CRM system shows how staff introduce potential customers and track the process of consulting customers |

In October 2021, Dai-ichi Life Vietnam and Sacombank rolled out the new product, K-Care Cancer Insurance, into the market. Distributed online on the Sacombank Pay app, it offers customers a financial backup with simple procedures, convenient online payment, and quick completion of insurance contracts.

Dai-ichi Life Vietnam has also tied up with other banking partners to provide life insurance contract management utilities for customers on banks' digital platforms, such as premium payment and automatic payment entrustment on SacomPay and LienViet24h, as well as automatic fee reminders (auto-bills) on SacomPay.

In addition, the life insurance company also constantly improves support systems for the sales team, such as the Expanded Distribution Channel Portal (AD Portal), Sales Opportunity Management System (Referral System), and Activity Management System (SAM), to facilitate technology integration in the ecosystem.

With its customer-centric business philosophy and commitment to sustainable development, Dai-ichi Life Vietnam will coordinate with banking partners to build a comprehensive digital finance and insurance ecosystem to bring outstanding values and the best experience to customers, partners, employees, and financial consulting teams.

| Dai-ichi Life Vietnam: Delivering lifelong healthcare to customers As health and peace of mind are top concerns for Vietnamese people nowadays, Dai-ichi Life Vietnam has made ongoing efforts to bring the most advanced healthcare and financial protection solutions to customers with the aim to becoming Vietnam’s leading comprehensive health insurance provider. |

| Dai-ichi Life Vietnam wins two regional awards at Asia Pacific Enterprise Awards 2021 Dai-ichi Life Insurance Company of Vietnam Ltd. (Dai-ichi Life Vietnam) was crowned in the categories of Corporate Excellence and Inspirational Brand. The awards ceremony was held at Gem Convention Centre in Ho Chi Minh City on February 25. |

| LienVietPostBank and Dai-ichi Life Vietnam sign exclusive 15-year agreement On November 22, LienVietPostBank and Dai-ichi Life Insurance Company of Vietnam (Dai-ichi Life Vietnam) held the signing ceremony for the exclusive bancassurance agreement at JW Marriott in Hanoi. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Hanwha Life hosts training course in South Korea for Vietnamese fintech talents (November 20, 2025 | 09:51)

- Insurers accelerate post-typhoon recovery (October 28, 2025 | 15:31)

- Shinhan Life Vietnam builds growth on people strategy (October 07, 2025 | 09:45)

- Insurance sector initiates rapid response after Typhoon Bualoi devastation (October 03, 2025 | 18:25)

- Non-life insurers face mounting pressure after typhoon hits motor sector (October 02, 2025 | 18:59)

- Prudential Vietnam delivers responsible investment package (September 25, 2025 | 10:37)

- Insurers struggle to keep pace with EV rapid adoption (August 29, 2025 | 17:12)

- Non-life insurance market in sees bright spots in H1 despite rising challenges (August 28, 2025 | 16:21)

- Life insurance rebounds with renewed growth and trust (August 06, 2025 | 18:04)

- Global Care launches Vietnam’s first insurance KOL platform (July 25, 2025 | 09:42)

Tag:

Tag:

Mobile Version

Mobile Version