Carmakers ride on despite sales dip

|

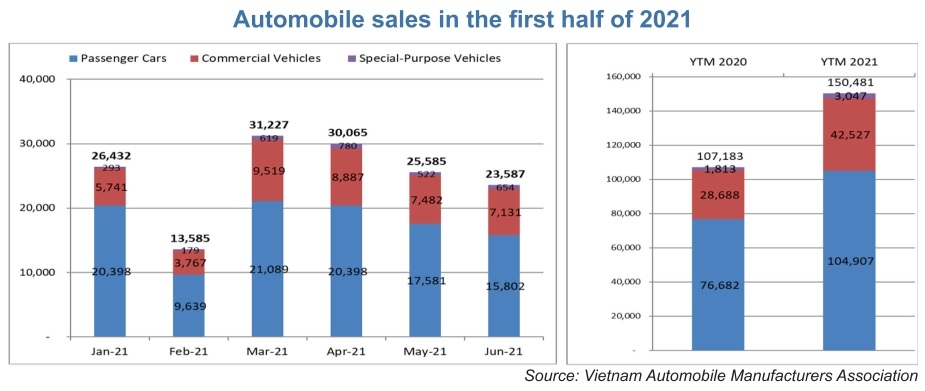

According to the Vietnam Automobile Manufacturers Association, Vietnamese consumers bought 150,481 units, up 40 per cent on-year in the first six months of 2021, in which passenger vehicles saw sales rise 37 per cent, and commercial vehicles grew 48 per cent.

The recovery of the car market has nevertheless slowed in 2021 as many dealers such as Toyota, Ford, and Mitsubishi in Ho Chi Minh City, Hanoi, and other provinces had to suspend operations to adhere to social distancing measures.

For June only, the total industry reached 23,587 units, down 8 per cent on-month, of which 15,802 units were passenger cars (down 10 per cent versus the previous month), and commercial vehicles at 7,131 units (down 5 per cent).

Among automobile manufacturers and traders in Vietnam in June, except for VinFast, Honda, and Suzuki, which still maintain growth momentum, the sales of the remaining car manufacturers in the market have all decreased significantly. This includes Ford, which saw sales drop 23 per cent, while Mazda and Mitsubishi witnessed a fall of 25 and 33 per cent, respectively.

Southern cities and provinces, including key markets such as Ho Chi Minh City, Dong Nai, and Binh Duong – which account for nearly 45 per cent of the country’s monthly auto sales – saw car consumption in June only make for nearly 40 per cent.

“The auto business has never been as difficult as it is now; the impact of the new wave of COVID-19 continues to drag sales down,” said one Ho Chi Minh City car dealer. “Even the number of cars that have signed sales contracts and are deposited by customers must be kept in storage because they cannot be registered, causing a burden for dealers.”

Meanwhile Dang Quan, head of sales at a Hyundai showroom in Hanoi, said that the sales fell quite sharply in June compared to the previous month, but the trend was not a surprising one.

Quan added that the global shortage of semiconductor chips has also affected the production and assembly of domestic vehicles as well as the import of many car models to Vietnam for distribution.

A representative of Truong Hai Auto Corporation (THACO) predicted in local newswires that the number of locally-assembled cars to the market will decrease in the near future, which will lead to an increase in car prices, especially with imported cars. Therefore, domestic assemblers have been trying their best to minimise the impact on customers.

Japanese carmaker Toyota Vietnam previously admitted delay of delivery of some imported models due to limited supply. But, although the global shortage of semiconductor chips has not affected Toyota Vietnam’s production so far, big risks remain.

In order to maintain sales, carmakers including Toyota, Honda, Mazda, Nissan, Mitsubishi, and Hyundai are in a race to launch the best updates and models and accompanying campaigns.

Updated models include the Toyota Vios, Hyundai Santa Fe, Isuzu D-Max, Mitsubishi Attrage, Volkswagen Tiguan, Mercedes C-class and E-class, and BMW Series 5.

A survey of dealers found that the Vietnamese auto market has been recording the deepest price drop since 2017 in many brands. The retail prices of most popular car models are decreasing (even with models down to hundreds of millions of VND) compared to the listed prices associated with promotions, incentives, and special offers including the registration fee cuts.

Honda has offered its CRV preferential Civic model at a reduction of VND40-60 million ($1,700-2,600) per unit. Toyota Vietnam meanwhile opened a promotional programme to reduce VND20-30 million ($870-1,300) per unit compared to the listed price for some models, while the high-end line being distributed by THACO in the Vietnamese market such as the BMW 3-Series, BMW 530i, and BMW 740Li has seen a reduction of VND180-200 million ($7,800-8,700) per unit.

According to experts, despite the application of many measures to stimulate demand, it is forecast that car sales will continue to decline in the coming months due to the restrictions being placed in key markets. In addition, next month is the lowest shopping period of the year, which will place even tougher challenges on the business activities of car manufacturers as well as the auto market as a whole.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Ho Chi Minh City launches plan for innovation and digital transformation (February 25, 2026 | 09:00)

- Vietnam sets ambitious dairy growth targets (February 24, 2026 | 18:00)

- Masan Consumer names new deputy CEO to drive foods and beverages growth (February 23, 2026 | 20:52)

- Myriad risks ahead, but ones Vietnam can confront (February 20, 2026 | 15:02)

- Vietnam making the leap into AI and semiconductors (February 20, 2026 | 09:37)

- Funding must be activated for semiconductor success (February 20, 2026 | 09:20)

- Resilience as new benchmark for smarter infrastructure (February 19, 2026 | 20:35)

- A golden time to shine within ASEAN (February 19, 2026 | 20:22)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

Tag:

Tag:

Mobile Version

Mobile Version