Nickel potential eyed up by major players

According to the International Nickel Study Group, global primary nickel production is forecast to reach 3.12 million metric tonnes in 2022, a rise of around 10 per cent from 2021, while the demand is seen at 3.04 million mt in 2022, an increase of about 18 per cent from 2021.

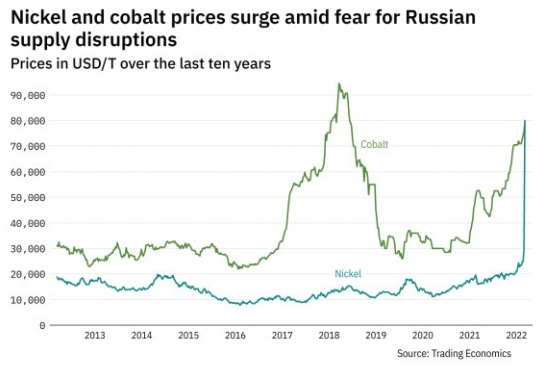

Last week, the nickel price was around $33,000 per mt, a 100 per cent increase in comparison with last year, although the price fell quickly from the historical level of over $100,000 per tonne on March 8, which caused the London Metal Exchange to suspend the trading of nickel on all venues for the rest of the day.

Dao Duy Anh, head of the National Institute of Mining-Metallurgy Science and Technology, said, “The demand for nickel will increase significantly worldwide as the scale of battery and electric vehicle production is more expanded.”

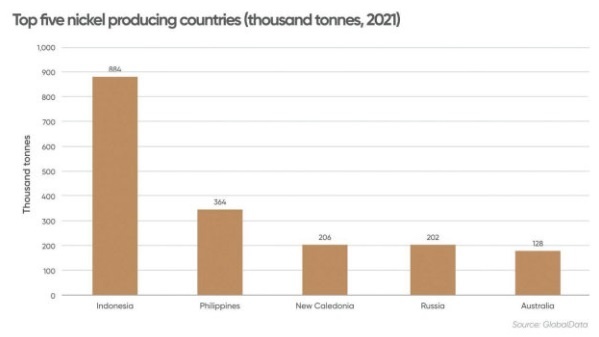

Nickel is mainly used in the production of stainless steel and other alloys, and can be found in batteries, mobile phones, medical equipment, and many other products. The biggest producers of nickel are Indonesia, the Philippines, and Russia.

Total nickel reserves and resources in Vietnam are currently estimated at 3.6 million tonnes, mainly in Thanh Hoa, Son La, and Cao Bang provinces, according to the National Institute of Mining-Metallurgy Science and Technology.

|

|

The nickel price fluctuation came amid widening Western sanctions against Russia, including Russian banks from the SWIFT international payments system. Given that Russia’s nickel ore accounts for 11 per cent of the global supply, and its pure nickel accounts for 20 per cent, the impact is not surprising, analysts said.

Last year, Vingroup began constructing the VinES battery factory in Vung Ang Economic Zone in the central province of Ha Tinh, marking its a significant step in the group’s strategy, in which Vingroup aims to procure batteries from the world’s top manufacturers and collaborate with partners to produce the world’s best batteries, backed by in-house research and development.

Bui Quang Ha, chairman at gold and nickel group Cavico Ltd., said that the volatility of the market along with supportive policies from the government are great opportunities for mineral investors in Vietnam. At the same time, the holding and mining of nickel will help ensure great profits.

“Improving the recovery efficiency of nickel and other useful metals in low-concentration nickel mines will be increasingly profitable. By doing so, Vietnam will become a major partner of countries with high demand for nickel,” Ha added.

The price hike also brought a windfall for Australian multi-metal miner Blackstone Minerals, who considered Vietnam a reliable and equitable jurisdiction for nickel production and export as the Indonesian ore export ban came into effect in 2020.

Scott Williamson - Managing director Blackstone Vietnam has the potential to become a major player in the nickel market, and this is underpinned by the quality of the existing reserves as well as the overall geological potential. Although Blackstone quickly identified the nickel potential of the northern province of Son La’s Ta Khoa district, the region is largely underexplored with further dedicated exploration required. But the potential there is huge, thus unlocking this value will take several years. Therefore, our short-term priorities are very focused. Having said this, Blackstone is interested in collaborating in other opportunities for nickel mines in Vietnam, given our ambitions to build a large downstream refinery in northern Vietnam to produce nickel precursors for the battery industry. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- MAE names big 10 policy wins in 2025 (February 06, 2026 | 08:00)

- US firms deepen energy engagement with Vietnam (February 05, 2026 | 17:23)

- Vietnam records solid FDI performance in January (February 05, 2026 | 17:11)

- Site clearance work launched for Dung Quat refinery upgrade (February 04, 2026 | 18:06)

- Masan High-Tech Materials reports profit: a view from Nui Phao mine (February 04, 2026 | 16:13)

- Hermes joins Long Thanh cargo terminal development (February 04, 2026 | 15:59)

- SCG enhances production and distribution in Vietnam (February 04, 2026 | 08:00)

- UNIVACCO strengthens Asia expansion with Vietnam facility (February 03, 2026 | 08:00)

- Cai Mep Ha Port project wins approval with $1.95bn investment (February 02, 2026 | 16:17)

- Repositioning Vietnam in Asia’s manufacturing race (February 02, 2026 | 16:00)

Tag:

Tag:

![[Infographic] AMATA: Industrial and Smart City Developer](https://vir.com.vn/stores/news_dataimages/2026/022026/12/16/croped/amata-industrial-and-smart-city-developer-20260212165823.jpg?260212050401)

Mobile Version

Mobile Version