IDICO sells out at IPO

|

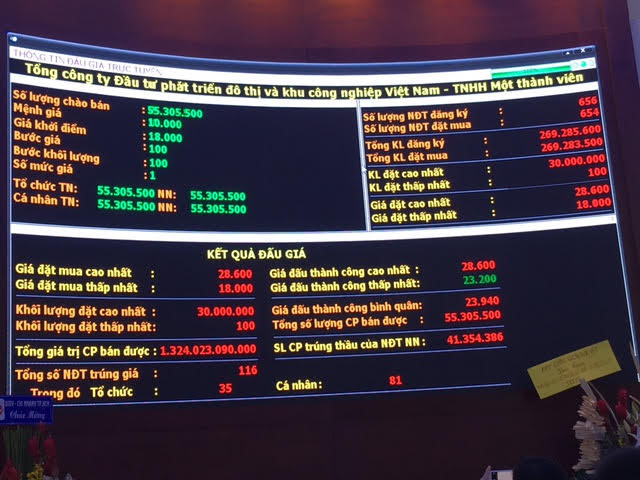

| The result of IDICO's IPO |

Notably, foreign investors succeeded on acquiring 41.35 million out of 55.3 million offered shares, equaling 74.8 per cent of the offered shares.

IDICO earned VND1.32 trillion ($57.98 million) on the IPO, selling 55.3 million offered shares at the average buying price of VND23,940 ($1.05) apiece. The lowest winning bid was VND23,200 ($1.02) and the highest VND28,600 ($1.26).

The event attracted the participation of 582 domestic individuals, 25 domestic organisations, and 40 international organisations, and nine individual foreigners, with the total registered share volume of 269.82 million, five times higher than the offered figure.

Along with the shares put on sale at its IPO, IDICO will put another 45 per cent stake, equalling 135 million shares, on sale to strategic investors. After the sales, the government will also offload its 36 per cent controlling stake in IDICO after December 31, 2018.

Previously, at the roadshow to introduce investment opportunities in IDICO organised on September 21, IDICO general director Nguyen Van Dat announced listing the company on the Ho Chi Minh Stock Exchange (HoSE) after 90 days of its IPO.

Being considered one of the “industrial park typhoons” of Vietnam, IDICO’s IPO garnered attention from both domestic and foreign investors. Besides, the race to become a strategic investor of IDICO has been heating up due to the entrance of heavyweights.

Dat stated at the earlier road show that 12 investors expressed their interest in becoming strategic investors of IDICO.

According to newswire Diendandoanhnghiep, three of these 12 investors, namely Kinh Bac City Development Holding Corporation, Bitexco Group, and SSG Group, already submitted the deposit.

IDICO operates in three major fields. First is investing and trading in technical infrastructure in industrial parks, the second is manufacturing and trading power, and the last one is real estate. One of the important criteria in selecting strategic investors is that investors must have experience in at least one of these sectors.

The race is quite tight because each enterprise has different strengths in different sectors.

Notably, in the industrial park sector, KBC is considered a heavyweight as it is one of their core sectors of operation. With 14 years of experience in this sector, KBC manages 5,154 hectares of land to develop IPs, making up 6 per cent of the country total. Meanwhile, IDICO currently holds 3,271ha of land, but the occupancy rate in IDICO’s IPs is quite low, thus the co-operation with KBC will help IDICO to improve the occupancy rate in IPs thanks to KBC’s management experience.

Regarding the power sector, Bitexco is far ahead the competition. Bitexco has invested in 10 hydropower plants and runs 18 hydropower plants across the country with a total capacity of 1,000MW.

Regarding the real estate sector, all three enterprises regard it as one sector of the core operations, with all of them being well-known across the real estate industry, boasting of large-scale projects. SSG has Saigon Pearl, Pearl Plaza, Bitexco with Bitexco Financial Tower, The Manor, JW Marriot Hotel, while and KBC has large-scale infrastructure projects in operation.

As of June 30, 2017, IDICO owned an equity of VND2.85 trillion ($125.2 million). It targets to reach the average annual growth of 15 per cent in revenue and profit within the next three years. In the 2018-2019 period, IDICO expects to earn VND15.57 trillion ($683.9 million) in revenue and VND669 billion ($29.4 million) in pre-tax profit.

| RELATED CONTENTS: | |

| IDICO offers IPO share volume for foreign investors | |

| IDICO reveals criteria for strategic investors | |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- Citi sharpens its focus on institutional banking (February 09, 2026 | 19:58)

- SSC steps up engagement with FTSE Russell on market reforms (February 09, 2026 | 17:33)

- IFC considers $50m trade finance guarantee facility for Nam A Bank (February 09, 2026 | 17:28)

- Hoa Phat Agricultural Development debuts shares on HSX (February 06, 2026 | 14:00)

- Vietcap’s VAD 2026 draws strong global investor turnout (February 06, 2026 | 13:30)

- New rules ease foreign access to Vietnam equities (February 05, 2026 | 17:29)

- 0.1 per cent tax proposed on each transfer of digital assets (February 05, 2026 | 17:27)

- Ministry of Finance tightens policy delivery at start of year (February 05, 2026 | 17:26)

- Vietnam steps up market reforms as FTSE Russell reviews upgrade progress (February 05, 2026 | 17:20)

- 2025 profits mixed amid strong energy and farming results (February 05, 2026 | 17:18)

Mobile Version

Mobile Version