VN stocks rebound on bottom-fishing

|

| VN stocks rebound on bottom-fishing |

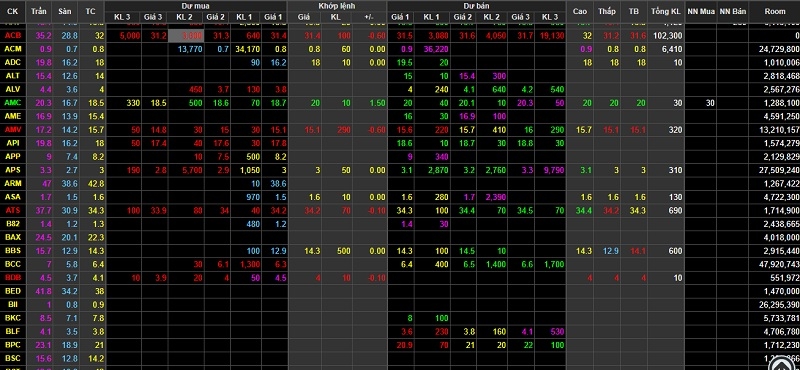

The benchmark VN-Index on the HCM Stock Exchange gained 0.99 per cent to close at 914.99 points, reversing from its loss of 5.7 per cent in the previous two sessions.

The minor HNX Index on the Ha Noi Stock Exchange rose 1.21 per cent to end at 99.99 points after having decreased by a total of 6.9 per cent since Monday.

More than 160 million shares were traded on the two local exchanges, worth VND3.9 trillion (US$170 million).

The trading figures were down 27.6 per cent in volume and 23.5 per cent in value compared to Tuesday’s numbers.

The market trading condition was positive with 242 gaining stocks against 192 declining, while 307 other stocks were unchanged.

Securities, retail and real estate stocks recorded the highest growth rates on Wednesday to bolster the market’s rise, data on vietstock.vn showed.

The capital inflow resulted in 9 of the 20 sectors seeing recovery, according to vietstock.vn, including large-cap stocks in the VN30 basket.

The large-cap VN30 Index was up 1 per cent to 900.89 points, with 19 gainers and nine losers.

Real estate giant Vingroup, the largest stock by market capitalisation, shot up by 5.3 per cent to trade at VND105,000 per share. Nearly 2 million shares were matched.

VIC’s affiliate Vinhomes (VHM) hit the daily limit rise of 7 per cent, touching the ceiling price of VND110,800 per share with the trading volume surging to 1.4 million shares.

The growth of the two pillar stocks has strongly supported the index.

In addition, many large caps such as Masan Group (MSN), FPT Corporation (FPT), Vietinbank (CTG), Asia Commercial Bank (ACB) and VPBank (VPB) also increased across the board, driving up the market.

According to Bao Viet Securities Company (BVSC), the VN-Index tumbled in the beginning before active bottom-fishing demand helped the two indices recover and rally in the last minutes.

However, the recovery of the market had also encountered a huge obstacle from the fall of many other large-caps such as dairy firm Vinamilk (VNM), budget carrier Vietjet (VJC), Techcombank (TCB), PetroVietnam Gas JSC (GAS) and insurer Bao Viet Holdings.

“The rebound today has partly calmed investors and the market is likely to continue rallying before retesting the bottom established earlier. Q2 income statement season will trigger a wide divergence among stocks,” BVSC said in its daily report.

The UPCOM Index on the Unlisted Public Company Market (UPCoM) was up 0.06 per cent to finish at 50.01 points. It had fallen 3.8 per cent on Tuesday.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- Corporate bond market poised for stronger growth cycle (January 28, 2026 | 17:13)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

Tag:

Tag:

Mobile Version

Mobile Version