Vietnam’s retail market takes on much-needed green journey

|

| Trang Bui, country head Cushman & Wakefield Vietnam |

Although Vietnam does not have mandatory regulations applicable to green buildings, green building development is usually carried out in a voluntary and encouraged manner. Many old buildings have been on the market for years with no green certification, and new buildings have the advantage of achieving green building certifications from the get-go.

The number of green buildings in Vietnam has reached over 300 projects with a total area of about 7.2 million square metres of construction floor. Saigon Centre 2 and Estella Place are examples of buildings that have been maintaining green standards with BCA Green Mark certification for many years, with the most recent recertification being in 2023.

AEON Group is also among investors interested in sustainable standards. Among them, the AEON Mall Hue project has earned LOTUS Gold and EDGE certification during the design phase. This is the first commercial centre project in Vietnam to receive EDGE certification.

These certifications recognise the investor’s efforts to incorporate features such as energy-efficient lighting, water-saving fixtures, and green spaces. It also gives developers, retailers, and customers more confidence that the building is built and operated to the highest design.

All of this is just the beginning of a long-term sustainability journey for the retail sector in Vietnam. The addition of green building certifications can help enhance the developer’s corporate image and the reputation of the developments. Another advantage for investors and developers is that environmentally friendly commercial buildings often have higher rents, better market prices, and also more resilient to any market downturn.

Shopping centres continue to optimise operations, upgrade facilities, and adjust the retail brand structure to attract consumers. In particular, sustainability is being valued more than ever by investors, developers, and shopping centre operators.

|

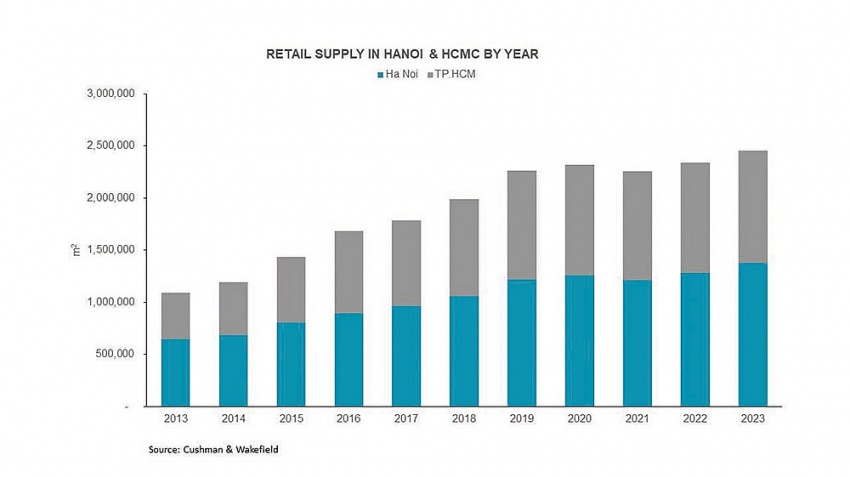

Cushman & Wakefield forecasts that by 2027 there will be 3 million sq.m of retail supply serving the two largest cities. We are seeing investors of new shopping centres and retail spaces gradually paying more attention to green standards from the very first steps of development.

Projects in the development stage such as Lotte Eco Smart City, Empire City in Thu Thiem in Ho Chi Minh City, or part of Starlake Tay Ho in Hanoi are working towards LEED green building certification. Similarly, quite a few commercial centres under construction, such as Tien Bo Plaza in Hanoi, have also registered for the LEED standards assessment.

In addition to achieving green certification, shopping malls are now trying to offer consumers more reasons to visit than just shopping.

Today’s shopping centres are built for all generations and diverse lifestyles. In addition to the food, beverage, and fashion retailers that are considered key in the tenant structure, other functions such as supermarkets, cinemas, children’s play zones, classrooms, sports and fitness, exhibitions, music, outdoor green spaces, and even aquariums are also being incorporated. This is taking place because developers are focusing on adding retail space to extend the time shoppers spend at the premises.

Along with investors and developers, even brands are starting to pay attention to green certificates to demonstrate their commitment to sustainability as well as their responsibility to society. For example, the Pizza 4P brand has just received LEED Gold certification for interior design and construction for their store at Lotte Mall West Lake Hanoi.

Investors, developers, and commercial property owners in Vietnam must now understand the fact that over time, the principles of responsible investing and environmental, social, and governance investing are becoming more and more popular. This has also pushed investors and developers to transform their strategic goals of sustainability into a top business priority in line with capital market requirements, rather than simply developing luxurious buildings.

The next challenge for cities is to ensure green building practices can become the norm. This requires the market to create a business environment that values green spaces and their developers.

For existing shopping centres, there will be a need to refurbish facilities to contribute to reducing carbon emissions. Developers can apply air pollution control measures, use renewable and recycled materials, and apply technology such as green finance, smart devices, sensors, and automation to detect areas that are consuming a lot of unnecessary energy. In addition, shopping centres can restructure inefficient spaces, converting them into greener and more cost-effective spaces.

The long-term fundamentals of Vietnam’s retail market remain strong, including population growth, the increasing popularity of the internet and smartphones, and the development of e-commerce coupled with changes in consumption habits.

Overall, Vietnam’s retail sector is gradually moving towards a more sustainable future. Moving the market towards a greener business environment may still be tough, but with cooperation between all parties in the market, over the next decade, green building will become the new must-have standard for all buildings in Vietnam.

| Retail bets on festive consumer rush Increased consumer demand at the end of the year has opened up the prospect of recovery for retailers after a gloomy business year. |

| Momentum created for retail market Retail businesses are still optimistic about their prospects, with the sector predicted to reach a growth rate of nearly 130 per cent in 2024. |

| Digital forays headline 2024 retail sector Vietnam’s retail sector is poised for a diverse recovery in 2024, driven by shifts towards essential goods, health products, and digital transformation. |

| A retail strategy for brands to tackle Vietnam’s meal tradition Vietnam’s macroeconomic landscape is showing signs of stable recovery, despite challenging global conditions. Amid such uncertainties, consumers are shifting their focus towards essential commodities, particularly food and groceries, thereby reinforcing the significance of home meals. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Citi economists project robust Vietnam economic growth in 2026 (February 14, 2026 | 18:00)

- Sustaining high growth must be balanced in stable manner (February 14, 2026 | 09:00)

- From 5G to 6G: how AI is shaping Vietnam’s path to digital leadership (February 13, 2026 | 10:59)

- Cooperation must align with Vietnam’s long-term ambitions (February 13, 2026 | 09:00)

- Need-to-know aspects ahead of AI law (February 13, 2026 | 08:00)

- Legalities to early operations for Vietnam’s IFC (February 11, 2026 | 12:17)

- Foreign-language trademarks gain traction in Vietnam (February 06, 2026 | 09:26)

- Offshore structuring and the Singapore holding route (February 02, 2026 | 10:39)

- Vietnam enters new development era: Russian scholar (January 25, 2026 | 10:08)

- 14th National Party Congress marks new era, expands Vietnam’s global role: Australian scholar (January 25, 2026 | 09:54)

Tag:

Tag:

Mobile Version

Mobile Version