Vietnam on course to surpass 2023 growth results

The General Statistics Office’s latest scenario on Vietnam’s economic growth notes that, based on the on-year growth of 6.42 per cent in the first half of this year, the Q3 and Q4 on-year rates are expected to stand at 6.53 and 6.1 per cent, respectively, bringing the whole-year growth rate to 6.5-6.6 per cent, which is, however, still lower than the 7 per cent rate currently expected by the government.

|

The economy grew 5.87 per cent in Q1 and 6.93 per cent in Q2.

Vietnam’s total GDP last year hit an estimated $430 billion. A 1 per cent growth rate means an additional $4.3 billion, and an additional 300,000 jobs for the economy.

According to fresh figures released last week by Trading Economics, the S&P Global purchasing managers’ index for Vietnam stood at 54.7 in July, remaining at its highest level since May 2022. New orders grew for the fourth consecutive month, with the expansion rate slightly slower than the near-record pace in June. New export orders also increased, though much softer compared to total new business.

“Consequently, manufacturers ramped up production, with the rate of expansion being the second-fastest on record,” Trading Economics said.

Under Trading Economics’ calculations, enterprises worked to expand capacity by boosting both purchasing activity and employment. Input buying surged, reaching its steepest pace since mid-2022, while staffing levels grew modestly and slower than in June. Furthermore, expectations of continued growth in new orders over the coming year bolstered confidence in the production outlook, although sentiment eased to its lowest level since January.

However, although Vietnam’s industrial manufacturing is maintaining strong growth month-to-month, it does not mean the economy can achieve the growth target of 7 per cent this year or an additional $30.1 billion.

Full-year GDP growth in Vietnam is expected to reach 5.5 per cent by the end of 2024. In the long term, the rate is projected to trend around 6 per cent in 2025 and 6.2 per cent in 2026, according to Trading Economics.

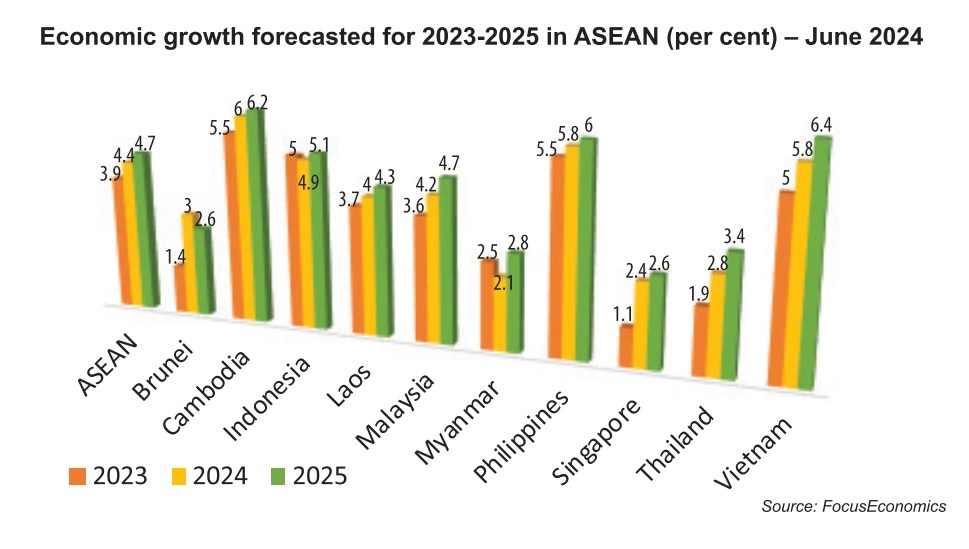

FocusEconomics also predicted that in 2024, Vietnam is poised to be the second-fastest-growing economy in ASEAN after Cambodia (see chart).

“The upsurge in global demand for electronics and IT will be pivotal in driving recoveries in both industrial output and merchandise exports. However, the growth of tourist-related services exports is set to moderate,” FocusEconomics said.

“The primary risk lies in the potential deceleration of external demand. FocusEconomics panellists see GDP expanding 5.8 per cent in 2024, and 6.4 per cent in 2025.”

Other international organisations have also predicted that Vietnam’s economic growth this year will be higher than the 5.05 per cent growth recorded last year.

For example, according to the Asian Development Bank’s (ADB) forecast released a few weeks ago, the growth outlook for Vietnam in 2024 and 2025 remains unchanged at 6 and 6.2 per cent respectively, driven by a strong first-half in 2024. However, trade-related manufacturing - one of its main drivers of recovery - is expected to slow down over the near term, while domestic demand will also remain subdued.

“From now until the end of this year, economic growth is projected to slow down compared to the first half due to lingering difficulties. We do not expect that exports and imports will continue witnessing strong double-digit growth, as we saw in the first half of this year,” said Nguyen Ba Hung, principal country economist at the ADB in Vietnam.

The International Monetary Fund and the World Bank recently have also projected respectively that the Vietnamese economy will increase at 5.8 and 5.5 per cent this year, citing numerous headwinds ahead, such as geopolitical tensions and trade protection policies in many economies.

According to Fitch Ratings, the fiscal and monetary policies of Vietnam have provided assistance for the economy, so that it may grow 6.3 per cent in 2024 and 7 per cent in 2025. The ASEAN+3 Macroeconomic Research Office based in Singapore last month also revised Vietnam’s economic growth forecast upward to 6.3 per cent for 2024 in its latest update.

United Overseas Bank analyst Suan Teck Kin commented, “With Q2 performance above our and market expectations and setting a positive tone, the outlook for 2024 remains bright. However, we caution that the second half of this year is likely to see a more muted performance, due to the higher base in H2 of 2023 as well as downside risks that are still present.”

These include conflicts between Russia and Ukraine and in the Middle East, which could disrupt global trade and energy markets. Nevertheless, Kin said, the recovery in the semiconductor cycle, stable growth in China and the region, and the likely easing of monetary policy by major central banks will be supportive of the outlook.

| Paulo Medas, mission chief for Vietnam International Monetary Fund

Fiscal policy is bolstering economic growth in 2024, given the anticipated public wage increase and ongoing efforts to accelerate public investment. Strengthening fiscal management will be crucial in addressing the challenges ahead. This includes enhancing the composition and quality of public spending and services, improving fiscal planning to better account for the medium- to long-term impacts of ageing and climate change, and bolstering safety nets. Revenue mobilisation will be key to funding social spending, tackling climate change, and addressing the significant infrastructure investment needs. The new Law on Credit Institutions marks a significant step forward and should be complemented by additional measures to strengthen supervision and governance in the financial sector. Further efforts to restore the health of the banking system – including measures to improve asset quality, phase out forbearance measures, and raise bank capital – will strengthen financial stability. Accelerating the resolution of failed banks is essential to limit costs and improve the financial and monetary system’s functionality. Strengthening the insolvency framework and debt enforcement will facilitate corporate restructuring and enhance financial resilience. Revisions to land and real estate laws are welcome to address legal bottlenecks in the sector. Further efforts to restructure weak developers and promote a sound corporate bond market are warranted. |

| Vietnamese economy likely to expand by 6.5 per cent in 2024: Economist The Vietnamese economy is likely to expand by 6-6.5 per cent in the base scenario, with even recovery recorded in all sectors of agriculture, industry, construction and services, Dr. Can Van Luc, a member of the National Financial-Monetary Policy Advisory Council, has predicted. |

| Vietnamese economy proceeding as predicted: experts Vietnam's GDP in the first quarter of 2024 will grow by around 5.5 per cent as predicted, according to experts and thinktanks. |

| Vietnamese economy fared well in Q1 despite external risks The global economy is facing several headwinds, including the slowdown in China and the Eurozone as well as the US Fed's possible delay of interest rate cuts. In this context, ASEAN may be a global safe haven for economic growth. Abel Lim, head of Wealth Management Advisory and Strategy at UOB, discussed with VIR's Thanh Van the outlook of the global economic condition and its impact on Vietnam. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Citi economists project robust Vietnam economic growth in 2026 (February 14, 2026 | 18:00)

- Sustaining high growth must be balanced in stable manner (February 14, 2026 | 09:00)

- From 5G to 6G: how AI is shaping Vietnam’s path to digital leadership (February 13, 2026 | 10:59)

- Cooperation must align with Vietnam’s long-term ambitions (February 13, 2026 | 09:00)

- Need-to-know aspects ahead of AI law (February 13, 2026 | 08:00)

- Legalities to early operations for Vietnam’s IFC (February 11, 2026 | 12:17)

- Foreign-language trademarks gain traction in Vietnam (February 06, 2026 | 09:26)

- Offshore structuring and the Singapore holding route (February 02, 2026 | 10:39)

- Vietnam enters new development era: Russian scholar (January 25, 2026 | 10:08)

- 14th National Party Congress marks new era, expands Vietnam’s global role: Australian scholar (January 25, 2026 | 09:54)

Tag:

Tag:

Mobile Version

Mobile Version