Vietnam not letting up in free trade deal bonanzas

|

| Vietnam not letting up in free trade deal bonanzas |

The Ministry of Industry and Trade (MoIT) this month underlined the urgent need for Vietnam to expand export markets to take advantage of economic links due to a seven-month reduction of exports and imports, and in order to enhance national economic status in the international arena.

In the first seven months of this year, Vietnam’s total goods export and import turnover is estimated to be $374.23 billion – down 13.9 per cent on-year “due to colossal difficulties in the global market”, according to the MoIT.

This includes $194.73 billion worth of exports, down 10.6 per cent; and $179.5 billion for imports, down 17.1 per cent. Total trade surplus hit $15.23 billion, which is over 11 times higher than that of $1.34 billion in the same period last year.

The MoIT earlier set a target of $775 billion in total goods export-import revenue this year – up by 6 per cent from 2022. This includes $394 billion for exports and $381 billion for imports, with a trade surplus of $13 billion.

“To expand export markets, we need to boost the negotiations and inking of new free trade agreements (FTAs) and economic links, including the early implementation of the Vietnam-Israel FTA (VIFTA), and signing deals with the United Arab Emirates and the Southern Common Market (Mercosur),” said MoIT Deputy Minister Phan Thi Thang. “This is aimed to diversify our export markets, products, and supply chains.”

She also underscored advantages for Vietnam to materialise these goals.

Vietnam is playing an increasing role in ASEAN, which has become an influential pivot for the world’s market regions, and an increasingly important market for many nations’ foreign and economic policies such as the EU’s Indo-Pacific Strategy, the US’ Indo-Pacific Economic Framework for Prosperity, and the UK’s upcoming membership of the Comprehensive and Progressive Agreement for Trans-Pacific Partnership.

“This will make it favourable for Vietnam’s investment attraction and trade expansion,” Thang stressed.

Intensifying integration

According to the MoIT, authorised agencies have been assigned to work with peers of Mercosur – Brazil, Argentina, Uruguay, and Paraguay – on the negotiations of a bilateral FTA in a bid to swell trade and investment ties with this bloc.

Currently, Vietnam has completed an internal review on the negotiations, hoping that the two sides will soon start negotiations later this year or early next year.

Mercosur is a high potential market for various Vietnamese key consumer goods such as telephones, mobile phones and parts, electrical products, garments and textiles, and footwear, said the MoIT.

Meanwhile, Vietnam and the UAE are negotiating the bilateral Comprehensive Economic Partnership Agreement, expected to be clinched later this year, when both countries celebrate 30 years of bilateral diplomatic ties.

Under statistics of the UAE, the import-export turnover between the two nations reached $8.7 billion last year, accounting for 30 per cent of the total trade exchange between the UAE and ASEAN.

Meanwhile, in order to implement the VIFTA which was signed in late July and will be adopted by the legislatures of Vietnam and Israel, both nations will launch a direct air route in late September, expected to help raise investment and trade ties. Total trade turnover hit $2.2 billion last year and $1.68 billion in the first seven months of this year. In addition, Vietnam has also been negotiating an FTA with the European Free Trade Association members of Switzerland, Norway, Iceland, and Liechtenstein.

|

Greater benefits

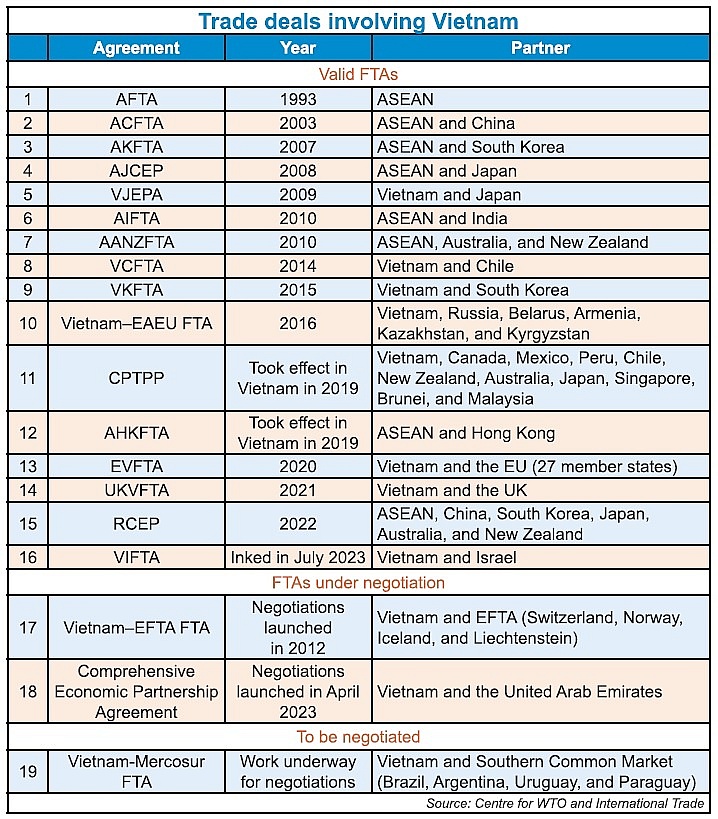

Starting with the participation in ASEAN and its trade agreement in 1995, Vietnam has been actively engaging further in bilateral and regional trade deals with major economies (see table).

Thanks to such international economic integration over the years, Vietnam’s economy has increased 1.4 times in scale within five years, becoming the fourth-largest economy in ASEAN, and ranking 37th worldwide.

According to the World Bank, Vietnam has been a development success story. Economic reforms since the mid-1980s, coupled with beneficial global trends, have helped propel Vietnam from being one of the world’s poorest nations to a middle-income economy in one generation.

Between 2002 and 2021, GDP per capita increased 3.6 times, reaching almost $3,700. Poverty rates declined from 14 per cent in 2010 to 3.8 per cent in 2020.

Thanks to its solid foundations, the economy has proven resilient through different crises. GDP growth is projected to ease to 4.7 per cent in 2023 down from 8.02 per cent in 2022, due to the moderation of domestic demand and exports. Vietnam’s economic growth is expected to gradually accelerate to 5.5 per cent in 2024 and 6 per cent in 2025. This will be further supported by the accelerating recovery of its main export markets such as the US, the Eurozone, and China.

Total trade turnover soared from $157.1 billion in 2010 to $668.5 billion last year, according to the MoIT.

The Ministry of Planning and Investment reported that total registered foreign direct investment into Vietnam reached $452.7 billion as of July 20. In the January-July 20 period, total newly registered and newly added capital and capital contributions and stake acquisitions hit $16.24 billion, up 4.5 per cent on-year.

“International economic integration has earned Vietnam much investment from overseas. Foreign-invested enterprises have been playing a very important role in the national socioeconomic development.” said economic expert Nguyen Mai. “Specifically, they have been providing employment for 4.5 million direct local labourers and millions of indirect labourers. They hold 23-25 per cent of total national development investment capital, and create more than half of industrial gross output, while helping the country develop a modern financial and banking system.”

“They also hold 70 per cent of the nation’s total export turnover, and are responsible for 20 per cent of state budget and 20 per cent of GDP,” Mai continued.

Dorsati Madani, senior country economist at the World Bank in Vietnam last week said that Vietnam in the long term will continue to be an attractive destination for investors.

“Even during the pandemic, foreign investment still entered the country. Now when conditions are changing very fast, investors still enter Vietnam in a higher number than other nations thanks to Vietnam’s political stability and improved business and investment climate,” Madani said.

All segments have been badly impacted by slow external demand and real estate issues, which cause people to have less confidence in job security and spend less. Companies I know have even reported a 20-50 per cent revenue drop on-year in the first half of this year. Most businesses now reduce their expenses at all cost, like only borrowing for necessary activities while postponing all plans regarding capital expenditure to wait and see on the situation. However, the Vietnamese government is doing everything it can and has acted to bring back momentum, including reducing interest rates, decreasing VAT by 2 per cent, accelerating spending, and tapping into many new international markets. I am confident the economy will bottom out in the second half of the year. Vietnam’s long-term view is still good without any fundamental change, and there are big opportunities in this decade. | |

We opened our first office in Vietnam last year at The Schippers Group. Since then, it has become one of our fastest-growing business units. We provide biosecurity solutions for livestock farms to optimise hygiene and reduce antibiotic use. I receive inquiries from multiple Dutch businesses interested in investing in Vietnam and setting up factories. This leads me to believe that the last quarter of 2023 and 2024 will be significantly more prosperous. I recommend that the government prioritise infrastructure, education investment, and streamlined admin procedures for foreign investors. Additionally, e-government services could be enhanced as hard copies of documents are still required at times. With sound policies to support enterprise, Vietnam’s rapid ascent is set to continue. | |

In recent years, Vietnam has accelerated its national digital transformation and proactively implemented supportive policies, yielding positive results. However, to develop a digital economy, Vietnam must overcome several challenges, among which cybersecurity and data privacy are important pillars to create trust and promote digital transformation. Thanks to ongoing efforts, the landscape in Vietnam has been improved. The number of cybersecurity breaches on Vietnamese systems fell by approximately 12 per cent in January-June compared to the same period in 2022. Our data also shows that Vietnam experienced one of the lowest ransomware attacks in 2022 compared to other regional nations. With increased overseas funding and digitalisation efforts, bad actors may still gravitate to Vietnam as a target, acknowledging the money that is flowing in this economy. It is important for organisations not to be complacent. | |

Vietnam is a dynamic and attractive market in Southeast Asia, with many opportunities for investment and business development. Japanese dairy company Morinaga Milk has committed to providing high-quality and nutritious products to millions of Vietnamese consumers. We have also established a presence in Vietnam through the acquisition of Elovi Vietnam and setting up several business entities and affiliates. Morinaga Milk has also been increasing our sustainability effort in Vietnam through donations and cooperation projects with organisations such as World Vision and FoodBank. We hope that the Vietnamese government will further improve the business environment and facilitate foreign investment by enhancing transparency, simplifying admin procedures, and investing in vocational training. | |

As everyone knows, Vietnam and may other places have been going through tough times during 2023. Nevertheless, I believe there has been an overall reality check on the country’s financial positioning. For the tourism industry, this has also forced the government to make sensible decisions on relaxing visa requirements. Vietnam is now able to compete with regional neighbours in attracting international tourists for longer and more frequent visits, something that should have been carried out long ago. It’s a big step in the right direction. Another problem yet to be resolved is the disbursement of government funding for infrastructure projects, which is also hindering the tourism industry. Hopefully, this current economic climate will also make developers come to their senses in terms of their real estate development projects. All over the country I see development of resort projects that simply make no economic sense that include dozens of shop houses and villas that remain empty due to a massive oversupply and no demand in the locations where they are being built. Having said that, in the longer term, tourism has a very bright future for Vietnam and it can bring huge financial benefits to the country as a whole. Hopefully the government and private enterprises can work together to push tourism as a key economic plank for the country going forward. | |

The investment environment in Vietnam keeps changing but, overall, we see more potential here than challenges. As a result, Vietnam will continue to attract more foreign investors in the near future. Regarding the country’s retail market, in the next five years or so, due to the impact of the current economic context, the consumers’ awareness of cost saving will likely continue for some time. The business environment is expected to be unpredictable for some time. Consumers always look for new things, and the speed of the change in consumer behaviour is extremely fast. Therefore, retailers like ourselves must continue changing in order to meet their demands. These changes are the opportunities for retailers like AEON to change and grow. We researched the Vietnamese market from 2009 before opening our first shopping mall in 2014. When looking back over the years, we have achieved our expectations for the first stage of development in Vietnam. As a retailer, we understand that there will be various differences in the regulations of each country. Therefore, we also expect related procedures to be simplified so that we can accelerate our investment. | |

Current difficulties are the result of macro challenges leading to a decrease in aggregate demand. There are early recovery signals, but it will take time to bring the economy back to its growth trajectory. Despite difficulties, there are prospects in certain industries such as: products and services meeting basic and essential needs, opportunities to consolidate the market through mergers and acquisitions, bad debt settlements, and restructuring, etc. There are also medium- and long-term prospects, especially in industries targeting the ever-growing middle class, middle-aged, and elderly people amid the rapidly ageing population. To accelerate the recovery, policy implementation should impact businesses in the quickest manner. The shorter the policy permeation time, the higher the policy impacts. In addition, it is necessary to improve credit quality and regain investors’ confidence. | |

Vietnam should build on and renew its old growth pattern based on urbanisation from the still largely inhabited countryside, cheap wages, and building of some infrastructures. Vietnam’s skilled labour force and sizeable population are drawing attention to burgeoning investment opportunities in pharmaceuticals and fintech. Furthermore, despite a global crunch in external demand, Vietnam’s service industry remains resilient. The State Bank of Vietnam’s measures have successfully maintained inflation under control while simultaneously implementing interest rate reductions. To ensure lasting development, Vietnam should become aware of the dire need for streamlined procedures, transparent regulations, credible institutions, and the rule of law. |

| FTAs to which Vietnam is a signatory, as of July 2023 The Vietnam - Israel Free Trade Agreement (VIFTA) was signed on July 25 and is the latest free trade agreement (FTA) Vietnam is a party to. Joining more FTAs will create significant opportunities for the country to deeply participate in global value chains, increase exports, boost GDP growth, and improve its institutions. |

| Vietnam can pose as gateway for Israel’s Southeast Asian trade In the wake of the groundbreaking Vietnam-Israel Free Trade Agreement (VIFTA), Nir Barkat, Israel’s Minister of Economy and Industry, talked to VIR’s Luu Huong about the myriad of opportunities the trade pact presents for both countries. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Partnerships drive sustainable finance (January 07, 2026 | 09:23)

- FDI inflows reach $38.42 billion in 2025 (January 06, 2026 | 17:55)

- $2.1 billion Nghi Son LNG-fired thermal power plant waits for investor (January 06, 2026 | 17:51)

- GE Vernova powers up Vietnam with first 9HA gas power plant in the country (January 06, 2026 | 16:54)

- Solid finish for manufacturing after volatile year (January 06, 2026 | 08:50)

- Meiko strengthens Vietnam operations with new PCB plants (January 06, 2026 | 08:49)

- Ho Chi Minh City backs $2 billion AI data centre with dedicated task force (January 06, 2026 | 08:43)

- PM sets January deadline for high-speed rail consultant (January 06, 2026 | 08:40)

- New decree spurs on PPP implementation (December 31, 2025 | 19:01)

- Global alliance develops $1 billion AI data centre network in Vietnam (December 30, 2025 | 10:08)

Mobile Version

Mobile Version