UPCoM set to close its doors in five years

|

| The change will result in greater transparency for investors and the markets |

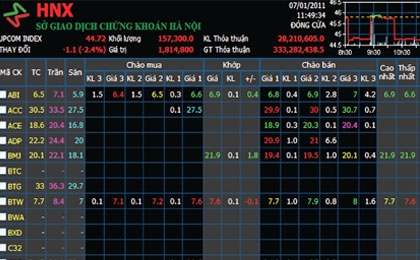

Companies floating on the market (UPCoM) would be gradually shifted into the official Ho Chi Minh Stock Exchange (HoSE) and Hanoi Stock Exchange (HNX), said Tran Van Dung, general director of HNX, the governing body of UPCoM.

“The target to close UPCoM, in fact, is the target of sticking companies’ initial public offerings with official listing like developed nations do,” said Dung.

UPCoM was born in June 2009 to facilitate trading of shares of public firms before they can list on HoSE and HNX. But UPCoM’s lower information disclosure requirements make firms reluctant to find their way into HoSE and HNX.

The UPCoM is currently home to only 106 among more than 4,000 public companies in Vietnam.

Its market liquidity, meanwhile, was at a low level with trading values averaging at VND7.5 billion ($375,000) per session, less than one tenth of HoSE and HNX’s transaction values.

The new amended Law on Securities adds a new regulation that all public companies must trade their shares on regulated markets within one year after making an initial public offering.

The amended law, coming into effect in July 1, 2011, is said to strongly animate UPCoM as a huge number of public companies are forced to float on the government-run markets.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- Corporate bond market poised for stronger growth cycle (January 28, 2026 | 17:13)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

Mobile Version

Mobile Version