Sun shines on liquidity

Trading volume reached more than 59 million shares worth VND791 billion ($38.2 million) on the main Ho Chi Minh Stock Exchange (HoSE) bourse, sharply jumping to 80 million shares worth VND648 billion ($31.3 million) on the Hanoi Stock Exchange (HNX).

Trading volume reached more than 59 million shares worth VND791 billion ($38.2 million) on the main Ho Chi Minh Stock Exchange (HoSE) bourse, sharply jumping to 80 million shares worth VND648 billion ($31.3 million) on the Hanoi Stock Exchange (HNX).

Bidding for shares were massively ordered since the opening, particularly for leading speculative shares. On the HoSE, real estate shares Tan Tao Investment Industry Corp. (HoSE), Becamex Infrastructure Development (IJC), Licogi 16 (LCG), Investment and Trading of Real Estate (ITC), Hoang Anh Gia Lai (HAG) along with financial shares Saigon Securities Inc. (SSI), PetroVietnam Finance (PVF) continued saw millions of units matched each.

Low-price speculative stocks PetroVietnam-Idico Long Son Industrial Park Investment (PXL), Nari Hamico Minerals (KSS), Vietnam Electricity Construction (VNE), Ninh Van Bay Real Estate (NVT), Hoang Quan Consulting-Trading-Service Real Estate Corp (HQC) were bid the most in an expected rallying trend.

The sentiment was even more exciting on the HNX as speculators rushed to purchase leading stocks on this bourse. PetroVietnam Construction (PVX) saw a dramatic surge in its trading volume with 10 million shares matched, followed by VNDirect Securities (VND) at 9,4 million units, Habubank (HBB) 7.2 million units, Kim Long Securities (KLS) 6 million units.

Demand for low-price shares like Hanoi Investment General Corp. (SHN), Wall Street Securities (WSS), Saigon-Hanoi Securities (SHS), International Financial Investment and Enterprise Development (IDJ) jumped as well, although those companies all showed weak business performances.

Up to 16 stocks had matching volumes surpassing the 1 million unit level on the HoSE today, while 14 stocks saw their matching volumes surpass that level on the HNX.

However, the holders suddenly locked in profits at the session’s end. The HoSE’s VN-Index ended 3.07 points or 0.74 per cent lower to 410.91 points, led by Military Bank (MBB), Sacombank (STB), Eximbank (EIB) and Masan Group (VIC) massively falling. Decliners outran advancers 131 to 98.

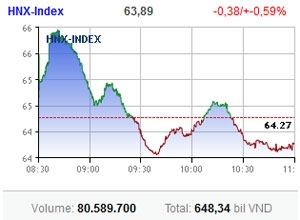

The HNX saw 156 falling stocks outrunning 118 up, dragging the benchmark HNX-Index off 0.38 points or 0.59 per cent to 63.89 points.

Eximbank (EIB) continued to outperform on the HoSE with 4.1 million shares matched today.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- Corporate bond market poised for stronger growth cycle (January 28, 2026 | 17:13)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

Mobile Version

Mobile Version