Real estate giants report heavy losses

|

| Real estate giants report constant losses after ransack |

In the first half of the year, businesses were embattled by the pandemic outbreak and its resurgence, leading to poor business results for businesses, especially after a review of their financial statements.

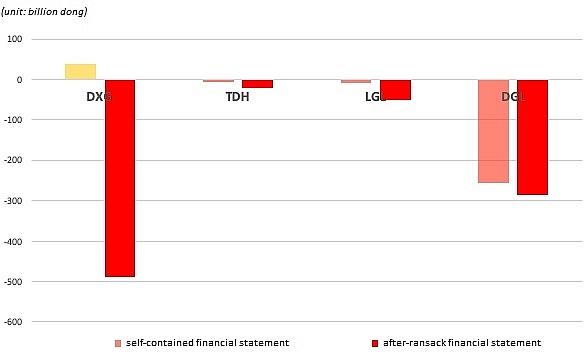

Recently, ThuDuc House (HSX: TDH) reported VND20 billion ($870,000) in net losses, triple the amount in the company's original financial statement. The statement explained that financial costs in the second quarter rose by 108 per cent on-year, while the company had yet to earn revenue from several released projects like Centum Wealth (which is expected to improve in the next quarters).

Long Giang Land Corporation (HSX: LGL) has just announced its reviewed first-half financial statement, in which net loss increased 10-fold compared to the statement before review. Net revenue did not change much but costs rose sharply, resulting in VND25 billion ($1.1 million) in gross losses. Additionally, financial and corporate management costs have also been much higher, net loss also increased to VND58 billion ($2.5 million) from VND9 billion ($391,300) in the unreviewed financial statement.

Dat Xanh Group (HSX: DXG) also reported VND488 billion ($21.2 million) in reviewed net losses for the first half of the year, while the figure was VND38 billion ($1.65 million) in the unreviewed financial statement. After-tax profit has been revised from around $5 million to negative VND374 billion ($16.26 million) due to transferring all LDG Investment JSC shares and setting aside VND526 billion ($22.87 million).

The net losses of Duc Long Gia Lai Group (HSX: DLG) have also increased to VND286 billion ($12.43 million) from VND257 billion ($11.17 million) in the unreviewed financial statement. This was due to financial costs rising 11 per cent as projects were temporarily suspended in the first half while other revenues decreased. Notably, corporate income tax expenses doubled to VND14 billion ($608,700). The audited statement also brought into question whether DLG can continue operating, stating that this depends on future performance as well as negotiations with owners on extending and restructuring principal, interest debt, and interest reduction.

Additionally, some others also reported a sharp decrease in net profit after review. For example, Kinh Bac City Development Holding Corporation (HSX: KBC) has just announced a 73 per cent drop in after-tax profit in its first-half financial statement, from VND55 billion ($2.4 million) to VND15 billion ($652,200).

In fact, the COVID-19 pandemic has had a significant impact on business, especially in real estate, leaving businesses under pressure from shareholders, investors, and partners.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- An Phat 5 Industrial Park targets ESG-driven investors in Hai Phong (January 26, 2026 | 08:30)

- Decree opens incentives for green urban development (January 24, 2026 | 11:18)

- Public investment is reshaping real estate’s role in Vietnam (January 21, 2026 | 10:04)

- Ho Chi Minh City seeks investor to revive Binh Quoi–Thanh Da project (January 19, 2026 | 11:58)

- Sun Group launches construction of Rach Chiec sports complex (January 16, 2026 | 16:17)

- CEO Group breaks ground on first industrial park in Haiphong Free Trade Zone (January 15, 2026 | 15:47)

- BRIGHTPARK Entertainment Complex opens in Ninh Binh (January 12, 2026 | 14:27)

- Ho Chi Minh City's industrial parks top $5.3 billion investment in 2025 (January 06, 2026 | 08:38)

- Why Vietnam must build a global strategy for its construction industry (December 31, 2025 | 18:57)

- Housing operations must be effective (December 29, 2025 | 10:00)

Tag:

Tag:

Mobile Version

Mobile Version