Major ventures on way from chip makers

In the framework of meetings with the leadership of Thai Nguyen People’s Committee in late October, President of Samsung Vietnam Choi Joo Ho revealed the latest business result of the company in the country, while also mentioning the construction process of the expanded Samsung Electro-Mechanics Vietnam venture, which is estimated to cost $920 million.

|

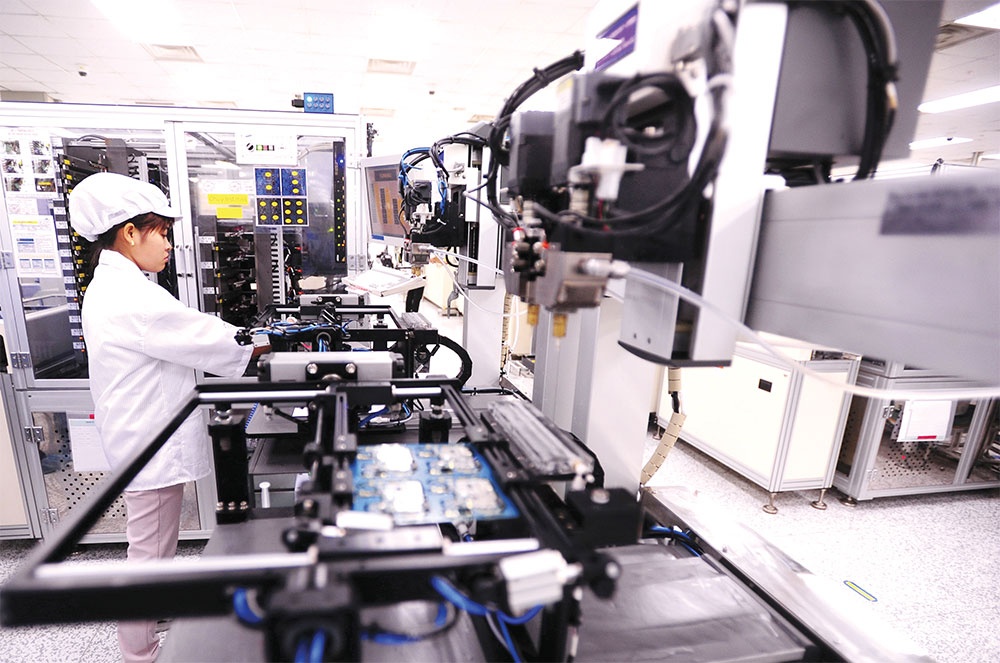

| After a struggle with global semiconductor shortages this year, top groups are trying to get back on track, Photo Le Toan |

“Samsung Vietnam is making efforts to ensure the construction process as committed. We expect to debut the first semiconductor component facility in the second quarter of 2023 and the factory is planned to enter mass production in July,” Ho said.

Samsung Vietnam reported a growth of 6 per cent in business and production results, and that rate is expected to increase to 10 per cent for the whole year, Choi added.

The expanded project will focus on the trial production of flip-chip ball grid array – a surface-mount packaging technology used for integrated circuits. Samsung Electro-Mechanics described the array as the “most difficult” product to manufacture among semiconductor package substrates, as the high-intensity package substrate connects semiconductor chips and main substrates with flip-chip bumps.

Samsung is just one of the world’s largest memory chip producers to be implementing semiconductor component projects in Vietnam. At present, mobile phone and smart electronics producer Hana Micron Vina from South Korea is eager to recruit a labour force to work on its expanded facility, which is in the final construction workload.

The expansion has a total investment of $600 million which will be disbursed within 10 years, including an additional investment of $249 million over the next three years.

A representative of the Investment Management Division under Bac Giang Industrial Zones Management Authority told VIR, “Hana Micron Vina’s project is key for the province. A part of the expanded facility is planned to start operation imminently and the entire facility is expected to do so by the end of next year, with a full annual capacity of 400,000 products.”

Hana Micron Vina first invested in the northern province of Bac Giang in 2019 with a $60 million scheme. After one year of operation, the company decided to expand the facility to meet the increasing demand of products. In total, the South Korean company will invest $1.6 billion between now and 2035 to build a plant to manufacture, assemble, and test semiconductor products on a site of 23 hectares.

Amkor Technology, one of the world’s largest providers of outsourced semiconductor packaging, design, and test services, is also eager to implement the construction of a factory at Yen Phong II-C Industrial Park in the northern province of Bac Ninh.

The investor will pump $1.6 billion into the factory and disbursement will be completed in 2035. The first phase of the project will focus on the production, assembly, and testing of semiconductor materials for the world’s leading semiconductor and electronic manufacturing companies. The semiconductor market value in Vietnam is set to grow by $1.65 billion over the 2020-2025 period, as per a report published in May by British market research firm Technavio. The growing use of the Internet of Things is driving semiconductor market growth in Vietnam and increasing adoption of smart home technology will be the key trend in the near future, the report said.

Responding to the opportunity to attract global semiconductor manufacturers, Do Nhat Hoang, director general of the Foreign Investment Agency under the Ministry of Planning and Investment (MPI), said, “During meetings with foreign investors, we see that many semiconductor manufacturers have plans to invest billions of US dollars in Vietnam. Offering tariff incentives is one of the largest competitive advantages we have.”

However, in the long term, these incentives face the risk of falling behind because of the application of a global consumption tax in 2023.

“The MPI is studying the policy to harmonise global regulations with the particular policy of Vietnam so that we can still comply with international commitments while ensuring the rights and benefits of foreign investors and retain them to expand the operations here,” Hoang said.

| Vietnamese telecoms giants grappling with chip shortfall While the shortfall of semiconductor chips largely caused by the Russia-Ukraine conflict is affecting the performance of Vietnamese telecoms giants, higher targets have been set with prospects driven by growing digital transformation demands on a local level. |

| US chip giant Synopsys supports Vietnam in training new engineers The American chip software firm Synopsys Inc. and Saigon Hi-tech Park (SHTP) signed an MoU on August 26 for the group to support chip design training in Vietnam. |

| Vietnam picking up slack as hub for chips High-tech investment is making a splash in Vietnam’s economic landscape, and so the country is emerging as the destination for semiconductor manufacturers, where local players are seemingly leading the way. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Kurz Vietnam expands Gia Lai factory (February 27, 2026 | 16:37)

- SK Innovation-led consortium wins $2.3 billion LNG project in Nghe An (February 25, 2026 | 07:56)

- THACO opens $70 million manufacturing complex in Danang (February 25, 2026 | 07:54)

- Phu Quoc International Airport expansion approved to meet rising demand (February 24, 2026 | 10:00)

- Bac Giang International Logistics Centre faces land clearance barrier (February 24, 2026 | 08:00)

- Bright prospects abound in European investment (February 19, 2026 | 20:27)

- Internal strengths attest to commitment to progress (February 19, 2026 | 20:13)

- Vietnam, New Zealand seek level-up in ties (February 19, 2026 | 18:06)

- Untapped potential in relations with Indonesia (February 19, 2026 | 17:56)

- German strengths match Vietnamese aspirations (February 19, 2026 | 17:40)

Tag:

Tag:

Mobile Version

Mobile Version