Inherent advantages lay the path for investment from US

In 2024, Vietnam and the United States will continue boosting their comprehensive strategic partnership. What does this mean for bilateral trade?

|

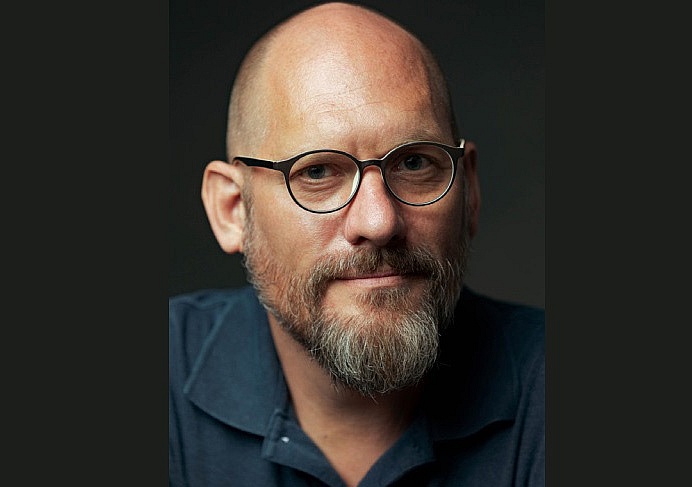

| Richard D. McClellan, country director of the Tony Blair Institute for Global Change in Vietnam |

This year is very important for the US and Vietnam, as it will mark 30 years since the trade embargo was lifted. Following the normalisation of relations between the two countries in 1995, Vietnam has become the seventh-largest trading partner of the US as of 2022. Meanwhile, Vietnam currently has 230 projects in the US, registered at $1.26 billion.

Both countries have agreed to work together on developing a semiconductor ecosystem in Vietnam and improving its position in the global semiconductor supply chain.

What is more, they have announced the launch of initiatives to train the Vietnamese workforce in semiconductor-related skills. The US government has provided $2 million in initial funding for this purpose, and both the Vietnamese government and private sector have pledged their support.

The Vietnamese government has devised a plan to develop its semiconductor sector, including the goal to increase the number of semiconductor human resources to 50,000 by 2030. The National Assembly has urged the government to establish an investment support fund for the high-tech industry, including the semiconductor industry.

You highlighted the importance of the semiconductor industry. What approach should Vietnam take in this field?

Thanks to its strategic location and potential for development, Vietnam has become an appealing destination for many major US corporations, who are showing their commitment through long-term investments in the country.

The investment activities of major corporations such as Apple and Intel offer a positive impact on Vietnam’s economy. In addition to bringing advanced technology and infrastructure, these corporations also facilitate Vietnamese businesses to integrate more deeply into their global supply chains. Such investments are expected to create a spillover effect, encouraging other technology corporations to invest and expand their operations in Vietnam.

However, Vietnam faces the challenge of creating a solid infrastructure and policy foundation to attract American investors while ensuring a level playing field for all. Vietnam should focus on developing energy infrastructure that aligns with socioeconomic development, offers sustainable pricing, and generates profit.

Additionally, there is mounting pressure to promote green development and greener production. If Vietnam fails to provide clean energy to global manufacturers soon, the market may lose its attractiveness, and investors may start to find other alternative markets.

Vietnam and the US can expand cooperation in many other fields. What areas in Vietnam are likely to offer opportunities for expansion?

Vietnam has been exporting a large quantity of goods to the US market over the years. In 2022, Vietnam’s primary export products to the US were machinery, equipment, tools, and spare parts ($20.1 billion), followed by textiles ($17.3 billion) and computers, electronic products, and components ($15.9 billion). Given Vietnam’s competitive advantage in these sectors, we predict that these product groups will continue to play a significant role in Vietnam’s exports to the US in 2024 and beyond.

In addition, emerging fields will also offer more opportunities for Vietnamese businesses to participate in supplying raw materials, components, and equipment to industries such as energy, aviation, the digital economy, semiconductors, and AI. These industries are also aligned with Vietnam’s export strategy in the foreseeable future.

The US is implementing trade protection policies to safeguard domestic production. Do you have any suggestions for Vietnamese export businesses?

Maintaining high product quality and compliance with international standards will play a crucial role in enhancing the competitiveness of Vietnamese goods.

By meeting strict requirements, local exporters can reduce the chances of facing non-tariff barriers, which in turn increases US consumers’ trust in Vietnamese products. This can lead to greater export market opportunities and expansion.

Vietnamese businesses should also actively seek opportunities to cooperate with US businesses through joint ventures or forming strategic partnerships. This will facilitate market entry and assist in resolving legal issues.

Leveraging the expertise and networks of local partners will help Vietnamese businesses improve their understanding of the US market and complex legal system, thereby optimising their strategies for sustainable growth.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- South Korean company to build synthetic graphite anode material plant in Thai Nguyen (March 05, 2026 | 16:41)

- YADEA launches $100-million smart manufacturing plant in Bac Ninh (March 03, 2026 | 11:55)

- Law on Investment takes effect (March 02, 2026 | 16:21)

- VinFast invests nearly $500 million in its EV plant in Ha Tinh (March 02, 2026 | 16:19)

- Ho Chi Minh City attracts nearly $980 million in FDI in early 2026 (March 02, 2026 | 10:57)

- Japan’s Fujiya strengthens production base in Vietnam (February 28, 2026 | 09:00)

- Haiphong gains new growth impetus from strategic planning and integrated infrastructure (February 27, 2026 | 16:40)

- Kurz Vietnam expands Gia Lai factory (February 27, 2026 | 16:37)

- SK Innovation-led consortium wins $2.3 billion LNG project in Nghe An (February 25, 2026 | 07:56)

- THACO opens $70 million manufacturing complex in Danang (February 25, 2026 | 07:54)

Mobile Version

Mobile Version