Indices pickup on pillar stocks

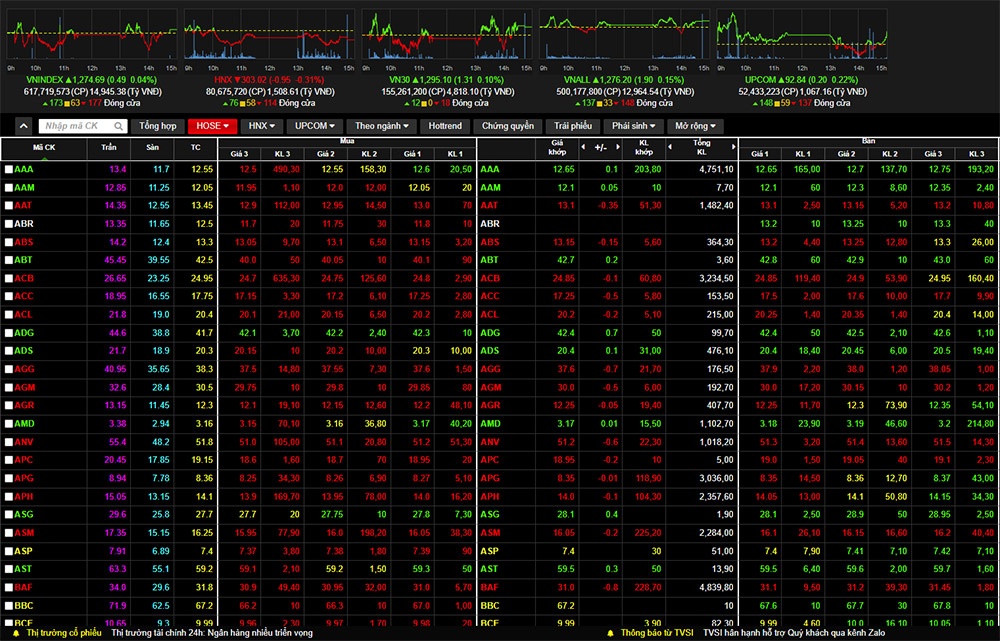

The VN-Index on the Ho Chi Minh Stock Exchange (HoSE) rose 11.09 points, or 0.88 per cent, to 1,273.42 points.

|

| Indices pickup on pillar stocks |

The market breadth was positive with 273 stocks increasing, while 142 declined.

Liquidity continued to improve, of which matching value on the southern market climbed by 35.2 per cent to over VND8.2 trillion (US$351.7 million), equal to a matching volume of 345 million shares.

The index's gains was mainly thanked to pillar stocks, with the VN30-Index, which tracks the 30 biggest stocks on the HoSE, posting a rise of 11.93 points, or 0.93 per cent, to 1,292.89 points.

In the VN30 basket, 22 stocks inched up, while four slid and four stayed unchanged.

Leading the uptrend was bank, real estate and IT stocks.

Specifically, BIDV was the biggest gainer with an increase of 4.08 per cent, followed by Vinhomes (VHM), Sahabank (SHB), FPT Corporation (FPT) and Vietinbank (CTG), of which SHB hit the maximum daily gain of 7 per cent.

On the Ha Noi Stock Exchange (HNX), the HNX-Index ended higher this morning, up 2.42 points, or 0.8 per cent, to 305.84 points.

| Shares decline on cautious sentiment Stocks headed lower on Monday with investors in a cautious mood amid increased selling pressure. |

| Shares end week on negative note The stock market ended the week on a negative note as increased selling pressure made indices reverse to fall in the final minutes of trading. |

| Shares retreat after four-day rally, liquidity declines Shares ended the week on a negative note, putting a break on a four-day rally streak, as investors became timid when the VN-Index approached the resistance zone. |

| Indices pickup on pillar stocks Benchmark indices settled higher on Monday morning, backed by many large-cap stocks. |

| Shares to keep upward trend this week: brokers Vietnamese shares are forecast to continue their upward trend this week as profit-taking pressure is cooling down significantly. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- Corporate bond market poised for stronger growth cycle (January 28, 2026 | 17:13)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

Tag:

Tag:

Mobile Version

Mobile Version