Improving disclosure quality

|

| By Hoang Hung Partner, Vietnam Markets leader, PwC Vietnam |

In today’s economy, financial metrics reflect only part of a company’s true value. Intangible assets such as talent, customer reach, and brand are increasingly important factors to consider when deciding to invest in or acquire a business. More stakeholders are starting to include ESG factors when they assess a company’s strategy, risk profile, and ultimately, its plan for creating long-term value.

ESG factors can also help stakeholders evaluate a company’s brand risks, appeal to customers, and ability to attract talent. Investors realise that ESG factors are important but there is currently a disconnect between what they want to know and what companies disclose. And the reasons behind this disconnect are quite complex.

Information divide

Through our work with diverse clients, we have observed that investors are very interested in ESG factors and that they consider them when making investment decisions. Investors want to know about a company’s exposure to climate risks, its efficiency and stewardship in using natural resources, the quality and safety of its products, and how it treats its workers. Many companies have started to report ESG factors in response to these increased expectations for more transparency. However, there is no complete alignment between companies and investors on what, where, and how often to report.

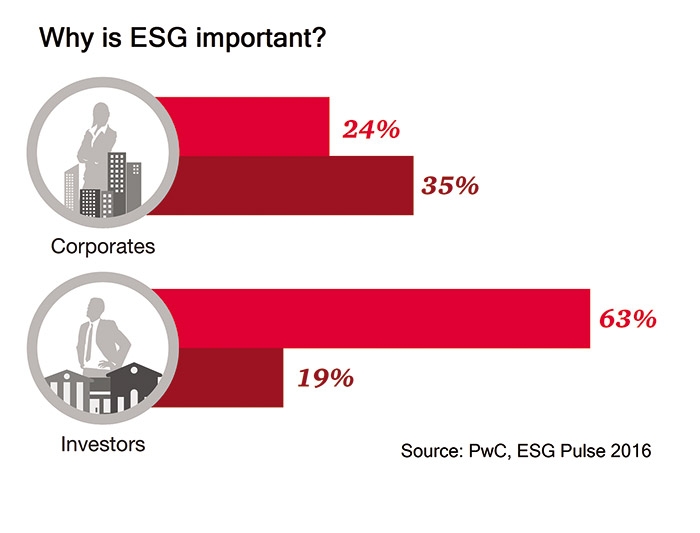

So what is the problem? There are, in fact, several. First of all, companies and investors see different value in disclosing ESG information: while companies focus on growth, investors focus on risks. Investors and companies also speak different languages when it comes to ESG – a challenge made worse by the competing frameworks and standards designed for different audiences. While both investors and companies agree that reporting ESG information is good for the broader stakeholder group, many companies are not sure if and how investors really use this information.

Institutional investors often have professional teams that focus on the risks facing the companies they invest in, yet not all investors are able to connect the ESG data from the stewardship or governance oversight part of the organisation with what is used on the investing side. As a result, chief investment officers and portfolio managers may not focus on the ESG data – which can send a message to companies that ESG information is not a critical factor in the overall investment decision-making.

There are several reasons why chief investment officers and portfolio managers are not using the data. For starters, there is no consistent definition of ESG, making it mean different things to different people. Another issue is that ESG disclosures are voluntary, so companies can choose among different frameworks for reporting – resulting in information that is not necessarily comparable from company to company.

|

|

|

Bridging the gap

So, how should this problem be dealt with? A turning point in embedding ESG data in corporate reporting will happen when institutional investors demonstrate that this data plays a key role in their investment decisions. More available, consistent and reliable information could play a bigger role in portfolio management.

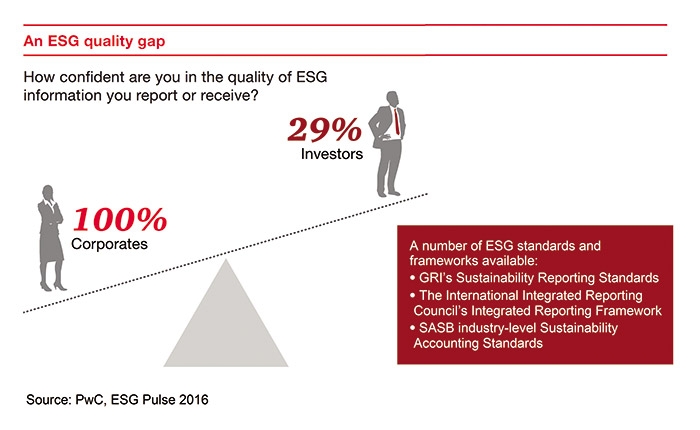

ESG information would certainly be more useful if commonly recognised standards were used when disclosing ESG metrics. According to a study by PwC US in 2016, more than nine out of ten investors (92 per cent) said that S&P500 companies were not disclosing ESG data in a way that made it easy to compare to other companies. Meanwhile, 60 per cent of corporates in the survey said the data they disclosed was comparable to that of other companies. This gap in the way the two groups think about ESG disclosure is a big divide. Corporates are quite confident of the information they are disclosing and its comparability to that of their peers. Most investors, on the other hand, do not think that the disclosed information enables easy comparisons.

Investors would benefit from standard ESG disclosure within a consistent global reporting framework. Having formal and consistent standards can help them better interpret the information. Some investors believe that ESG reporting will support operational and financial performance and how companies manage it to achieve long-term financial sustainability and offset long-term risks. But until we get to a common framework and set of standards, inconsistent disclosure will affect the usefulness of ESG data.

Raising quality of ESG disclosure

According to assessments by local exchanges, the disclosure of ESG information by listed companies in Vietnam has improved over the years in compliance with the provisions set out in Circular No.155/2015/TT-BTC issued by the Ministry of Finance, which clearly stipulates the disclosure of ESG performance of companies. The overall quality of reporting was raised, while the number of companies producing reports also increased. ESG disclosures were also bright spots in the 2018 annual reporting season, reflecting the adoption of international best practices and meeting investors’ requirements on quality of disclosure.

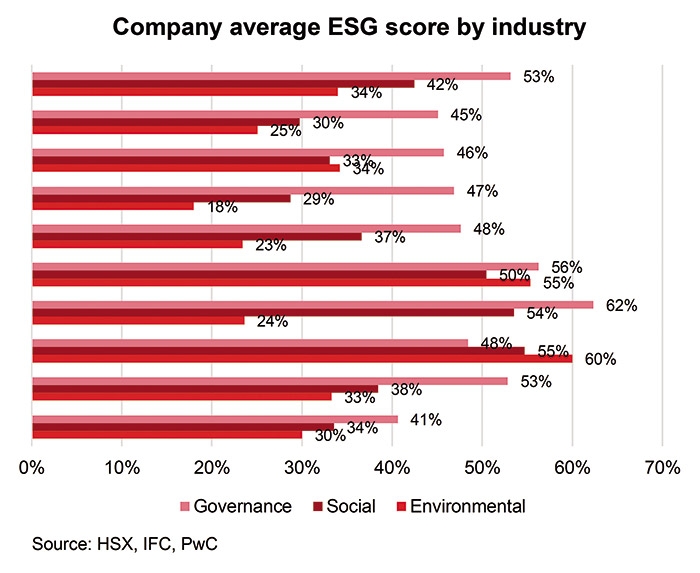

As part of the 2018 ESG performance assessment review done by the Ho Chi Minh City Stock Exchange (HSX) and the International Finance Corporation (IFC) with technical assistance from PwC, companies were called on to be more focused and proactive in their communications with investors about ESG issues, as well as listen to their concerns and respond appropriately. Disclosing ESG information in a clear, transparent manner will help companies improve medium and long-term growth prospects and reduce risks. Investors are also continually improving their connections and integrating information gained from functional departments into investment analysis and decision-making. The results of the ESG disclosures are the basis for the Vietnam Sustainability Index (VNSI), which was officially launched by HSX in July 2017 and continually revised in 2018. This is a new metric in the stock market, in line with international practices and aimed at promoting responsible investment. Hopefully, with the participation of proactive companies in the VNSI index, there will be more opportunities to access green funds and capital from international investment funds and financial institutions. These will certainly contribute to the sustainable growth of the Vietnamese stock market in the coming time.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Citi economists project robust Vietnam economic growth in 2026 (February 14, 2026 | 18:00)

- Sustaining high growth must be balanced in stable manner (February 14, 2026 | 09:00)

- From 5G to 6G: how AI is shaping Vietnam’s path to digital leadership (February 13, 2026 | 10:59)

- Cooperation must align with Vietnam’s long-term ambitions (February 13, 2026 | 09:00)

- Need-to-know aspects ahead of AI law (February 13, 2026 | 08:00)

- Legalities to early operations for Vietnam’s IFC (February 11, 2026 | 12:17)

- Foreign-language trademarks gain traction in Vietnam (February 06, 2026 | 09:26)

- Offshore structuring and the Singapore holding route (February 02, 2026 | 10:39)

- Vietnam enters new development era: Russian scholar (January 25, 2026 | 10:08)

- 14th National Party Congress marks new era, expands Vietnam’s global role: Australian scholar (January 25, 2026 | 09:54)

Mobile Version

Mobile Version