Groundhog day for market

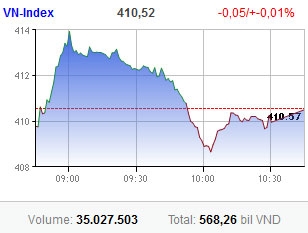

The VN-Index of Ho Chi Minh Stock Exchange (HoSE) slipped 0.05 points or 0.01 per cent to close at 410.52 points. Meanwhile, Hanoi Stock Exchange’s (HNX) HNX-Index lost 0.95 points or 1.44 per cent to 65.02 points – the lowest ever level of the benchmark.

Investors continued bailing out their holdings, putting the market under strong selling pressure. Up to 151 stocks declined on the main HoSE, doubling the advancers of 79 stocks.

Real estate shares topped the decliners. A mass of stocks were dragged to the floor by strong selling pressures, among them also Hoang Anh Gia Lai (HAG) and Song Da Urban & Industrial Zone Investment and Development (SJS).

Meanwhile, financial shares massively dropped on increasing woes among the banking sector. Military Bank (MBB) hit the floor after significantly rallying in previous sessions. Vietcombank (VCB) and Vietinbank (CTG) both gave back more than 2 per cent, while Saigon Securities Inc. (SSI) was off 1.15 per cent.

Sacombank (STB) opened hitting the ceiling thanks to the bank’s announcement to buyback a record high share volume. The shares, however, reduced with a gain of just 3.79 per cent due to strong selling pressures.

Securities company shares meanwhile dipped on the HNX, pushed down by fresh fears among investors about brokerages’ weak financial health. SME Securities (SME) continued hitting the floor today, followed by Orient Securities (PRS), Trang An Securities (TAS), Phu Hung Securities (PHS) and Vincom Securities (VIX).

Habubank (HBB), Saigon-Hanoi Bank (SHB) and Asia Commercial Bank (ACB) slightly shed around 1-2 per cent. Some 180 stocks were down on the northern bourse, while 58 up and 157 unchanged.

The market kept drying out with liquidity reaching just 35 million shares worth VND568.26 billion ($27.5 million) on HoSE. Put through volume sharply rose to 9.5 million shares worth VND197 billion ($9.5 million).

HNX’s total volume stood at 27.5 million shares worth VND278.68 billion ($13.5 million).

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- Corporate bond market poised for stronger growth cycle (January 28, 2026 | 17:13)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

Mobile Version

Mobile Version