FTSE Russell meeting reveals optimism on Vietnam's stock market upgrade

|

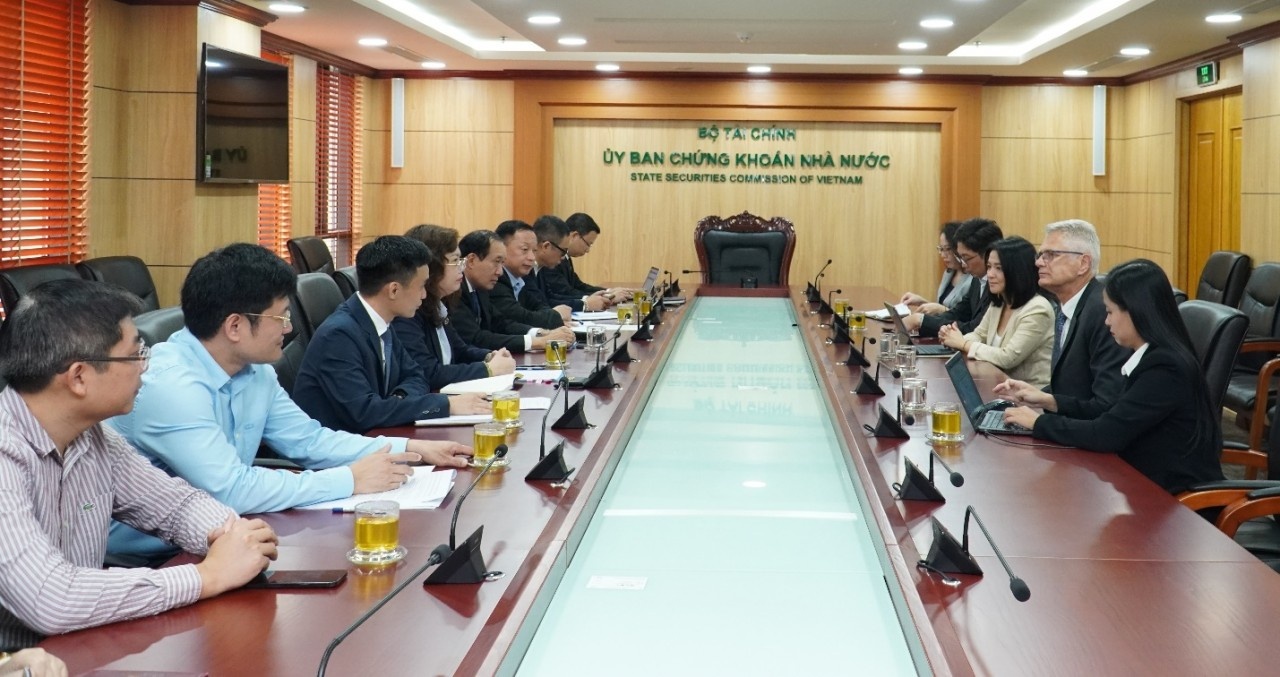

The discourse centred on policy updates, market insights, and strategies to overcome hurdles affecting the upgrading criteria for the Vietnamese stock market.

The SSC delegation featured prominent figures such as Vu Thi Chan Phuong, chairwoman of SSC, Pham Hong Son - SSC's vice chairman, and other high-ranking SSC officials. They were joined by representatives from the Vietnam Securities Depository and Clearing Corporation (VSD).

On the FTSE Russell side, the meeting was graced by Tim Batho, head of Strategy, Policy, and Global Client Solutions, Asia-Pacific, and Wanming Du, director of Index Policy, Asia-Pacific, both representing FTSE Russell. Furthermore, the World Bank was also present, with Ketut Kusuma, a senior financial sector expert and the national coordinator for finance at the World Bank in Vietnam.

"Through recent meetings with various market participants, we have reached a unanimous agreement on the significance of our mission and the necessity to implement strategies that advance Vietnam's stock market," Phuong said.

She also provided insights into the current progress and cooperation between SSC and the Ministry of Finance in addressing persisting impediments that stand in the way of Vietnam's ascent into the ranks of emerging markets.

Phuong expressed her contentment with the consensus that materialised during recent discussions between SSC, securities firms, custodian banks, and other parties.

"These dialogues have asserted the collective acknowledgment of the paramount importance and urgency in implementing strategies that propel Vietnam's stock market to the next level," she said.

FTSE Russell representatives commended the vigorous efforts exerted by SSC, alongside the collaborative endeavours of affiliated entities and market participants.

Tim Batho from FTSE also shared valuable insights on the recent assessment and market ranking reports from the September 2023 review. This report notably maintains Vietnam's position on the watchlist for promotion to the secondary emerging market category.

"The recent efforts by SSC, the Ministry of Finance, and related entities show that Vietnam has taken significant strides, and we eagerly await the transformation of regulatory efforts into concrete actions," Batho said.

His remarks underscore the optimism surrounding Vietnam's stock market, as it seeks to carve a prominent niche on the global stage.

These discussions signify the nation's unwavering commitment to enhancing the transparency, efficiency, and accessibility of its stock market.

The progression towards emerging market status holds the promise of attracting more foreign capital, stimulating investment, and offering greater opportunities for investors, reinforcing Vietnam's role as a burgeoning player on the global financial landscape.

| The barriers associated with market status upgrade As Vietnam’s stock market stands poised on the threshold of significant upgrades, there is an air of anticipation among experts and investors alike. Such a move would send positive signals, heralding both increased market liquidity and foreign investor participation, while also driving greater transparency in the marketplace. |

| Transparency crucial to upgrading the stock market The goal of upgrading the stock market by 2025 requires the concerted efforts of ministries and market members. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Banks roll out God of Wealth Day promotions (February 26, 2026 | 17:10)

- VinaCapital launches Vietnam's first two strategic-beta ETFs (February 26, 2026 | 09:00)

- Banking sector targets double-digit growth (February 23, 2026 | 09:00)

- Private capital funds as cornerstone of IFC plans (February 20, 2026 | 14:38)

- Priorities for building credibility and momentum within Vietnamese IFCs (February 20, 2026 | 14:29)

- How Hong Kong can bridge critical financial centre gaps (February 20, 2026 | 14:22)

- All global experiences useful for Vietnam’s international financial hub (February 20, 2026 | 14:16)

- Raised ties reaffirm strategic trust (February 20, 2026 | 14:06)

- Sustained growth can translate into income gains (February 19, 2026 | 18:55)

- The vision to maintain a stable monetary policy (February 19, 2026 | 08:50)

Tag:

Tag:

Mobile Version

Mobile Version