EVFTA puts wind in the sails of industry

|

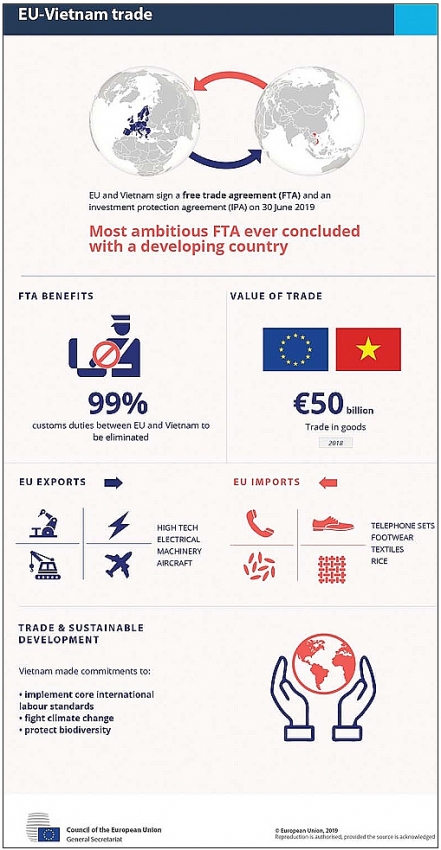

Nicolas Audier, chairman of the European Chamber of Commerce in Vietnam (EuroCham), said that even before the EU-Vietnam Free Trade Agreement (EVFTA) is ratified and implemented, new European companies are opening representative offices and branches or are looking for sourcing partners in Vietnam in anticipation of the benefits that this historic agreement will bring.

“For instance, the EU is set to import even greater quantities of agricultural products and seafood from Vietnam, taking advantage of lower prices once tariff reductions come into effect, and we have seen new European companies moving to Vietnam before the EVFTA is ratified to prepare for these new opportunities,” Audier said.

The same is true across other sectors and industries. It is clear that the EVFTA has put Vietnam on the radar of many European investors. Last October, EuroCham co-organised a luncheon in Brussels with the Vietnamese Prime Minister Nguyen Xuan Phuc and 20 major European investors, who all wish to grow their presence here.

Key sectors to benefit

Bao Viet Securities’ report on the EVFTA and its opportunities, released last week, showed that Vietnamese industries like textile, garment, and footwear are expected to benefit the most from the new deal.

Export of textiles, garments, and footwear from Vietnam to Europe reached around $9 billion in 2018. The average tariff applied by the EU on these products was 9 per cent. These tariffs are going to be eliminated within three years, or, for less sensitive products, immediately after the signing.

Vietnam Textile and Garment Group predicted that if the EVFTA is put into force this year, the total textile and garment export turnover will exceed $40 billion, up $4 billion compared to 2018. Some textile firms get a large portion of their revenue from the EU, and they will see a sharp increase in orders. Such firms include Saigon Production, Trade & Garment JSC, which garners 32 per cent of its revenue from the EU, TNG Investment & Trade JSC (21 per cent), Garment Company 10 (36 per cent), and Viet Tien Garment Corp. (18 per cent).

Apart from the immediate benefits, there are still many steps that need to be taken, so that Vietnam can reap the full benefits of this new legislation.

Many argued that Vietnam needs to build a strong domestic textile and garment industry, with lower import components, to be able to capture all the benefits. Strict requirements on certificates of origin on all apparels imported to Europe can reduce the benefits for Vietnam, especially when a majority of materials are imported from other markets

Apart from the growth of enterprises, which should be a priority, the government must provide guidance and initiatives to help improve the knowledge and awareness of the affected businesses. Meanwhile, Vo Van Kien Nhan, from Viet Tien Garment JSC, said he is looking forward to the entry into force of the EVFTA and put high hopes on the agreement, though he anticipated harsh competition from foreign brands such as Zara and H&M.

Audier noted that labour-intensive manufacturing has driven Vietnam’s remarkable socio-economic development over the past 30 years. However, future jobs and growth might depend predominantly on a digital economy and hi-tech solutions in all industries.

To develop the digital economy, three conditions must be fulfilled – infrastructure, security, and people’s trust in the digital economy. European firms have been a trusted, reliable, and secure partner in helping develop Vietnam’s earliest telecommunications and ICT networks, and driving significant internet usage across the country.

Denis Brunetti, co-chairman of the EuroCham, said, “Our members remain committed and dedicated to helping the country take advantage of the new wave of inclusive and sustainable digital innovation.”

Hi-tech manufacturing and global chains

Vietnam is embracing the Industry 4.0 staples in an attempt to create a role for itself as a tech hub within Southeast Asia and thus moving away from its image of being a low-cost, export-orientated manufacturing destination.

Vietnam’s policymakers have been searching for an alternative industrial strategy that will allow the country to maintain its growth trajectory, but also make it more sustainable from a social, business, and environmental perspective.

“The government is working on many projects to move into the 4.0 era,” said Pham Hoang Mai, general director of the Department of Science, Education, Natural Resources and Environment under the Ministry of Planning and Investment. “However, the most important thing is to ensure institutional reform of the domestic business climate to encourage innovation, especially in sectors with great potential for implementation, such as manufacturing, processing, agriculture, finance, logistics, healthcare, and education.”

The Italian Chamber of Commerce in Vietnam’s president Michele D’Ercole told VIR that the implementation of the EVFTA is expected to create a further increase in trade and investment relations between Italy and Vietnam. After the agreement comes into effect, 65 per cent of import duties on European exports to Vietnam will be removed, and the remaining tasks will be liberalised within 10 years. Therefore, Vietnam offers an opportunity that Italian investors cannot ignore.

“Italian investors are becoming increasingly interested in Vietnam across many sectors. The majority of investment is in manufacturing, infrastructure, pharmaceuticals, transportation, metal products, and food processing,” D’Ercole said. “While traditional industries such as footwear, textile, consumer goods, and manufacturing remain the major attractors of foreign direct investment (FDI), emerging sectors like infrastructure, renewable energy, machinery, and connectivity are also promoted to Italian investors.”

He underlined that the ASEAN’s economic outlook remains positive, and its trade is becoming more diversified and high-tech-based. The effects of the United States-China trade dispute could have both direct and indirect impacts on the ASEAN economy. Specifically, in addition to the typical challenges of a trade war, there may be unique opportunities involving the realignment of the value chain.

“EU companies impacted by the new legislation can function as an important asset for ASEAN countries when it comes to the rearrangement of the value chain. Moreover, in a forward-looking approach, Italian companies should look to the ASEAN region as a new partner to work with while aiming to boost the domestic market,” noted D’Ercole.

Vietnam is home to global corporations such as ABB, Bosh, Intel, Samsung, and Piaggo, who have all invested into research and development (R&D) projects and centres in Vietnam. Such investment creates jobs for thousands of people, while also adding more value to the products made in Vietnam and making manufacturing more cost-efficient. In turn, this can make Vietnam more competitive and create opportunities to move up the global value chain.

R&D projects in the country have been increasing in both quantity and scale thanks to preferential policies from the government to foreign investors, such as tax and land incentives. Vietnam has become a hub for many major manufacturers of technology products, and moving R&D closer to where manufacturing takes place is also cost-effective.

According to the AHK World Business Outlook 2019, a survey conducted by the German Industry and Commerce in Vietnam, German enterprises have stayed optimistic about their performance in Vietnam, as well as their growth prospects for 2020. This is despite a potential global economic crisis and escalating trade tensions. Specifically, 77 per cent of German companies in Vietnam assessed their business situation in 2019 as good (56 per cent last year). This is much higher than the 61 per cent average of Southeast Asia.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Themes: EVFTA & EVIPA

Related Contents

Latest News

More News

- Hermes joins Long Thanh cargo terminal development (February 04, 2026 | 15:59)

- SCG enhances production and distribution in Vietnam (February 04, 2026 | 08:00)

- UNIVACCO strengthens Asia expansion with Vietnam facility (February 03, 2026 | 08:00)

- Cai Mep Ha Port project wins approval with $1.95bn investment (February 02, 2026 | 16:17)

- Repositioning Vietnam in Asia’s manufacturing race (February 02, 2026 | 16:00)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

- Navigating venture capital trends across the continent (February 02, 2026 | 14:00)

- Motivations to achieve high growth (February 02, 2026 | 11:00)

- Capacity and regulations among British areas of expertise in IFCs (February 02, 2026 | 09:09)

- Transition underway in German investment across Vietnam (February 02, 2026 | 08:00)

Tag:

Tag:

Mobile Version

Mobile Version