Connectivity a factor in positive results of logistics companies

Could you shed some light on the business results of logistics companies operating in the port sector?

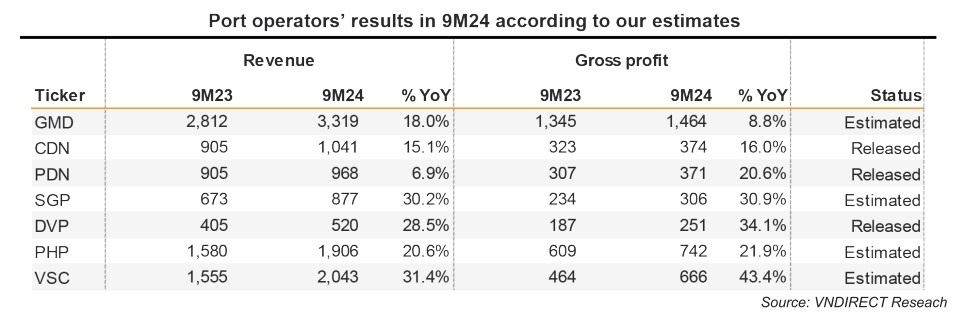

Port operators such as Gemadept (GMD), Vinconship (VSC), Haiphong Port, and Saigon Port posted solid growth in 2024. In the year-to-date, most port operators have recorded gains in core operations (see figure). We believe this positive momentum will continue into the rest of 2024, maintaining high revenue levels due to the global peak season in June-July.

|

| Dang Huy Hoang, research analyst at VNDirect Securities |

As of October 23, several port operators, including Danang Port, Dong Nai Port, and Dinh Vu Port, have released their earnings results. The positive net revenue momentum is attributed to an increased workload from the recovery of trading activity, and higher handling prices for most port operators.

According to GMD, Nam Dinh Vu port (NDV) is estimated to handle 100,000TEUs per month. Consequently, NDV is expected to operate at 108 per cent of its designed capacity, reaching 1.3 million TEUs, a 45 per cent on-year increase.

Additionally, their other core project, Gemalink, also performed well in the first nine months of 2024. It handled an average of 150,000TEUs per month. They estimate that this deep-sea port will handle a total of 1.5 million TEUs in 2024, achieving full capacity. With such high operational efficiency, GMD plans to expand both NDV and Germalink, with the expansion phase starting in late 2025 to 2026.

Another interesting development is with VSC. It is in its merger and acquisition phase, increasing its capacity since last year. In the first half of 2024, it acquired 99 per cent of Nam Hai Dinh Vu (previously owned by GMD), making VSC the owner. Consequently, Nam Hai Dinh Vu’s revenues will be accounted for by VSC in 2024, marking significant growth this year.

In September, VSC announced plans to dredge and maintain the Ha Nam channel, specifically from NDV port to their own port. This will enhance their ability to attract services from shipping lines. However, expansion comes with borrowing costs. VSC faces high depreciation and interest expenses, significantly impacting their net profit.

|

How do you assess the performance of shipping lines in Vietnam’s logistics market so far?

Container transporter Hai An Transport and Stevedoring JSC is likely to perform better since the third quarter of 2024, while bulk transporter Vietnam Ocean Shipping JSC continues to struggle. Based on the World Container Index and Baltic Dry Index, we see a surge in container freight due to disruptions in the Red Sea, affecting global container trade. This will drive container shipping line profit margins from 2024.

Hai An has experienced some lag with freight as they mainly operate domestically. Their main driver will be leasing operations. Their vessels were chartered at $17,000 per day in late 2023 and early 2024. However, since the third quarter of 2024, we believe they will revise their contracts at higher rates.

In our June 2024 update report for Hai An, we estimated their fleet would be leased at nearly $20,000 per day.

What are the opportunities and challenges for listed logistics companies in the last quarter of 2024 and beyond?

In the fourth quarter of 2024, northern-based companies will face a slower pace of manufacturing due to Typhoon Yagi impacts. The Purchasing Managers’ Index reached 47.3 in September, but manufacturing firms remain optimistic about the coming months.

We believe exports will continue to drive logistics companies, while domestic demand remains low due to weak consumer demand. Moreover, as exports drive growth, positive foreign direct investment inflows will support the logistics sector in the long term.

Vietnam’s high connectivity rating in the global trading map Vietnam’s Port Liner Shipping Connectivity Index ranks in the top 8 globally, mainly due to competitive handling prices and a favourable position. Another factor is effective operations: Vietnamese ports typically have berth hours ranging between 10-15 hours, below the global average of 22.7 hours. Meanwhile, continuous infrastructure upgrades in recent years will boost the logistics sector’s capacity.

| Vietnam's logistics sector confronts new challenges Experts and business leaders looked at how Vietnam can overcome challenges and unlock the potential of its logistics sector at the Vietnam Logistics Summit 2024 on October 31. |

| Digital transformation to compete in challenging logistics market Digital transformation is revolutionising logistics, as technologies like AI, Blockchain, and IoT unlock new levels of efficiency, adaptability, and innovation in supply chain management. |

| Logistics supply chain efficiency on the rise The expanding consumer market, with abundant supply and a favourable geographical location for penetration and network expansion, is pushing Vietnam’s logistics supply chain to increase efficiency. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Citi economists project robust Vietnam economic growth in 2026 (February 14, 2026 | 18:00)

- Sustaining high growth must be balanced in stable manner (February 14, 2026 | 09:00)

- From 5G to 6G: how AI is shaping Vietnam’s path to digital leadership (February 13, 2026 | 10:59)

- Cooperation must align with Vietnam’s long-term ambitions (February 13, 2026 | 09:00)

- Need-to-know aspects ahead of AI law (February 13, 2026 | 08:00)

- Legalities to early operations for Vietnam’s IFC (February 11, 2026 | 12:17)

- Foreign-language trademarks gain traction in Vietnam (February 06, 2026 | 09:26)

- Offshore structuring and the Singapore holding route (February 02, 2026 | 10:39)

- Vietnam enters new development era: Russian scholar (January 25, 2026 | 10:08)

- 14th National Party Congress marks new era, expands Vietnam’s global role: Australian scholar (January 25, 2026 | 09:54)

Tag:

Tag:

Mobile Version

Mobile Version