Burgeoning offshore deposits no cause for alarm

|

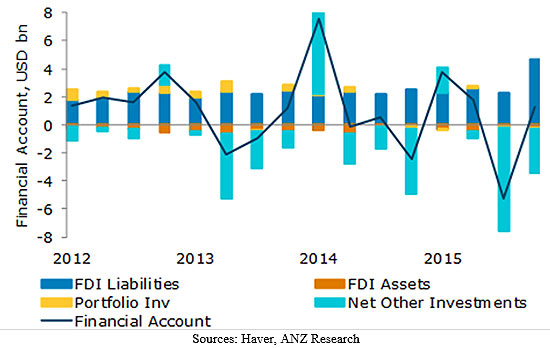

In the third quarter of 2015, the State Bank of Vietnam (SBV) revealed the offshore deposits under the other investment element in the balance of payments financial account, which added up to a massive $7.3 billion. Should one worry over such figure and Vietnam's foreign currency drain?

Indeed, the net other investment account in the BOP posted a significant rise in the outflow of $7.3 billion in the third quarter. However, on an annual basis, total net outflow in other investments reached $9.1 billion in 2015, after the slow down in Q4. While the outflow in Q3 seems oversized, it is not unusual. Given that the tendency slowed down in Q4, in our view, the risk of sustained deposit outflow has eased. Now that the upside pressure on the USD/VND rate has been eased, we see little risk of further capital outflow.

Although the central bank said that it was normal for the offshore deposits to be boosted to $7.3 billion, as the result of the Chinese yuan devaluation last August and expectation over a Fed rate hike last September, do you think it was normal practice for local banks to make overseas deposits, to ensure high liquidity across the local banking system?

The surge in outflow in Q3 to $7.3 billion could have been triggered by the unexpected devaluation of the CNY and the subsequent devaluation of the USD/VND rate. At the time, the upside pressure on the USD/VND rate was still strong, so the risk off sentiment was unusually high. Since the start of 2016, the trade balance has been posting a year-to-date surplus and the expectation of a delay in Fed hikes has taken the pressure off the USD/VND rate. However, the 0 per cent cap in deposit rates in USD accounts will temper USD deposits’ return to Vietnam.

While the local government yearns to issue some $3 billion worth of international G-bonds, why would it not issue through Vietnamese commercial banks to take advantage of the $7.3 billion available in offshore deposits?

By issuing international bonds to tap into global resources, the government is diversifying its sources of funding. It also ensures that the local credit market is not crowded out by government. In case these offshore deposits come back to Vietnam, USD liquidity may be used to finance the needs of the local market.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- Corporate bond market poised for stronger growth cycle (January 28, 2026 | 17:13)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

Mobile Version

Mobile Version