Bond issuance slows amid tightening controls

|

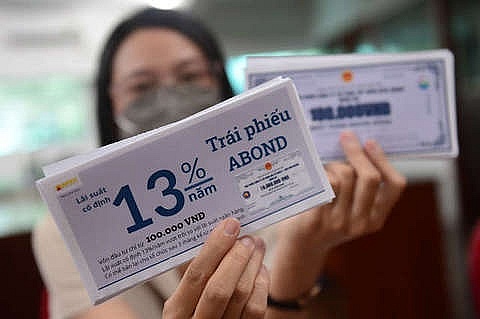

| A bondholder shows her ABOND bonds. Photo mns.com |

The Ministry of Finance reported that the total issuance volume of privately-placed bonds plunged to around VND30 trillion (US$1.3 billion) in April, down 33 per cent year-on-year.

In the first two weeks of May, the issuance figure reached VND5.2 trillion, equaling one-third of the figure last year.

Notably, realty bonds fell sharply to about VND820 billion in April, far less than their average monthly volume of VND26 trillion in 2021.

The market experienced not only decreasing bond issuances but also a buyback spree.

Specifically, premature bond buybacks in April alone stood at VND11.9 trillion, comparable to the figure of VND12.8 trillion in the previous three months combined.

The securities firm SSI underlined the Tan Hoang Minh Group's cancellation of issuance of nine bond batches as a major factor making firms cautious about bond issuance, resulting in a less active market.

SSI forecast that the market would continue to lose steam in the next quarter as firms postponed their issuance plans to wait for new regulations and guidance from the Government.

“The corporate bond market is expected to remain less active in Q2 unless the Government introduces new policies. The notorious Tan Hoang Minh case and the governmental crackdown on the market have made a significant impact on issuers and investors,” SSI added.

Some other experts are more optimistic about the future. They underscored premature bond buybacks as a boost to firms' financial health.

"The total volume of bonds that are going to mature in 2022 and 2023 is enormous. The premature bond buyback would spare firms the pain of paying bond interests higher than bank interests and reduce the ratio of debt to equity," they said.

The Ministry of Finance has been gathering comments on the fifth amendment to the Decree 153 on corporate bond issuance, aiming to put the market back in order.

The amendment is expected to raise the bar on professional investors and grant the right to offer privately-placed bonds to only public firms with collateral or payment guarantees.

SSI said that the amended decree if approved, would improve transparency and reduce illegal practices in the bond market. However, it will likely make the bond channel unavailable for a majority of market players.

"The corporate bond market operates on the principle of risk-return tradeoff. Regulations in the amended decree would make a private placement of bonds more difficult for issuers," SSI said.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Private capital funds as cornerstone of IFC plans (February 20, 2026 | 14:38)

- Priorities for building credibility and momentum within Vietnamese IFCs (February 20, 2026 | 14:29)

- How Hong Kong can bridge critical financial centre gaps (February 20, 2026 | 14:22)

- All global experiences useful for Vietnam’s international financial hub (February 20, 2026 | 14:16)

- Raised ties reaffirm strategic trust (February 20, 2026 | 14:06)

- Sustained growth can translate into income gains (February 19, 2026 | 18:55)

- The vision to maintain a stable monetary policy (February 19, 2026 | 08:50)

- Banking sector faces data governance hurdles in AI transition (February 19, 2026 | 08:00)

- AI leading to shift in banking roles (February 18, 2026 | 19:54)

- Digital banking enters season of transformation (February 16, 2026 | 09:00)

Tag:

Tag:

Mobile Version

Mobile Version