BAC A BANK offers new bonds worth $62.5 million

The aim is to increase safe and profitable investment opportunities for customers as well as meet the needs of the gradually warming bond market, the bank said.

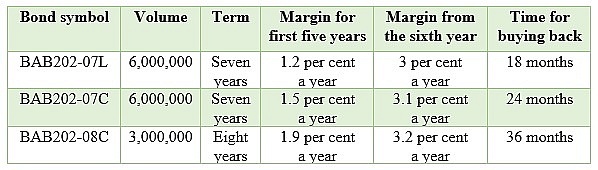

The bond products will have an interest rate higher than average personal deposit interest rates for a term of 12 months, with a maximum margin of 1.9 per cent a year.

Individual investors and organisations will be able to buy bonds for only VND50 million ($2,083) and VND100 million ($4,166).

|

The bonds have a face value of VND100,000, with interest paid every 12 months for terms of seven or eight years. The expected buy-back time is 18, 24, and 36 months from the date of issuance, corresponding to each bond symbol.

|

Similar to previous issuances, BAC A BANK's bonds will be non-convertible and unsecured, and distributed directly at the bank's head office and offices nationwide, making it easy for buyers.

After the offering ends on October 28, the bonds will be centrally registered at the Vietnam Securities Depository and Clearing Corporation and listed on the Hanoi Stock Exchange (HNX), in compliance with the government’s orientation for developing a healthy and transparent bond market.

Accordingly, investors can proactively trade and borrow bonds at competitive interest rates, creating conditions for customers to be proactive in their finances if they suddenly need capital, and fully exercise the rights of bond owners, including transfers, donations, and mortgages.

With the capital raised through previous bond issuances, BAC A BANK continues to affirm its stable financial health, timely supplying capital to the economy, and ensuring its capital adequacy ratio in operations and growth targets approved by the State Bank of Vietnam.

“With the orientation of lending to sectors encouraged by the government with low risks and volatility such as high-tech agriculture and social security, BAC A BANK has been growing from strength to strength for nearly 30 years,” said Chu Nguyen Binh, deputy general director of BAC A BANK.

“The bank has been maintaining a stable loan portfolio with more than half coming from essential sectors that are less affected by market factors such as agriculture, forestry and fishery, and manufacturing and processing technology,” Binh continued. “BAC A BANK especially focuses on providing credit to large enterprises with good credit quality within BAC A BANK's typical lending value chain. In addition, we provide investment consultancy for customers in the industry, so we have a comprehensive understanding of their operating situation and business prospects, and closely monitor their cash flow."

| BAC A BANK hits award with foreign exchange transaction Within the framework of the Vietnam FX Awards 2024 held in Hanoi recently, Bac A Commercial Joint Stock Bank (BAC A BANK) was honoured to be granted the award of Top 5 Banks with the largest foreign exchange trading volume in Vietnam on FX matching year 2023 awarded by the London Stock Exchange Group (LSEG). |

| BAC A BANK sets out ambitious business targets After strong performance last year, BAC A BANK has mapped out new business targets for the 2024-2029 period, with improvements across the board. |

| BAC A BANK enhances options for young enterprises BAC A BANK is now offering an attractive loan product designed specifically for young enterprises. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Banking sector targets double-digit growth (February 23, 2026 | 09:00)

- Private capital funds as cornerstone of IFC plans (February 20, 2026 | 14:38)

- Priorities for building credibility and momentum within Vietnamese IFCs (February 20, 2026 | 14:29)

- How Hong Kong can bridge critical financial centre gaps (February 20, 2026 | 14:22)

- All global experiences useful for Vietnam’s international financial hub (February 20, 2026 | 14:16)

- Raised ties reaffirm strategic trust (February 20, 2026 | 14:06)

- Sustained growth can translate into income gains (February 19, 2026 | 18:55)

- The vision to maintain a stable monetary policy (February 19, 2026 | 08:50)

- Banking sector faces data governance hurdles in AI transition (February 19, 2026 | 08:00)

- AI leading to shift in banking roles (February 18, 2026 | 19:54)

Tag:

Tag:

Mobile Version

Mobile Version