Asian markets rattled by fresh trade concerns

|

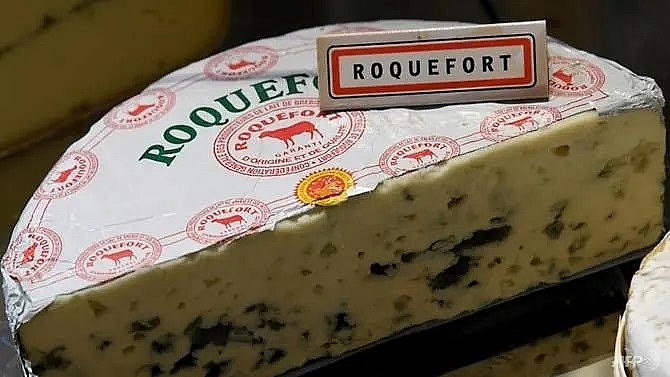

| Roquefort cheese and sparkling wine are among the French goods that could be hit with huge tariffs by the US in retaliation for a digital tax. (Photo: AFP/Bertrand Guay) |

Optimism that Beijing and Washington will eventually hammer out a partial agreement as part of a wider deal has supported equities for weeks, helping Wall Street to numerous records.

But investor sentiment was dealt a blow on Monday when Donald Trump said he would reinstate steel and aluminium tariffs on the two South American countries, which he accused of manipulating their currencies and hurting US farmers.

Later, officials warned they would hit France with up to 100 per cent in levies on US$2.4 billion in goods, saying a digital tax was discriminatory against US tech firms such as Google, Apple and Amazon.

Sparkling wine, yoghurt and Roquefort cheese could be hit as soon as next month, while US Trade Representative Robert Lighthizer warned his office was also considering similar moves against Austria, Italy, and Turkey.

On Tuesday, France vowed a "strong" response to any sanctions.

"Given Brazil was seen as a close friend of Trump and even they could not be exempt from tariffs, there is a notion that every country, regardless of what they do, could have tariffs imposed, which creates a lot of uncertainty of businesses," said Tapas Strickland at National Australia Bank.

NEW WARNING TO CHINA

Analysts said the moves against Brasilia and Buenos Aires citing currency movements raised the possibility the US could use a similar justification against China, which it has also accused of forex manipulation.

Adding to the sense of unease, US Commerce Secretary Wilbur Ross told Fox News that more tariffs on Chinese goods planned for Dec 15 would be imposed if the first phase of trade talks was not completed by then.

"If nothing happens between now and then, the president has made quite clear he'll put the tariffs in," he said.

Tokyo ended 0.6 per cent lower, Hong Kong shed 0.2 per cent and Sydney sank more than two per cent with investors disappointed that the Australian central bank held off cutting interest rates.

Seoul retreated 0.4 per cent and Singapore was off 0.5 per cent while Manila eased 0.2 per cent. Mumbai, Taipei and Jakarta were also down but Shanghai and Taipei both ended with small gains.

In early trade London fell 0.1 per cent but Frankfurt jumped 0.7 per cent and Paris gained 0.2 per cent.

Still, JP Morgan Asset Management strategist Kerry Craig said there were expectations that a "narrow deal around trade can be achieved".

But he added: "While there is a clear economic incentive from both sides to do some sort of deal, the political desire to reach more than the minimum is weak, as the two sides are still going to want to compete in areas such as technology."

The uncertainty over trade, combined with a disappointing US manufacturing report, sent all three main indexes on Wall Street tumbling, while Paris and Frankfurt also suffered big losses.

On forex markets, the yen, considered a safe haven in times of uncertainty, rallied higher on Monday against the dollar but pared its gains in early Asian business.

Oil prices extended gains ahead of a key meeting of OPEC and other major producers, which is expected to see them maintain output cuts into June, with speculation they could go on until the end of 2020.

- Key figures around 0820 GMT -

Tokyo - Nikkei 225: DOWN 0.6 per cent at 23,379.81 (close)

Hong Kong - Hang Seng: DOWN 0.2 per cent at 26,391.30 (close)

Shanghai - Composite: UP 0.3 per cent at 2,884.70 (close)

London - FTSE 100: DOWN 0.1 per cent at 7,281.24

Euro/dollar: DOWN at US$1.1076 from US$1.1078 at 2145 GMT

Pound/dollar: UP at US$1.2956 from US$1.2943

Euro/pound: DOWN at 85.50 pence from 85.58

Dollar/yen: UP at ¥109.10 from ¥108.96

West Texas Intermediate: UP 28 cents at US$56.24 per barrel

Brent North Sea crude: UP 21 cent at US$61.13 per barrel

New York - Dow: DOWN 1.0 per cent at 27,783.04 (close)

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- Corporate bond market poised for stronger growth cycle (January 28, 2026 | 17:13)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

Tag:

Tag:

Mobile Version

Mobile Version