Ambitious 2023 targets out of reach with weak progress

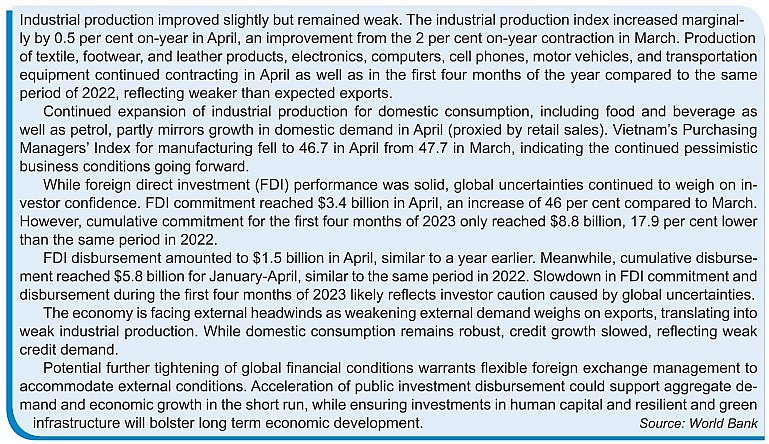

Both domestic and global difficulties badly affecting Vietnam’s industrial production were highlighted last week when the National Assembly opened its fifth session in Hanoi.

“The economic situation has continued depressing and the consumption demands in Vietnam’s key export markets have slashed due to high inflation. Meanwhile, there has been a rise in geopolitical tensions and many nations have tightened their monetary policy. All of these have badly affecting Vietnam’s industrial production and socioeconomic performance as a whole,” said Vuong Dinh Hue, Chairman of the National Assembly (NA).

The government last week reported that in Q1, GDP grew only 3.32 per cent on-year, the lowest Q1 growth level over the past 12 years. In which many localities saw their industrial growth record a low or below-zero level. For example, regional GDP declined in the provinces of Bac Ninh (11.85 per cent), Quang Nam (10.88 per cent), Ba Ria-Vung Tau (4.75 per cent), Vinh Phuc (2.47 per cent), and Quang Ngai (1.07 per cent). These localities are some of Vietnam’s biggest industrial hubs.

“Production and business activities are facing enormous difficulties, especially in the sectors of industry and construction, and small- and medium-sized enterprises,” Deputy Prime Minister Le Minh Khai told the NA.

“The total number of newly registered enterprises and enterprises resuming operations has decreased, while the number of those with halted operations and dissolution has risen,” he said.

The government reported that in the first four months of 2023, there were about 49,900 newly established businesses registered at around $20.2 billion and employing as many as 331,400 labourers – up only 0.6 per cent in the number of enterprises but down 26.8 per cent in registered capital; and 4.8 per cent in the number of employees as compared to those in the same period last year.

If an additional $26.28 billion registered by the nearly operational 17,200 enterprises is taken into account, the total newly registered capital inserted into the economy in the first four months sat at $46.48 billion, down 46 per cent on-year.

Also in this period, the number of businesses with halted operations reached nearly 50,000, up 21.8 per cent on-year. Moreover, nearly 21,000 enterprises stopped operations and waited for completing dissolution procedures, up nearly 40 per cent. Some 6,100 businesses completed such procedures, up 10.1 per cent. On average, each month saw 19,200 enterprises were kicked out of the market.

|

|

Expanding risks

“Since early this year, the world situation has continued witnessing rapid and complicated uncertainties which are difficult to forecast, badly affecting almost all nations and regions globally,” DPM Khai stressed. “High inflation, tightened monetary policy, and a prolonged hike in interest rates have led to a decline in economic growth and in consumption of Vietnam’s big export markets.”

On-year GDP growth in the United States for Q1 was 1.6 per cent, while it was 1.3 per cent in the EU, 0.8 per cent in South Korea, 1.6 per cent in Japan, 0.1 per cent in Singapore, and 2.7 per cent in Thailand. The World Bank has made a forecast that the global economy may grow only 1.7 per cent this year, while the International Monetary Fund (IMF) also expected a 2.8 per cent rise.

Along with bankruptcy threats to major banks earlier this year, particularly in the US, the global property market has been bogged down in difficulties, with a slash reported in housing sales in the US, Canada, and China, according to the Vietnamese government report submitted to the NA.

“These grey situation has had a knock-on effect on many sectors and the psychology of investors, enterprises, and people – with the volume of bank deposits plummeting,” said Vu Hong Thanh, Chairman of the National Assembly Economic Committee.

Minister of Planning and Investment Nguyen Chi Dung added, “The economy is quite open to the world, so any fluctuations in the global market such as high inflation, high prices of materials, and supply chain disruptions can have negative impacts on the country’s macroeconomic stability, economic growth, inflation, and people’s incomes.”

According to the General Statistics Office, the economy’s GDP was valued at $409 billion in 2022 when total export-import turnover reached $732.5 billion, which was 1.8 times higher than GDP.

New projections

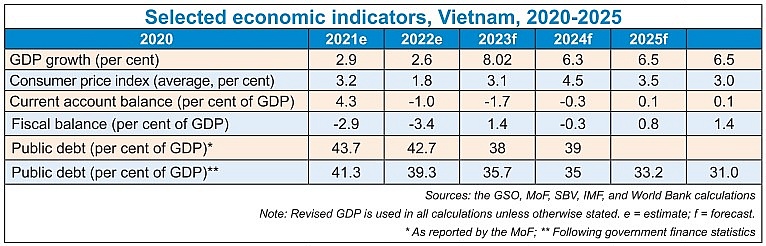

For this year, the government expects the economy to expand by around 6.5 per cent, below a decade-high of 8.02 per cent touched in 2022.

Over a week ago, at a bilateral meeting with Vietnamese Prime Minister Pham Minh Chinh in Hiroshima, IMF managing director Kristalina Georgieva praised Vietnam’s economic management policy. She said that Vietnam is a bright star in the global economic sky and the country’s economic growth is expected to double that of the global economy.

“Vietnam’s medium-term growth prospects remain strong, and we discussed how to navigate Vietnam’s economy in a challenging and uncertain global environment,” she posted on Twittter.

PM Chinh told Georgieva of Vietnam’s success in various fields, including establishing a stable financial market and an elevated national brand valued at $431 billion in 2022, with the country achieving the fastest growth worldwide in brand development in the 2020-2022 period. Vietnam also climbed 12 places in the World Happiness Report 2023.

Recently, the World Bank predicted Vietnam’s 2023 GDP growth at 6.3 per cent; the Asian Development Bank had it at 6.5 per cent; and Standard Chartered put it at 6.5 per cent.

However, Fitch Solutions takes caution about Vietnamese economic prospects forecast. It said that Vietnam’s real GDP growth slowed sharply from 13.7 per cent on-year in Q3 of 2022 to 5.9 per cent in Q4 of 2022, and “we remain cautious about the outlook for 2023.”

“While the economy will receive support from a likely rebound in demand from mainland China, it will not be enough to offset the impact of a further weakening in global demand. With domestic inflation also set to rise a little further and monetary tightening underway, we expect GDP growth to slow from 8.02 per cent in 2022 to 6.5 per cent in 2023, below the pre-pandemic average of 7 per cent,” Fitch Solutions said.

Meanwhile, according to Trading Economics expectations, the GDP annual growth rate in Vietnam is expected to be 3.3 per cent by the end of this quarter. In the long term, the rate is projected to trend around 6.1 per cent in 2024 and 5.9 per cent in 2025. Meanwhile, FocusEconomics panellists expect Vietnam’s GDP to expand 5.4 per cent in 2023, which is down 0.3 percentage points from last month’s forecast, and 6.5 per cent in 2024. “Economic momentum will soften this year due to slower growth in private consumption, fixed investment and exports. That said, stronger fiscal spending will add support, and Vietnam will remain among ASEAN’s top performers,” FocusEconomics stated.

| Directive to fortify local production As the COVID-19 outbreak is poised to cause a global economic crisis affecting Vietnam, the government’s fresh solutions to boost local production to achieve the country’s economic growth goal are hoped to give a kiss of life to both enterprises and investors. |

| Global demand geared up to rise Despite massive challenges, Vietnam’s trade landscape is slowly gaining momentum thanks to a bit-by-bit recovery in local production and gradual reopening of many foreign markets, promising a brighter export-import picture for the country until the year’s end. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Citi economists project robust Vietnam economic growth in 2026 (February 14, 2026 | 18:00)

- Sustaining high growth must be balanced in stable manner (February 14, 2026 | 09:00)

- From 5G to 6G: how AI is shaping Vietnam’s path to digital leadership (February 13, 2026 | 10:59)

- Cooperation must align with Vietnam’s long-term ambitions (February 13, 2026 | 09:00)

- Need-to-know aspects ahead of AI law (February 13, 2026 | 08:00)

- Legalities to early operations for Vietnam’s IFC (February 11, 2026 | 12:17)

- Foreign-language trademarks gain traction in Vietnam (February 06, 2026 | 09:26)

- Offshore structuring and the Singapore holding route (February 02, 2026 | 10:39)

- Vietnam enters new development era: Russian scholar (January 25, 2026 | 10:08)

- 14th National Party Congress marks new era, expands Vietnam’s global role: Australian scholar (January 25, 2026 | 09:54)

Tag:

Tag:

Mobile Version

Mobile Version