Aligning with green EU edicts challenging but achievable

Could you shed some light on why a flood of European companies have expanded their manufacturing operations in Vietnam?

Vietnam’s free trade agreement with the EU (EVFTA) has contributed to its attractiveness for European companies seeking to expand their manufacturing operations. As one of only two Southeast Asian countries with such an agreement, Vietnam offers European businesses a unique advantage in the region.

|

| European Chamber of Commerce in Vietnam (EuroCham) chairman Dominik Meichle |

According to EuroCham’s latest Business Confidence Index survey, about a quarter of our members have reported significant to moderate benefits from the agreement, mostly through reduced or eliminated tariffs and increased market competitiveness. The impact is also seen in the growth of Vietnamese exports to Europe, which have climbed from €35 billion ($38.1 billion) in 2019 to over €48 billion ($52.8 billion) in 2023.

Despite this, recent policy changes in Vietnam have raised concerns among some European businesses. New taxes and technical barriers, while not technically violating the letter of the EVFTA, seem to go against its intended spirit of open trade. To make matters more difficult, many of our members face challenges with complex compliance requirements and a lack of recognition for international standards.

Beyond the EVFTA, Vietnam’s appeal to European businesses is clear. Its young, eager workforce of more than 50 million, along with lower labour costs, appeal to a wide range of European industries. However, about 70 per cent of these workers have not had formal training, which creates both challenges and opportunities, especially for companies that need skilled workers in high-tech fields.

Vietnam’s location in Southeast Asia is also a big advantage for European businesses. Being in Vietnam makes it easy to reach other important Asian markets like China, Japan, South Korea, and ASEAN members. This makes managing supply chains easier and lowers the cost of transporting goods.

Vietnam’s strong focus on building infrastructure is another advantage for European businesses. Investing a significant 6 per cent of its GDP compared to the ASEAN average of 2.3 per cent, Vietnam is making a big effort to improve its infrastructure. This translates to smoother operations and easier access to markets across the region, making Vietnam even more attractive as a business location.

What are the driving forces behind the growing trend of green manufacturing in Vietnam?

Vietnam’s manufacturing sector is undergoing a significant shift towards sustainability, driven by several key factors. Increasing consumer demand for eco-friendly products is pushing companies to adopt greener practises. Investors are also favouring businesses with strong environmental commitments, providing financial incentives for sustainable operations.

Additionally, European companies operating in Vietnam are setting an example by prioritising green initiatives, thanks to their long-standing emphasis on sustainability. The EU Green Deal, an ambitious set of policies aimed at achieving climate neutrality in Europe by 2050, is further accelerating this transition.

To access the European market, Vietnamese exporters must adhere to strict environmental standards, posing challenges but also creating opportunities for businesses willing to adapt. While compliance may require investments and operational changes, it can ultimately lead to increased competitiveness, improved brand reputation, and reduced environmental impact.

However, the path to greener manufacturing is not without obstacles. Smaller businesses, in particular, may struggle to meet the stringent EU standards due to limited resources and technical know-how. Addressing these challenges will require a collaborative effort, with government support and industry partnerships playing a crucial role in ensuring a smooth and inclusive transition.

In response to the current landscape, the Vietnamese government has shown a commitment to supporting sustainable practises in the manufacturing sector, recognising the potential benefits of reduced pollution, lower costs, and increased competitiveness.

Recent policy shifts, including the introduction of the direct power purchase agreement, further signal the government’s intent to promote sustainability. By enabling businesses to directly purchase electricity from renewable energy providers, the decree could pave the way for greater adoption of renewable energy sources. However, the decree’s ultimate effectiveness depends on successful implementation and will need to be evaluated over time to determine its true impact.

For businesses of all sizes seeking insights into sustainable practises, opportunities to adapt operations, or partnerships aligned with this green movement, EuroCham’s upcoming Green Economy Forum and Exhibition 2024 in Ho Chi Minh City from October 21-23 will present an invaluable platform, and we encourage everyone to join us.

What challenges are EU enterprises currently coping with?

Although Vietnam is actively improving its regulations, frequent changes and unclear implementation can create uncertainty for businesses, making it difficult to plan for the future. While this is common in fast-growing economies, clearer and more consistent regulations would provide a more stable environment for companies to operate and invest.

Despite some improvements in administrative efficiency, thanks to digitalisation, there’s still a lot of room for streamlining. Simplifying approval processes for key documents like investment registration certificates and enterprise registration certificates, as well as reducing paperwork, would help projects move faster and allow businesses to adapt quickly to market changes.

EuroCham is actively involved in these improvements through our participation in the Prime Minister’s Advisory Council for Administrative Procedure Reform. This council allows us to directly voice concerns and work with the government and others to streamline processes, improve public services, and create a more efficient business environment. While we acknowledge the progress made, faster reforms are crucial for continued economic growth.

A key area that needs improvement is the process for obtaining work permits and visas for foreign workers. While a decree introduced in September 2023 aimed to streamline these procedures, its impact has been limited. Despite the decree, only 3.3 per cent of EuroCham members reported significant improvements in our recent survey, with half acknowledging some progress and a quarter reporting no change at all.

Another challenge for European companies is complying with both the EU’s General Data Protection Regulation and Vietnam’s Personal Data Protection Decree (PDPD). These regulations are complex and often require companies to make educated guesses about compliance, leading to potential risks.

Adding to this, it requires companies to conduct impact assessments for data processing and transfers, but there’s limited guidance from authorities. In fact, our recent survey revealed that a quarter of respondents do not fully understand the PDPD’s requirements, and only a third feel confident in their ability to comply.

The potential for substantial fines and even website licence revocation for non-compliance further amplifies concerns among European businesses when it comes to this issue.

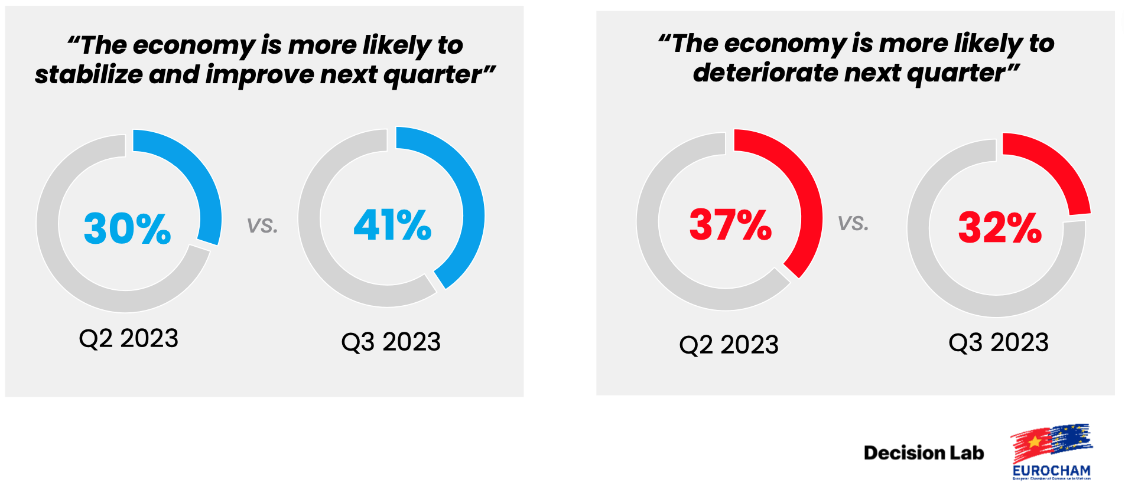

| European investors upbeat about Vietnam as business confidence rebounds European investors are optimistic about the prospects of Vietnam as shown by the Business Climate Index (BCI) of the European Chamber of Commerce (EuroCham) rebounding in Quater. |

| European investors eye greener incentives European enterprises are focusing more and more on green investments to tap into fresh opportunities from Vietnam’s actions to achieve net zero by 2050, but they need legal improvements and incentives to facilitate their plans. |

| Vietnam remains attractive to European investors Vietnam remains appealing to European investors amidst the tough global situation, according to the latest report by The the European Chamber of Commerce in Vietnam. |

| Bac Ninh lures European investors to its industrial hub The northern province of Bac Ninh is striving to entice more European investors, further expanding opportunities in the area. |

| European investor-sentiment on Vietnam improves The European Chamber of Commerce Vietnam's (EuroCham) quarterly Business Confidence Index (BCI) has regained its upward trajectory in the third quarter of 2023, offering a glimmer of hope for Vietnamese businesses after a turbulent year. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- SK Innovation-led consortium wins $2.3 billion LNG project in Nghe An (February 25, 2026 | 07:56)

- THACO opens $70 million manufacturing complex in Danang (February 25, 2026 | 07:54)

- Phu Quoc International Airport expansion approved to meet rising demand (February 24, 2026 | 10:00)

- Bac Giang International Logistics Centre faces land clearance barrier (February 24, 2026 | 08:00)

- Bright prospects abound in European investment (February 19, 2026 | 20:27)

- Internal strengths attest to commitment to progress (February 19, 2026 | 20:13)

- Vietnam, New Zealand seek level-up in ties (February 19, 2026 | 18:06)

- Untapped potential in relations with Indonesia (February 19, 2026 | 17:56)

- German strengths match Vietnamese aspirations (February 19, 2026 | 17:40)

- Kim Long Motor and AOJ Suzhou enter strategic partnership (February 16, 2026 | 13:27)

Tag:

Tag:

Mobile Version

Mobile Version