Stock market slips and slides

Investors’ sentiment for the rest of the year ahead of the Lunar New Year or Vietnam’s Traditional Tet Festival – amid the absence of any supporting macroeconomic indicators – is believed to be the reason behind the market’s lacklustre performance recently according to analysts.

Investors’ sentiment for the rest of the year ahead of the Lunar New Year or Vietnam’s Traditional Tet Festival – amid the absence of any supporting macroeconomic indicators – is believed to be the reason behind the market’s lacklustre performance recently according to analysts.

Meanwhile, “the risk of a high consumer price index (CPI) prior to Tet still looms, especially with the frosty weather in recent weeks likely pushing food prices even higher,” said Bao Viet Securities in a note to their clients.

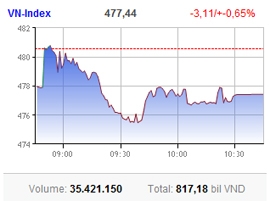

VN-Index of Ho Chi Minh Stock Exchange (HoSE) fell 2.58 points, or 0.54 per cent, to close at 477.97 points. On Hanoi Stock Exchange (HNX), HNX-Index dipped as well to 104.76 points, down 2.71 points or 2.52 per cent.

Liquidity was still low with 35.4 million shares worth VND817.180 billion ($40.86 million) traded on HoSE and 34.47 million shares worth VND605.42 billion ($30.27 million) changing hands on HNX.

Further upstream, some blue-chips stocks that are said to be driving up the market managed to register gains, such as Bao Viet Holding (BVH) which added 2.72 per cent and Masan group (MSN), which gained 1.33 per cent while Vinpearl J.S.C. (VPL) continued to rise for the 15th consecutive session.

VPL outperformed the whole market when gaining 4.9 per cent, with 84,000 units changing hands.

“VN-Index is not reflecting exactly the market’s movement, which is reducing investors’ confidence,” said Woori CBV analysts.

Financial sector fell down with Sacombank (STB) shedding 0.65 per cent while Eximbank (EIB) dropping 2.68 per cent lower, PetroVietnam Finance (PVF) gave back 1.24 per cent and Sai Gon Securities (SSI) lost 4.29 per cent on HoSE.

Habubank (HBB) eased back 2.73 per cent and Kim Long Securities (KLS) shed 4.7 per cent on the Hanoi exchange.

Major stocks like Hoang Anh Gia Lai Group (HAG) and PetroVietnam Fertilisers (PVF) went down as well.

Foreigners bought nearly 4 million shares of 94 stocks on HoSE today, focusing mainly on SBT, HAG, CTG, VSH and HSG. On the northern bourse, they bought 520,600 shares of stocks like PVS, PVX, VNF, CVT and VCG, while selling 518,700 shares mainly of PVS, VND, DBC, CVT and SHN.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- Corporate bond market poised for stronger growth cycle (January 28, 2026 | 17:13)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

Mobile Version

Mobile Version