PwC: market capitalisation of Global Top 100 set $21 trillion record

|

The rise is more subdued than the 15 per cent increase reported in 2018, reflecting more challenging market conditions.

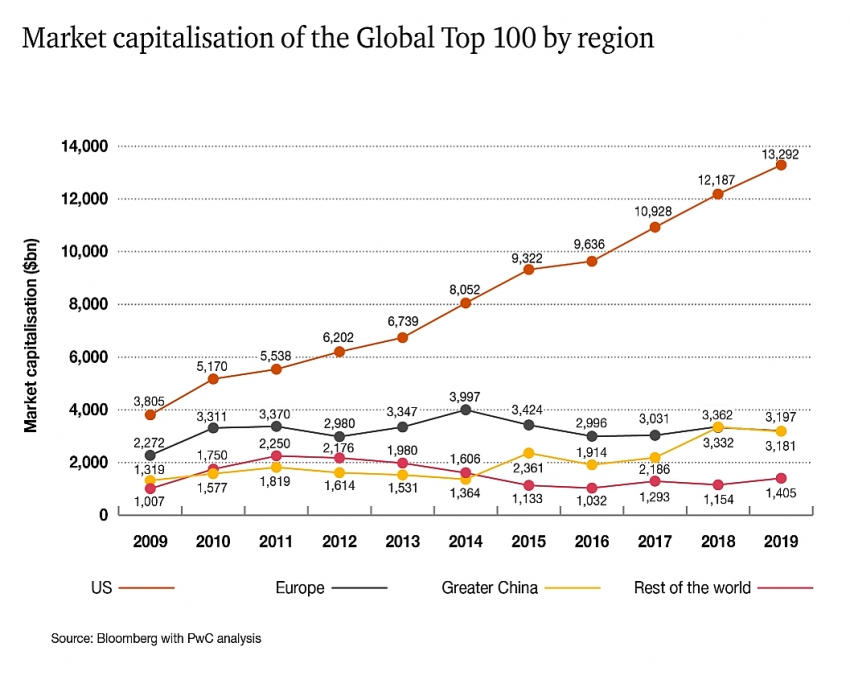

Growth in market capitalisation in the past year has been primarily driven by US companies by virtue of a robust economic environment. Both Greater China and Europe registered a decrease in market capitalisation, reversing last year’s gains.

The technology sector continues to dominate, although the healthcare, consumer services, and telecommunications sectors performed most strongly over the past year.

For the fifth year running, the US accounts for more than half (54) of the Global Top 100 by the number of companies with a growth of 9 per cent, outpacing the overall. US companies represent 63 per cent of the total market capitalisation, up from 61 per cent last year.

| PwC’s Global Top 100 analyses the leading 100 global companies by market capitalisation and compares how the list evolves year-on-year. |

Greater China is the second-largest component of the Global Top 100 by market capitalisation, despite a 4 per cent decline in the past 12 months following trade uncertainties and their impact on local market sentiment.

This contrasts with the 57 per cent increase in 2018, when three new companies entered the Global Top 100 and two rose to the top ten.

The survey also shows that geopolitical challenges including uncertainty around Brexit are likely to have impacted Europe-based companies in the ranking in the past year.

Three European based companies have left the Global Top 100 and overall European based companies in the ranking lost 5 per cent in market capitalisation.

The technology sector continues to be the largest component of market capitalisation within the Global Top 100, ahead of the financial sector, with healthcare in third place.

The 15 per cent growth in the healthcare, consumer services, and telecommunications sectors outpaced technology (6 per cent), which experienced volatility in late 2018. Financials was the weakest performing sector with a 3 per cent decline in market capitalisation.

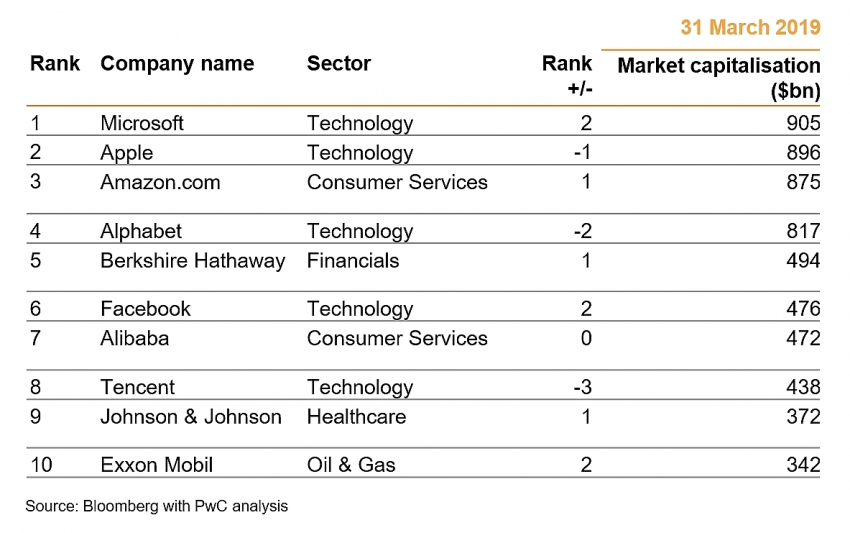

The global top ten continues to be dominated by the technology and e-commerce companies – Microsoft, Apple, Amazon, Alphabet – followed by Facebook in sixth position and Alibaba and Tencent as numbers seven and eight, respectively.

|

Particularly, Microsoft was the strongest performer in terms of absolute increase in market capitalisation, gaining $202 billion or 29 per cent in value compared to 2018, which propelled it into the top spot.

It is followed by Apple, Amazon, and Alphabet. This breakaway group is 40 per cent ahead of the fifth-ranked company, Berkshire Hathaway, which has a market capitalisation of $494 billion.

In the private company domain, the value of the top 100 unicorns grew by 6 per cent to $815 billion at March 31, 2019, consistent with their public company counterparts.

Nearly half (48 per cent) of the top 100 unicorns were from the US, also in line with what is stated in the Global Top 100.

Notably, Greater China contributes approximately 30 per cent of unicorns in both number and value terms, which is a much higher proportion than for the Global Top 100. As a significant source of future IPOs or acquisitions by other companies, this suggests more entries from Greater China into the Global Top 100 in due course.

Ross Hunter, partner and IPO Centre leader at PwC UK, said, “While the technology sector did not perform as strongly as in previous years, it continues to dominate the Global Top 100, with the top four US giants in a league of their own.

“In the longer term, we anticipate the imbalance reducing, with Greater China technology companies, in particular, challenging the current position – the prominence of companies from Greater China amongst the unicorns may be evidence supporting this.”

PwC’s Global Top 100 analyses the leading 100 global companies by market capitalisation and compares how the list evolves year by year. This analysis was conducted for the period between March 31, 2019 and March 31, 2018 and captures companies’ market capitalisation in US dollars, based on their location.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Vietnamese consumers express concern about climate change (October 11, 2025 | 14:06)

- ESG seen as key to Vietnam’s business credibility and capital attraction (September 29, 2025 | 18:38)

- From compliance to strategy: ESG criteria gaining ground (September 29, 2025 | 15:47)

- Vietnamese firms step up ESG game (September 23, 2025 | 15:26)

- Vietnam tax and legal changes set to shape foreign investment landscape (September 16, 2025 | 13:46)

- Vietnamese businesses navigate US tariffs (June 25, 2025 | 12:14)

- The impact of cloud, AI, and data on financial services (April 14, 2025 | 11:20)

- Vietnam 2025 M&A outlook: trends, deals, and opportunities (March 21, 2025 | 08:54)

- Vietnam's M&A landscape mirrors global trends (February 18, 2025 | 17:13)

- Asia-Pacific CEOs enter 2025 with optimism and caution (February 06, 2025 | 17:16)

Tag:

Tag:

Mobile Version

Mobile Version