Profit-taking pushes markets back

Ho Chi Minh Stock Exchange (HoSE) and Hanoi Stock Exchange (HNX) saw some rising sessions during last week without no supportive news, which had early raised forecasts about a looming fall. Investors who gained from the sudden rises largely bought out since yesterday.

Ho Chi Minh Stock Exchange (HoSE) and Hanoi Stock Exchange (HNX) saw some rising sessions during last week without no supportive news, which had early raised forecasts about a looming fall. Investors who gained from the sudden rises largely bought out since yesterday.

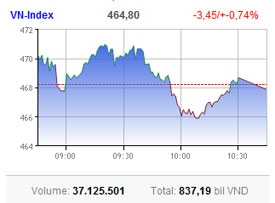

High inflation and the government increasingly tightening financial policies discouraged investors, which strongly reduced the demand for shares today. Liquidity reached 37 million shares worth VND837.2 billion ($20.7 million), down 11 per cent and 3.6 per cent, respectively.

At the close, the benchmark VN-Index lost 3.45 points, or 0.74 per cent, to 464.8 points.

The majority of blue-chip stocks sharply fell, with Vincom Corp. (VIC) off 4.13 per cent, Vietcombank (VCB) shedding 3.65 per cent and Hoang Anh Gia Lai Group (HAG) losing 3 per cent.

Saigon Securities Inc. (SSI) dropped 4.44 per cent, while PetroVietnam Fertilisers (DPM) and PetroVietnam Finance (PVF) significantly giving up as well.

Even Vietinbank (CTG), which was strongly bought in by foreigners during recent sessions, declined up to 2.22 per cent today.

Penny and mid-cap stocks largely fell in line with the downward trend of blue-chips, boosting the decliner amount on HoSE to 165, nearly tripling the advancers.

Foreigners cashed in the southern bourse today, focusing on blue-chips CTG, VCB and FPT. However, the buying trend was quite modest, with net buying value reaching VND30 billion ($1.95 million).

Some major stocks like PetroVietnam Drilling (PVD), Hoa Phat Group (HPG) and Masan Group (MSN) ended higher.

Hanoi exchange saw a stronger decline with up to 210 stocks down compared with 56 up.

The HNX-Index lost 1.67 points, or 1.76 per cent, to 93.17 points. Liquidity significantly reduced to VND604.3 billion ($29.2 million).

VnDirect Securities (VND), Bao Viet Securities (BVS) and Kim Long Securities (KLS) were among top decliners.

PetroVietnam Services (PVS), PetroVietnam Construction (PVX), PetroVietnam Insurance (PVI) along with Asia Commercial Bank (ACB) all declined. Habubank ended flat.

Foreigners seemingly started leaving the HNX. They bought just VND8.2 billion ($396,000) while selling VND8.6 billion ($415,000) worth of shares on the bourse today.

Generally, there is still uncertainty among investors about the market’s upcoming moves.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- Corporate bond market poised for stronger growth cycle (January 28, 2026 | 17:13)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

Mobile Version

Mobile Version