News gives falling market new wings

Nguyen Son, spokesman for State Securities Commission (SSC), confirmed with local media this morning that the Ministry of Finance had approved the two new trading instruments, comprising margin account trading and buying-selling same stock in a session. The decision will come into effort on August 1.

Nguyen Son, spokesman for State Securities Commission (SSC), confirmed with local media this morning that the Ministry of Finance had approved the two new trading instruments, comprising margin account trading and buying-selling same stock in a session. The decision will come into effort on August 1.

After the high anticipated news was released, demand for shares sharply rose on the two stock exchanges. The sellers, however, largely stopped selling shares simultaneously.

Real-estate shares were among the ones being bid the most. Tan Tao Investment Industry Corp. (ITA) and Investment and Trading of Real Estate (ITC) saw more than 19,000 and 26,000 bid orders at ceiling price remaining at the session close, respectively.

Licogi 16 (LCG) saw more than 15,000 ceiling bid orders outstanding, PetroVietnam - Idico Long Son Industrial Park Investment (PXL) 14,000 orders, DIC Investment and Trading JSC (DIC) and Development Investment Construction JSC (DIG) 3000 orders each.

Sao Mai Construction Corp. (ASM) hit the ceiling after hitting the floor for 10 consecutive sessions, with more than 1,000 ceiling bid orders outstanding.

Cheap shares in production sectors were strongly bid for as well. Seafood JSC No 4 (TS4) saw over 94,000 bid orders at ceiling remaining, while Dong Phu Rubber (DRH) saw more than 28,000 orders.

Of the major stocks, Refrigeration Electrical Engineering (REE) and Saigon Securities Inc. (SSI) were bid the most today.

Other major stocks including Sacombank (STB), Vietinbank (CTG) and Hoang Anh Gia Lai (HAG) outperformed the market, but just over a million units of each stock changing hands. Several blue-chips saw just small volumes traded as sellers much restrained selling out shares.

Most the southern bourse advanced with 232 stocks up, among them 150 hit the ceiling. Just 22 stocks were off and 28 unchanged.

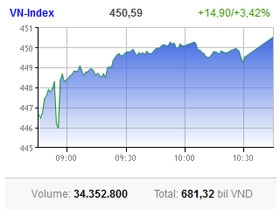

The benchmark VN-Index of the Ho Chi Minh Stock Exchange (HoSE) soared 14.9 points or 3.42 per cent to 450.59 points. Liquidity slightly rose to 34.35 million shares worth VND681.32 billion ($32.9 million).

On the Hanoi Stock Exchange (HNX), the benchmark HNX-Index jumped 2.32 points or 3.23 per cent to 74.05 points.

Investors strongly focused on major stocks on this bourse, in which PetroVietnam Construction (PVX) and Kim Long Securities (KLS) saw more than two million bid orders at ceiling each remaining, VnDirect Securities (VND) one million orders, while Bao Viet Securities (BVS), Thai Hoa Vietnam Group (THV) and Vinaconex (VCG) were massively bid for as well.

At the close, as high as 196 stocks hit the ceiling. Liquidity was of 28.2 million shares worth VND300 billion ($14.5 million).

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- Corporate bond market poised for stronger growth cycle (January 28, 2026 | 17:13)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

Tag:

Tag:

Mobile Version

Mobile Version