Masan Resources reports solid nine-month performance

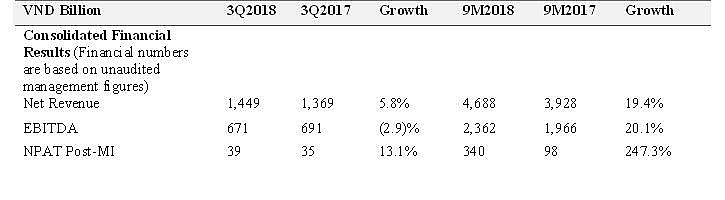

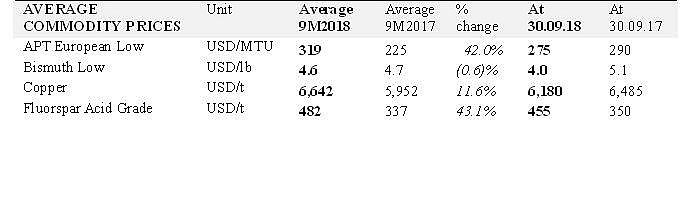

The country’s largest integrated industrial minerals and chemicals manufacturer Masan Resources (UpCoM: MSR) posted a revenue of VND4.688 trillion ($203.8 million) in the first nine months of 2018, a 19.4 per cent increase on-year. Copper inventory remained high as prices were less favourable due to the ongoing trade war and slightly muted demand, but the benchmark price for main products in the period was significantly higher in comparison to the same period last year.

The management’s initiative to increase price realisation continued to be successful with price realisation on a tungsten equivalent unit basis 5.8 per cent higher in the first nine months of 2018 than in the same period last year.

|

| MSR evolves as the largest ex-China Tungsten chemicals producer |

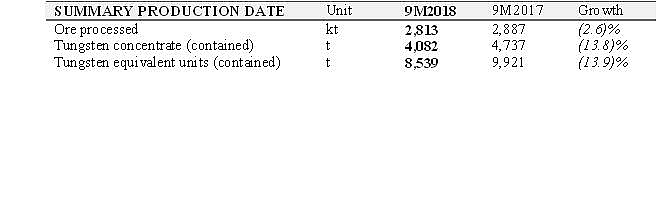

Earnings before interest, taxation, depreciation, and amortisation (EBITDA), meanwhile, grew by 20.1 per cent to VND2.362 trillion ($102.7 million) over the same period last year. Despite lower tungsten head grades resulting in a 14.1 per cent reduction in tungsten equivalent units production, MSR recorded an EBITDA margin of 50.4 per cent, representing a 32 basic-point increase over the first nine months of 2017.

Management is strictly monitoring costs and accelerating the commissioning of its capital upgrade projects, specifically to the tungsten and fluorspar circuits to ensure that the Nui Phao project continues to be one of the lowest cost producers of scale. MSR has already delivered $30 million in free cash flow (FCF) during the first nine months of 2018, and is expected to deliver 30 per cent growth in FCF for the 2018 financial year against 2017.

|

| Masan Resources reported solid nine-month performance |

MSR delivered an attributable net profit of VND340 billion ($14.78 million) in the period, representing a 247.3 per cent increase over the same period last year, delivering a profit margin of 7.2 per cent for the first time ever.

The plunge in tungsten prices was anticipated as a result of the summer shutdown in Europe and the uncertainties caused by the ongoing US-China trade war. Despite subdued benchmark prices, the tungsten concentrate market continues to remain tight with very limited supply available globally and the underlying demand drivers for tungsten end-use products remaining strong. The expectations of stronger and sustainable growth in tungsten demand were also reflected by many of the participants in the recently concluded Annual General Meeting of International Tungsten Industry Association (ITIA) in China.

|

| Market Development: Trade uncertainties leading to short term price volatility in a fundamentally strong Tungsten market |

MSR continues to develop an integrated business model to generate strong cash flows and profits through commodity cycles and offer flexibility to pay down debts and declare cash dividends to shareholders. In line with this strategy, during the third quarter of 2018, Nui Phao Mining (NPMC), a wholly-owned subsidiary of the company, acquired H.C. Starck GmBH’s 49 per cent stake in Nui Phao-H.C. Starck Tungsten Manufacturing LLC (NHTCM) for the total cash consideration of $29.1 million. Subsequent to the acquisition, the name of NHTCM has been changed to Masan Tungsten Limited Liability Company (MTC).

The NPMC processing plant has achieved the best tungsten recoveries since the start of operations, but production levels were low due to consciously treating lower tungsten head grades in the first nine months of 2018.

Based on MSR’s results in the period, the acquisition of H.C. Starck GmBH’s 49 per cent stake in MTC and current outlook on pricing fundamentals, management is confident in being able to deliver net revenue and attributable profit to shareholders in line with previously released guidance ranges of VND7.3-8 trillion ($317.39-347.82 million) and VND600-1,000 billion ($26.06-43.47 million), respectively.

As anticipated at the start of the third quarter of 2018, global political and trade agendas had a bearing on the commodity prices and the upward momentum in the commodity prices was halted by the ensuing business uncertainties.

MSR management participated in the 31st Annual General Meeting of ITIA at Chengdu, China and found many of the participants having a strong view of further demand growth of end-use tungsten products in the near future. The US, Japan, and South Korea represent more than 40 per cent ex-China tungsten demand and are witnessing a strong demand growth for tungsten products, while European demand has moderated due to over-production in the first half of 2018.

A supply-side structural shift is taking place in China that accounts for more than 80 per cent of primary global tungsten supply. Stringent environmental regulations, rising production costs, and continuing inspection drives are leading to supply-side consolidation and increasing cost pressures providing strong support to global tungsten prices.

Tungsten prices have been stable for the last six weeks and with the return of European buyers in the market. NPMC management is consistently receiving more enquiries for spot sale and expects the benchmark prices for tungsten to recover to the average of the first nine months of 2018 by the end of this fiscal year.

Upgrades to the tungsten circuit have increased tungsten recovery from ore processed by 6.3 per cent over the same period last year. With the capital upgrades performing as expected and a planned shut-down successfully completed in September 2018, management is expecting recovery rates to hit 70 per cent in the fourth quarter of 2018.

The performance of the fluorspar circuit continues to improve quarter-on-quarter, with the recoveries for fluorspar in the third quarter of 2018 increased by 1.2 per cent from the previous quarter and by 6.4 per cent from the same quarter last year.

|

| Operational Highlights: Recovering more with less |

In line with MSR’s five-year strategy, post-acquisition of H.C. Starck GmBH’s share in MTC, and the strategic partnership between Masan Group, the parent company of MSR, and SK Group, one of the largest corporate groups in South Korea, management is currently in the process of further increasing the capacity of the highly profitable tungsten chemicals business in Vietnam and is in discussions with selected partners to have strategic partnerships in and outside Vietnam for further downstream integration and getting closer to end-user customers.

The management is also looking to further secure the supply of raw materials to ensure the maximum utilisation of MSR’s existing and future expanded processing facilities in Vietnam and is in discussion with upstream suppliers for strategic acquisition or long-term off-take contracts.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Masan Consumer names new deputy CEO to drive foods and beverages growth (February 23, 2026 | 20:52)

- Myriad risks ahead, but ones Vietnam can confront (February 20, 2026 | 15:02)

- Vietnam making the leap into AI and semiconductors (February 20, 2026 | 09:37)

- Funding must be activated for semiconductor success (February 20, 2026 | 09:20)

- Resilience as new benchmark for smarter infrastructure (February 19, 2026 | 20:35)

- A golden time to shine within ASEAN (February 19, 2026 | 20:22)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

- Future orientations for healthcare improvements (February 19, 2026 | 08:29)

- Infrastructure orientations suitable for a new chapter (February 19, 2026 | 08:15)

Tag:

Tag:

Mobile Version

Mobile Version