Market ends at the crossroads

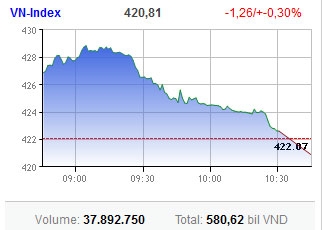

The VN-Index lost 1.26 points or 0.3 per cent to close at 420.81 points, helped by falls of major stocks like Vincom Corp (VIC), Vinamilk (VNM), PetroVietnam Drilling and Well Services (PVD), Hoa Phat Group (HPG) and financial shares like Vietinbank (CTG) and Sacombank (STB). The benchmark opened by rising more than six points.

The VN-Index lost 1.26 points or 0.3 per cent to close at 420.81 points, helped by falls of major stocks like Vincom Corp (VIC), Vinamilk (VNM), PetroVietnam Drilling and Well Services (PVD), Hoa Phat Group (HPG) and financial shares like Vietinbank (CTG) and Sacombank (STB). The benchmark opened by rising more than six points.

Investors reduced cashing in on speculative stocks. Binh Duong Trade and Development (TDC) and PetroVietnam-Idico Long Son Industrial Park Investment (PXL) both ended flat.

Transport Engineering Construction & Business Investment JSC 584 (NTB), Urban Development and Construction Corp. (UDC), PetroVietnam Transportation Corp. (PVT) and Mientrung Petroleum Construction (PXM) significantly dropped.

Becamex Infrastructure Development (IJC) was active with 2.5 million shares matched, adding 1.79 per cent. Hoang Quan Consulting–Trading–Service Real Estate Corp (HQC) gained 2.94 per cent with nearly two million shares traded.

Major stock Ocean Group (OGC) outperformed the market with 3.2 million shares matched, hitting the ceiling throughout the session. Other major stocks like Saigon Securities Inc. (SSI), Tan Tao Investment Industry Corp. (ITA), Refrigeration Electrical Engineering Corp. (REE), DPM, STB, EIB were also among the most active stocks today.

Liquidity reduced to 38 million shares worth VND580.6 billion ($28 million). Decliners amounted to 135 stocks, outrunning 84 advancing.

“The market still contains risks with the main sentiment to quickly buy and quick sell,” said Hanoi Securities.

Of the same trend, Hanoi Stock Exchange’s (HNX) rising momentum also strongly faded out despite strong demand for speculative shares. The HNX-Index slightly climbed 0.27 points or 0.39 per cent to 70.21 points, after surpassing 71 points during the session.

Liquidity jumped on the bourse to 60 million shares worth VND658 billion ($31.8 million), helped by strong demand for driving stocks like Kim Long Securities (KLS), VnDirect Securities (VND), PetroVietnam Construction (PVX), Vietnam Construction and Import-Export (VCG).

KLS saw as many as nine million shares matched, VND 5.4 million shares, PVX 5 million shares and VCG 3.6 million shares. More than 10 other speculative stocks had matching volumes of 1-2 million units.

Some 143 stocks gained compared with 138 declining on the bourse. Some 136 stocks were unchanged or untraded.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- Corporate bond market poised for stronger growth cycle (January 28, 2026 | 17:13)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

Tag:

Tag:

Mobile Version

Mobile Version