Manufacturing sector remains in growth territory

|

At 50.8 points in November, the reading was down from 51.2 in October and pointed to only a modest strengthening in the health of the sector, but still represents an improvement over the 47.3 points in September.

Some firms raised production in response to an increase in new orders, but others reported that demand was relatively muted, leading to the slowdown in growth. Although total new orders increased amid signs of improving demand and the securing of new customers, weakness in international demand undermined overall growth.

In fact, new business from abroad decreased following a slight rise in the previous month, with exports down to the lowest level since July last year. While output and new orders continued to rise, albeit at weaker rates, employment decreased for the second month running in November. In some cases, firms lowered staffing levels to help reduce costs.

With workforce numbers down, firms again found it difficult to complete orders on time. As a result, backlogs of work increased for the sixth month running, albeit at the slowest pace since June.

Efforts made by firms to limit costs meant that input prices increased at a slightly slower pace in November. Where input prices did rise, firms linked this to supply shortages and currency weakness.

Similarly, output prices increased only slightly in November, with the rate of inflation broadly in line with that seen in the previous month.

Manufacturers continued to face lengthening delivery times from suppliers midway through the final quarter of the year. Lead times were extended for the third month in a row, and to a greater degree than was the case in October. Respondents signalled transportation issues and difficulties for suppliers to source raw materials.

Business confidence ticked down for the second month running and was the lowest since January. Manufacturers remained optimistic that output will rise over the coming year, however, with expectations linked to plans for new product launches and business expansions, plus rising new orders.

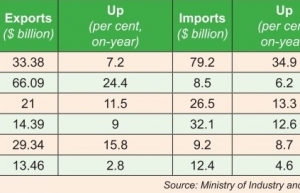

| Strong recovery evident as manufacturing exports surge As Vietnam attempts to host more investments in manufacturing and processing, exports have witnessed a rise, fuelled by global demand and domestic production recovery. |

| Manufacturing production suffers after Typhoon Yagi Typhoon Yagi had a significant impact on Vietnam's manufacturing sector in September, with heavy rain and flooding causing temporary business closures and delays across production lines and supply chains. |

| Vietnam semiconductor manufacturing industry ready to join global supply chain Vietnam has the opportunity to become a hub for semiconductor equipment manufacturing and strengthen its integration into the worldwide semiconductor value chain. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Hermes joins Long Thanh cargo terminal development (February 04, 2026 | 15:59)

- SCG enhances production and distribution in Vietnam (February 04, 2026 | 08:00)

- UNIVACCO strengthens Asia expansion with Vietnam facility (February 03, 2026 | 08:00)

- Cai Mep Ha Port project wins approval with $1.95bn investment (February 02, 2026 | 16:17)

- Repositioning Vietnam in Asia’s manufacturing race (February 02, 2026 | 16:00)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

- Navigating venture capital trends across the continent (February 02, 2026 | 14:00)

- Motivations to achieve high growth (February 02, 2026 | 11:00)

- Capacity and regulations among British areas of expertise in IFCs (February 02, 2026 | 09:09)

- Transition underway in German investment across Vietnam (February 02, 2026 | 08:00)

Tag:

Tag:

Mobile Version

Mobile Version