Liquidity takes a tumble as investors hedge bets

The buyers, meanwhile, remained cautious dragging successful trade volumes by 38.42 per cent on the Ho Chi Minh bourse to 24.62 million shares with values at VND554.54 billion ($26.79 million).

The buyers, meanwhile, remained cautious dragging successful trade volumes by 38.42 per cent on the Ho Chi Minh bourse to 24.62 million shares with values at VND554.54 billion ($26.79 million).

“The cheap supply is lowering,” said Au Viet Securities, assessing that it was a sign for a recovery.

However, the brokerage added that the supply at a higher price was plentiful still, which could curb that recovery trend.

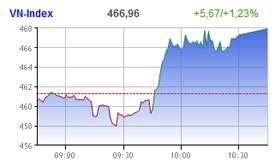

The VN-Index added 5.67 points, or 1.23 per cent, to 466.96 points. The HNX-Index of the northern bourse advanced 1.8 per cent (or 1.72 points) to 97.36 points.

Some analysts believed that the rebound was helped by a too deep market plunge early this week, which encouraged investors to cash in.

Masan Group (MSN), PetroVietnam Finance (PVF), FPT Corp. (FPT), Vinamilk (VNM) and Saigon Securities Inc. (SSI) were among the top advancers supporting the HoSE exchange.

Among them, Masan Group climbed 4.61 per cent, FPT 4.72 per cent and PVF up 4.74 per cent.

Banking shares significantly rose, with Vietinbank (CTG) adding 3.69 per cent, Eximbank (EIB) 2.47 per cent and Sacombank up 2.8 per cent.

Bao Viet Holding (BVH) was off 3.85 per cent.

Some 189 stocks advanced on the southern bourse, where 41 stocks were up and 55 unchanged. 26 hit ceiling compared with four hitting the floor.

On the Hanoi Stock Exchange (HNX), liquidity also significantly fell with 28 million shares worth VND441.74 billion ($21.34 million) changing hand, down more than 19 per cent.

Foreigners were net buyers on both bourses, with the net buying volume modest at 985,000 shares on the HoSE and 22,800 on HNX. Net buying value for the HoSE was of VND7.36 billion ($355,000).

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- Corporate bond market poised for stronger growth cycle (January 28, 2026 | 17:13)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

Mobile Version

Mobile Version