Key stocks brighten the darkness

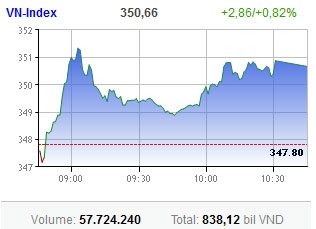

The VN-Index of Ho Chi Minh Stock Exchange (HoSE) modestly gained 2.86 points or 0.82 per cent to 350.66 points. The structure of advancers and decliners reversed against yesterday with 180 stocks up and 63 off.

The VN-Index of Ho Chi Minh Stock Exchange (HoSE) modestly gained 2.86 points or 0.82 per cent to 350.66 points. The structure of advancers and decliners reversed against yesterday with 180 stocks up and 63 off.

The rise was helped by major stocks, particularly real estate ones. Hoang Anh Gia Lai (HAG), Ocean Group (OGC) and Tan Tao Investment Industry Corp. (ITA) hit the ceiling thanks to large bidding volumes, while Licogi 16 (LCG), PetroVietnam-Idico Long Son Industrial Park Investment (PXL), Song Da Urban & Industrial Zone Investment and Development (SJS), Investment and Trading Of Real Estate (ITC) and Vincom Corp. (VIC) sharply increased with hundreds of thousand units matched each.

OCG was also strongly active today with as many as 10 million shares changing hands via the put-through method. The real estate stock also outperformed the HoSE with 1.8 million shares matched. Besides, VIC also saw 2.2 million shares negotiated.

Major financial stocks like Saigon Securities Inc. (SSI), Vietcombank (VCG), Vietinbank (CTG) also jumped with large matching volumes. Pillar stocks Bao Viet Holdings (BVH), Masan Group (MSN) and Vinamilk (VNM) were little changed reducing the rising momentum.

Liquidity jumped to 58 million shares worth VND838.1 billion ($40.5 million) on the southern bourse. Put-through volume still kept high at 31 million shares worth VND544.6 billion ($26.3 miilion), led by OGC, VIC, Sacombank (STB), Sacombank Securities (SBS), Refrigeration Electrical Engineering Corp. (REE).

The rise, however, happed amid absence of any supportive information, raising skepticism among market about a “bull-trap” session for a number of sellers to bailing out their holdings. Meanwhile, put through volumes keeping continuously raising questions about the real purposes of transactions among major shareholders.

The banking stock STB, the most active stock in recent weeks, dipped back to VND15,100, down 4.43 per cent.

Hanoi Stock Exchange’s (HNX) HNX-Index jumped 1.45 points or 2.56 per cent to close at 58.15 points. Most major stocks and high-liquid stopped dipping, modestly advancing or even jumping with 2-3 million units matched each.

Meanwhile, shares of bad-performing companies like Orient Securities (ORS), Wall Street Securities (WSS) and Thai Hoa Vietnam Group (THV) continued sharply dropping.

Liquidity, however, significantly reduced to 30.5 million shares worth VND248.9 billion ($12.1 million). Some 162 stocks gained, compared with 72 declining on the northern bourse.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- Corporate bond market poised for stronger growth cycle (January 28, 2026 | 17:13)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

Tag:

Tag:

Mobile Version

Mobile Version