Key investment principles to accumulate wealth: VCBF experts

Investment is a long-term process

|

Investors often believe that timing the market is crucial for success. However, experience has shown that attempting to buy at the lowest point and sell at the highest is as good as impossible. The key to profitability is investing for the long-term, which means holding onto investments for an extended period (e.g. over five years).

This approach leverages the power of compound interest and time, allowing your assets to grow significantly without being affected by short-term market fluctuations.

Increase your income by exploring ways to generate various sources of income, beginning normally by saving a portion from your regular salary and considering what to do when you receive a bonus. Investments can then generate further income flows, ranging from interest from deposits or bonds, dividends on shares, rents from property, profits from running or participating in a business, or even from a patent or royalty.

When considering investment opportunities, identify channels and funds that align with your financial goals and risk tolerance. Diversifying your investments helps mitigate risks such as market volatility, policy changes, and liquidity issues.

Don’t just look for quick wins

When starting out, many people look for the investment channel with the highest profit available.

However, it's wiser to begin with channels that have a stable long-term growth history. An investment channel that offers sustainable profits is preferable to one that shows a sudden surge in growth in a single year, but then either declines or shows minimal increases.

Chasing short-term trends often leads investors to buy at high prices.

For instance, when purchasing a car, you might be drawn to new features and modern technology.

However, what truly matters is the stability and durability of the car over time. A vehicle that performs well for one to two years but then quickly breaks down will cause the owner stress and prove more expensive than buying a different car that last longer and has a higher re-sale value. This transforms the car from an asset into a burden.

Instead of being engrossed in searching for short-term profits, build a long-term investment plan with suitable investment channels and holding times.

Set specific financial goals such as buying a house, buying a car, accumulating for the children’s education, financial investment or preparing for retirement life. Persistence and clear orientation will help you achieve sustainable success.

Staying disciplined is the key

Consistently invest a fixed amount deducted from your salary every month, and maintain this practice for many years.

It's remarkable how even with just VND1 million ($41)/month, after 40 years, assuming a compound interest rate of 13 per cent per year, you can accumulate over $666,600.

As your income grows, consider increasing the monthly investment amount to receive even larger returns. Regular monthly investments also averages out the prices when they’re high with the times when they’re low.

Seeking out the investment funds managed by a reputable fund management company

|

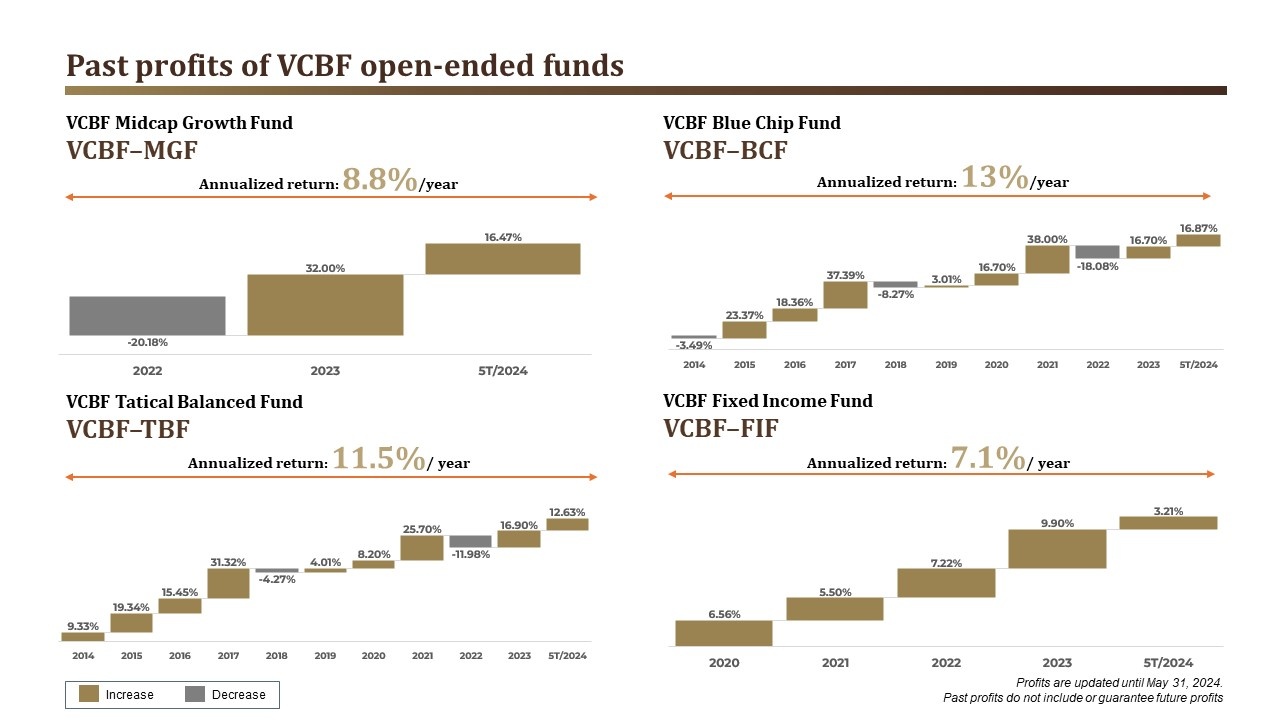

Vietcombank Fund Management Co., Ltd. (VCBF) offers various open-ended funds (OEFs), catering to all kinds of investors seeking profits in the stock market.

Whether you prefer a cautious approach or aim to maximise profits, you can select a suitable VCBF OEFs based on your risk appetite, with historical average annual returns ranging from 7-13 per cent.

With over a decade of experience in managing OEFs, VCBF has established itself as a trusted asset management partner.

|

| The year-to-date return and annualised return VCBF OEFs, as of May 31, 2024 |

VCBF Fixed Income Fund (VCBF-FIF): Ideal for cautious investors seeking returns higher than bank deposits without exposing themselves to significant volatility.

VCBF Blue Chip Fund (VCBF-BCF): Suited for investors aiming for long-term profits from stocks, with a medium to high-risk tolerance as the fund primarily invests in leading companies.

VCBF Midcap Growth Fund (VCBF-MGF): Designed for investors interested in accompanying mid-cap companies with promising long-term growth, even if it means tolerating larger short-term fluctuations.

VCBF Tactical Balanced Fund (VCBF-TBF): Tailored for investors seeking to invest in a diversified portfolio comprising large-cap stocks, mid-cap companies, and bonds, without the need to spread their investments across multiple funds.

This advice is intended to help new investors embark on their investment journey with a long-term, disciplined, and informed approach to accumulating wealth.

VCBF OEFs are also accessible through various platforms such as VCBF Mobile, VCB Digibank, Fmarket, MoMo, and VNSC by Finhay.

For more information about VCBF OEFs, you can visit www.vcbf.com or follow the Facebook Fanpage QUY MO VCBF.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- Private capital funds as cornerstone of IFC plans (February 20, 2026 | 14:38)

- Priorities for building credibility and momentum within Vietnamese IFCs (February 20, 2026 | 14:29)

- How Hong Kong can bridge critical financial centre gaps (February 20, 2026 | 14:22)

- All global experiences useful for Vietnam’s international financial hub (February 20, 2026 | 14:16)

- Raised ties reaffirm strategic trust (February 20, 2026 | 14:06)

- Sustained growth can translate into income gains (February 19, 2026 | 18:55)

- The vision to maintain a stable monetary policy (February 19, 2026 | 08:50)

- Banking sector faces data governance hurdles in AI transition (February 19, 2026 | 08:00)

- AI leading to shift in banking roles (February 18, 2026 | 19:54)

- Digital banking enters season of transformation (February 16, 2026 | 09:00)

Tag:

Tag:

Mobile Version

Mobile Version