Investors forced to wait on HSX technical upgrades

|

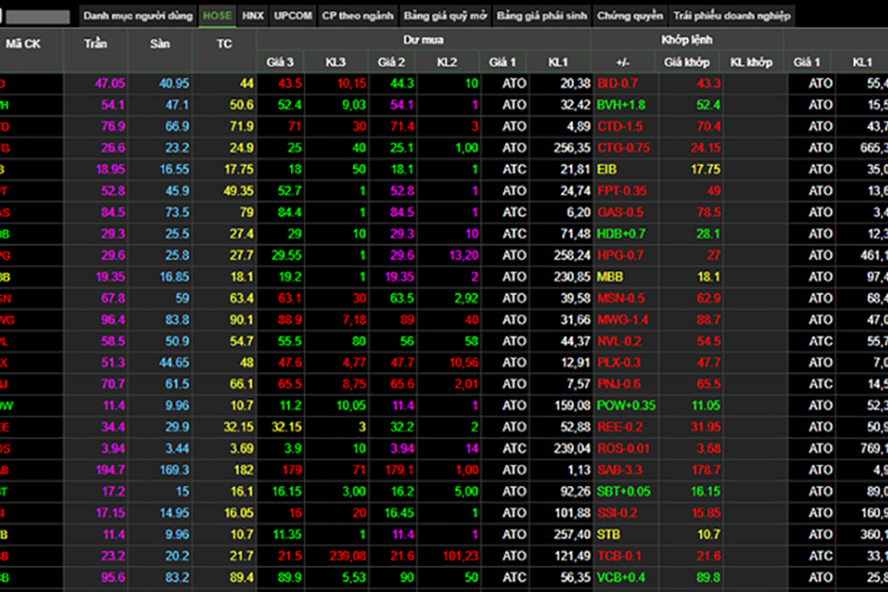

| Investors forced to wait on HSX technical upgrades, illustration photo |

In mid-March, the Ministry of Finance (MoF) comissionsed FPT and its subsidiaries to address the trading issues.

FPT Information System (FIS) has been assigned to develop an alternative system to host Ho Chi Minh City Stock Exchange (HSX) transactions thanks to its experience in building a number of synchronised infrastructures in financial markets such as the Hanoi Stock Exchange (HNX), the Vietnam Securities Depository Centre, and the State Bank of Vietnam.

FIS chairman Duong Dung Trieu said, “It is natural to ask what will work best to offer a perfect solution to the market. The favoured plan is to encourage enterprises to voluntarily transfer stocks from the HSX to the HNX. However, the process will take at least a few weeks because it will require the approval of its shareholders.”

Trieu said FIS is now collaborating with the HSX to find the most feasible approach as soon as possible. “But to alleviate the trading congestion within weeks or even one or two months is not likely to happen,” he said.

Trieu also added that issues at the HSX will require multiple rounds of testing to make sure the system runs smoothly.

A new trading system, with assistance from the South Korean Exchange, has been in the works since 2012 but has yet to be installed. Meanwhile, the core system of the HSX was initially implemented by experts from the Thailand Stock Exchange more than two decades ago. The Thai exchange is yet to reveal if it will provide any support for HSX’ modernisation.

On the other hand, Trieu of FIS told VIR that FPT is working directly with the HSX, the MoF, and the State Securities Commission to take the software from the Hanoi bourse and adapt it to the HSX.

“We are in the last phase of making HNX systems compatible with the Ho Chi Minh City counterpart. In the next two weeks, we will test the internal algorithms on this system and report on a plan for related parties,” he explained. “We are confident in handling the technical problems. However, all options must consider potentially associated risks and there are still many issues that do not depend on us, such as funding, testing errors, and others.”

After developing the communicating system with securities companies, FPT will choose to test with five brokerages initially, and eventually all securities firms in order to ensure smooth transactions

According to VinaCapital, retail investors’ interest in Vietnam’s stock market exploded in recent months, helping boost stock prices. New retail stock brokerage account openings have surged, as they have in stock markets around the world – but in Vietnam’s case, a circa 200 base points drop in the interest rates that savers earn from bank deposits over the last year has been one of the main factors attracting new investors to the stock market.

The VN-Index went up 7 per cent in the year-to-date, slightly outpacing the performance of its regional peers, despite larger expected rebounds in the corporate earnings in those countries, stemming from the fact that they suffered much bigger economic blows from the pandemic.

Michael Kokalari, chief economist at VinaCapital, believed that trading volumes have surged along with new retail accounts as retail investors typically account for over 85 per cent of stock market trading volume in Vietnam.

However, despite the vast potential of the equity market, the ongoing technical outages at the HSX have lowered investors’ appetite, as their buy and sell orders rarely match up.

“Unfortunately, surging stock market trading volumes overwhelmed the capacity of HSX systems, leading to a few brief trading interruptions in recent months. This issue understandably concerns both foreign and local investors, so the exchange is taking urgent measures to rectify the situation, but we regard this as a high-quality problem because it is a by-product of surging local interest in the stock market,” Kokalari added.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Banking sector targets double-digit growth (February 23, 2026 | 09:00)

- Private capital funds as cornerstone of IFC plans (February 20, 2026 | 14:38)

- Priorities for building credibility and momentum within Vietnamese IFCs (February 20, 2026 | 14:29)

- How Hong Kong can bridge critical financial centre gaps (February 20, 2026 | 14:22)

- All global experiences useful for Vietnam’s international financial hub (February 20, 2026 | 14:16)

- Raised ties reaffirm strategic trust (February 20, 2026 | 14:06)

- Sustained growth can translate into income gains (February 19, 2026 | 18:55)

- The vision to maintain a stable monetary policy (February 19, 2026 | 08:50)

- Banking sector faces data governance hurdles in AI transition (February 19, 2026 | 08:00)

- AI leading to shift in banking roles (February 18, 2026 | 19:54)

Tag:

Tag:

Mobile Version

Mobile Version