Interest rates of auctioned Government bonds continue to rise

With the latest G-bonds auctions, the amount of capital raised via this channel in the January-October period by the State Treasury came to 139.432 trillion VND, while the Vietnam Bank for Social Policies (VBSP) mobilised 12.3 trillion VND.

|

| A transaction office of BaoViet Bank (Photo: VNA) |

Compared to the end of September, annual interest rates for 10-year and 15-year bonds issued by the State Treasury increased to 4 percent and 4.1 percent.

Three-year and five-year bonds issued by the VBSP have annual interest rates of 4.7 and 4.8 percent, respectively.

On the secondary market, trading value of G-bonds during the month dropped by 40.4 percent, with an average trading value of 3.84 trillion VND per session, down 11.1 percent on-month.

The total volume traded via repos decreased by 57.68 percent while Outright transaction value reduced by 16.49 percent.

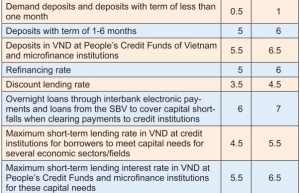

| Chairman of EuroCham Vietnam: The SBV's efforts were commendable As exchange rate pressure grows when circumstances are unfavourable, the State Bank of Vietnam (SBV) has raised the operational interest rates by 100 basis points (1 per cent) before the November Fed meeting on October 24, according to a report recently provided by the SSI. |

| State Bank of Vietnam alleviates market pressures The State Bank of Vietnam adjusted several operating interest rates last week, with the move deemed necessary in the context of a strong USD and increasing domestic pressure on interest rates and exchange rates. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Private capital funds as cornerstone of IFC plans (February 20, 2026 | 14:38)

- Priorities for building credibility and momentum within Vietnamese IFCs (February 20, 2026 | 14:29)

- How Hong Kong can bridge critical financial centre gaps (February 20, 2026 | 14:22)

- All global experiences useful for Vietnam’s international financial hub (February 20, 2026 | 14:16)

- Raised ties reaffirm strategic trust (February 20, 2026 | 14:06)

- Sustained growth can translate into income gains (February 19, 2026 | 18:55)

- The vision to maintain a stable monetary policy (February 19, 2026 | 08:50)

- Banking sector faces data governance hurdles in AI transition (February 19, 2026 | 08:00)

- AI leading to shift in banking roles (February 18, 2026 | 19:54)

- Digital banking enters season of transformation (February 16, 2026 | 09:00)

Tag:

Tag:

Mobile Version

Mobile Version