HoSE ends week on a sober note

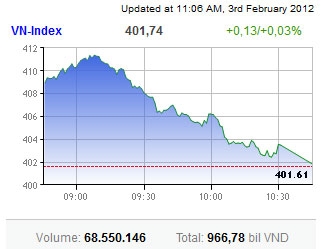

The benchmark VN-Index of the southern bourse saw just slight increase of 0.13 points or 0.03 per cent, ending at 401.74 points. Rising trend particularly faded throughout the session’s end.

The benchmark VN-Index of the southern bourse saw just slight increase of 0.13 points or 0.03 per cent, ending at 401.74 points. Rising trend particularly faded throughout the session’s end.

Trading volume soared with strongly rallying sentiment at the opening period of the session. As many as 68.6 million shares worth VND966.8 billion ($46.7 million) were matched, led by Military Bank (MBB) with more than 4 million units matched.

Tan Tao Investment Industry Corp. (ITA), Refrigeration Electrical Engineering Corp. (REE), Saigon Securities Inc. (SSI), Becamex Infrastructure Development (IJC), Nari Hamico Minerals (KSS) saw 2-3 million shares matched each, while dozens of stocks saw matching volumes surpassing 1 million units.

But REE, SSI, along with other active shares like Sacombank (STB), real estate stocks ITA, Licogi 16 (LCG), Tu Liem Urban Development (NTL), Ninh Van Bay Real Estate (NVT) massively turned heads to fall or kept unchanged.

MBB and Eximbank (EIB) strongly reduced their gains as compared with the rising trend in yesterday’s session.

Increasing selling pressure pushed up decliners to 151 stocks, doubled 83 advancers. Some blue-chips like Kinhbac City Development Share Holding Corp. (KBC), Thu Duc Housing Development (TDH) even hit the floor. Large-cap stock Sacom Development and Investment Corp. (SAM) was strongly sold after the company announcing big losses.

Analysts largely warned investors about a possible falling market, as interest rates are increasing back and inflation woes remain high after Tet.

Put-through volume jumped to 13.3 million shares worth VND239.9 billion ($11.6 million), led by Khang Dien House Trading and Investment (KDH) at 4.2 million units and Eximbank (EIB) at 3.5 million units.

Hanoi Stock Exchange’s (HNX) HNX-Index even lost further, down 0.72 points or 1.15 per cent to 61.85 points. Trading volumes also soared to 57.5 million shares worth VND441 billion ($21.3 million) as holders rushed to sold shares locking profits.

Matching volumes of PetroVietnam Construction (PVX) hit 7 million shares, VNDirect Securities (VND) 5.7 million shares, Kim Long Securities 3.6 million shares. VND and KLS significantly eased back.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- Corporate bond market poised for stronger growth cycle (January 28, 2026 | 17:13)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

Mobile Version

Mobile Version