Green is new buzzword for logistics arena

|

| Companies and developers have been able to demonstrate how they are moving towards green goals |

At the Vietnam Logistics Summit last week, Cao Hong Phong, deputy CEO of Gemalink, said that the company had pursued sustainable development goals early by setting up an environmental, social, and governance committee, developing an emission reduction roadmap, and conducting a greenhouse gas (GHG) emission inventory every year.

“To develop green ports, Gemalink has invested in energy-saving devices while installing solar energy across its warehouse system. The company is also planting forests in the Mekong Delta province of Vinh Long to obtain green finance. In May, we signed a sustainability-linked loan with HSBC, marking another green step in the development plan,” Phong said.

Thanks to these efforts, its ports have been recognised as green by the Vietnam Maritime Administration and have been granted the Green Port Award System by the APEC Port Services Network.

“We focus on green projects that achieve results after 1-2 years. This gives confidence to leaders, employees, users, and customers, and is a foundation for long-term green models,” Phong added.

Ashish Kapur, regional head of Cargo for Southeast Asia at Cathay Cargo, said the group upheld responsibility for the environment and had made commitments to sustainable operations. To facilitate this, it has implemented several practical initiatives at Cathay Cargo Terminal in Hong Kong.

“We not only use advanced warehouse management systems but also employ intelligent software to identify optimised routes, which helps reduce energy for vehicles,” Kapur said. “Efforts are also made to build an energy-saving system, such as installing solar panels on the roof of terminal. We’re looking for innovative and sustainable solutions for our tractors that transport cargo.”

With climate change disrupting supply chains and global regulations tightening, businesses need to step up efforts to comply with new sustainability standards. By mid-century, climate disruption to global supply chains could lead to up to $25 trillion in net losses.

In this context, governments are fast-tracking actions to meet 2030 targets, demanding rapid business adaptation. In Vietnam, regulated facilities must prepare GHG inventory every two years starting in 2024 and submit a GHG reduction plan by next year. Reporting of emission reduction results will occur annually from 2026.

Yap Kwong Weng, CEO of Vietnam SuperPort, said countries were committing to ambitious carbon reduction targets. Meanwhile, companies are embedding sustainability into core operations, driving carbon reduction.

“We want to pioneer sustainability across the spectrum of operations to create green logistics,” said Weng. “We develop logistics that strengthen regional connectivity and integrate sustainable solutions. We also supply specialised labour forces through talent development via avenues from Singapore. Our advanced technology and sustainable solutions are future-proofing the supply chain, ensuring resilience and competitiveness.”

Vietnam SuperPort, jointly developed by Singapore’s YCH Group and Vietnam’s T&T Group, aspires to become Southeast Asia’s first net-zero multimodal logistics port by 2040, thereby contributing to Vietnam’s efforts to achieve net-zero emissions goals.

According to the leading GHG Protocol corporate standard, a company’s GHG emissions are classified into three scopes. Scope 1 and 2 are mandatory to report, whereas Scope 3 is voluntary in some cases and is the hardest to monitor. However, companies succeeding in reporting all three scopes will gain a sustainable competitive advantage.

Eric Herding, managing director of DSV Air & Sea Vietnam, emphasised that Scope 1 and 2 are for warehouses and facilities, which are under the control of businesses. They just need to install solar panels on the roofs of warehouses, logistics facilities, and sorting and selecting centres to solve the energy problem.

“Scope 3 covers the entire chain, so it is hard for businesses to monitor emissions. Our approach is measuring the transport process in line with the global sustainability standards, and measuring aircraft emissions, load factors, routes, and more to find a baseline index for optimisation. One challenge is to find a more competitive alternative to sustainable fuels. We are still exploring different ways to optimise our operations towards green logistics,” he said.

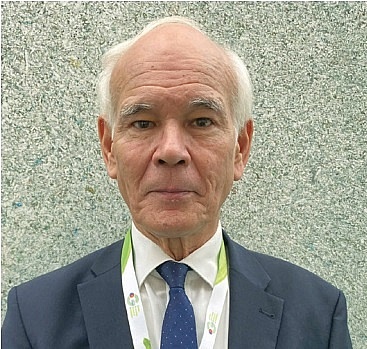

| Jean Henry Laboyrie, managing director Delta Context

Green logistics is important because the Vietnamese government has placed targets to reduce CO2 emissions in the industry as well as the transport sector. It is good for Vietnam’s environment and is also good for export. If the Vietnamese government and industries have a clean environment and clean logistics, it’s good for companies around the globe. We are focusing on waterway systems and ports to enhance this, and it is also like other industries such as garments and textiles, in which we need to have quality control for labour conditions. In Europe and North America, people appreciate the green factor and good conditions for labour. They don’t like it if the country where the goods are coming from does not take care of the climate or the environment. We are concentrating on waterway infrastructure and have a very concrete aim towards greening. We are also using IT tools and digitalisation for our operations. To encourage more foreign investment into green logistics in Vietnam, the government should create exclusive plans and make them more attractive for the private sector, such as tax incentives or subsidies. For instance, for waterways and logistics, you have to promote it. At the moment there is underfunding, but it is also not very well promoted as an alternative. In the Netherlands, we have special set-ups to promote the waterway sector. It is about taxes, subsidies, and promotion. Those are elements in which the government can play an important role. Major providers are welcome in Vietnam, but they have to show their added value and bring in technology that is suitable for the country - not only in the physical and institutional setting, but also for the culture as a whole. Ben Anh, group CEO, ITL Corporation

With an average annual growth rate of 14-16 per cent, Vietnam’s logistics industry is currently under pressure from generating large amounts of emissions, especially in transportation and warehousing. Applying green logistics solutions not only help reduce emissions, but also increases competitiveness when international customers and partners are prioritising logistics service providers that aim at green logistics and have a complete service ecosystem. Technology such as the Internet of Things, AI, blockchain, and big data helps track and manage goods, increase transparency and enhance customer experience. The combination of green and smart logistics not only contributes to building an effective supply chain, but also creates long-term sustainable value for the Vietnamese logistics industry, expanding opportunities to participate deeper in the global supply chain. To attract investment in green and smart logistics, Vietnam needs to build a clear and attractive legal environment and preferential policies. The government can implement tax and financial support policies for businesses investing in green infrastructure and smart technology. Implementing policies to support businesses in innovation, along with promoting digital transformation, will be an important factor in attracting investment. Vietnam needs to promote synchronous infrastructure development. Limitations including overloaded airports, limited waterway transportation, and heavy dependence on roads also contribute to affecting consumer spending and investment decisions. Victor Wai, head of Commerce Southeast Asia Maritime & Transport Business Solutions

Green and smart logistics are essential in the development of Vietnam’s logistics industry. It should be a high priority project on the government’s agenda, given that the population is growing and there’s a great demand for energy and more efficient use of energy. So it will be crucial to greenify the logistics sector. From the government perspective, there are economic objectives that need to be achieved from a sustainability angle. So there could be a viability gap that needs to be filled by the government to make a project feasible for the private sector to participate in. We already have several projects in Vietnam. One of the key projects that we completed early in 2024 was to support T&T group and YCH Group to develop a multimodel logistics hub in the northern province of Vinh Phuc That project is financed by the International Finance Corporation (IFC). We also look at the sustainability angle, whereby the logistics hub can aggregate all the activities there to reduce redundant truck movements or to improve connections for cargo owners. The challenges for enterprises to adapt green and smart logistics in Vietnam are based on securing funding, because international financial institutions like the IFC, Asian Development Bank, and World Bank have strict requirements on sustainability targets. Those targets need to be addressed comprehensively for them to bankroll those projects. |

| Logistics infrastructure can enjoy a bright future Vietnam’s logistics industry needs to address bottlenecks such as congestion, delays, and high costs to create a breakthrough. Tran Thanh Hai, deputy director of the Agency of Foreign Trade under the Ministry of Industry and Trade, spoke with VIR’s Hai Yen about the keys to reducing logistics costs. |

| Coordination can ease logistics issues It is time for logistics companies to embrace green transition, digital transformation, and business model restructuring. Dao Trong Khoa, chairman of the Vietnam Logistics Business Association, shared with VIR’s Bao Giang about the emerging directions for logistics companies. |

| Costs and competition head logistics advancement issues Accelerating transport infrastructure connections and investing in the development of logistics centres is the key to helping reduce logistics costs and increasing competitiveness for businesses. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Kurz Vietnam expands Gia Lai factory (February 27, 2026 | 16:37)

- SK Innovation-led consortium wins $2.3 billion LNG project in Nghe An (February 25, 2026 | 07:56)

- THACO opens $70 million manufacturing complex in Danang (February 25, 2026 | 07:54)

- Phu Quoc International Airport expansion approved to meet rising demand (February 24, 2026 | 10:00)

- Bac Giang International Logistics Centre faces land clearance barrier (February 24, 2026 | 08:00)

- Bright prospects abound in European investment (February 19, 2026 | 20:27)

- Internal strengths attest to commitment to progress (February 19, 2026 | 20:13)

- Vietnam, New Zealand seek level-up in ties (February 19, 2026 | 18:06)

- Untapped potential in relations with Indonesia (February 19, 2026 | 17:56)

- German strengths match Vietnamese aspirations (February 19, 2026 | 17:40)

Tag:

Tag:

Mobile Version

Mobile Version