Gold makes markets suffer

Home bullion surged continuously this morning to around VND44.1 million ($2.100) per tael, a strong jump of VND2.2 million per tael against yesterday’s close. This price is VND1.2 million ($58.5) per tael higher than the global prices.

Home bullion surged continuously this morning to around VND44.1 million ($2.100) per tael, a strong jump of VND2.2 million per tael against yesterday’s close. This price is VND1.2 million ($58.5) per tael higher than the global prices.

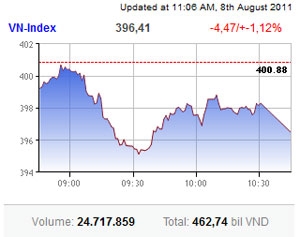

The VN-Index of Ho Chi Minh Stock Exchange (HoSE) declined since the session’s opening, closing at 396.41 points. The benchmark lost 4.47 points or 1.12 per cent.

The HNX-Index of Hanoi Stock Exchange (HNX) shed 1.22 points or 1.78 per cent to 67.32 points.

More than half of the HoSE eased back, mainly mid-cap and small-cap stocks. Speculative stocks like Tan Tao Investment Industry Corp. (ITA), Sacom Development and Investment Corp (SAM), Licogi 16 (LCG), Investment and Trading of Real Estate JSC (ITC) largely hit the floor or nearly hit the floor.

Securities company shares were also strongly sold on the HNX, pushing those driving stocks sharply down. Kim Long Securities (KLS), Bao Viet Securities (BVS) and VnDirect Securities (VND) lost 4-5 per cent, while Wall Street Securities (WSS) hit the floor.

Blue-chips significantly fell, of which Saigon Securities Inc. (SSI) shed 2.31 per cent, PetroVietnam Fertilizer (DPM) 1.61 per cent, FPT Corp. (FPT) 2.73 per cent and Hoang Anh Gia Lai (HAG) down 2.63 per cent.

A few others rose, among them Kinh Do Corp. (KDC), Bao Viet Holdings (BVH), Phu Nhuan Jewelry (PNJ). Sacombank (STB) was unchanged, while Vietcombank (VCB) slightly shed.

Weak liquidity has not improved on both two bourses. Matching values stood at VND337 billion ($16.3 million) on the HoSE, while hitting VND199.7 billion ($9.7 million) on HNX.

Investors still focused on a few major stocks like KLS, VND, Saigon-Hanoi Bank (SHB), STB and PetroVietnam Construction (PVX).

Overall, 24.7 million shares worth VND462.7 billion ($22.6 million) were traded on the southern bourse, while the HXN saw 23.4 million shares worth VND228.7 billion ($11.1 million) changing hands.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- Corporate bond market poised for stronger growth cycle (January 28, 2026 | 17:13)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

Mobile Version

Mobile Version