Generali Group toasts first-half performance with solid capital position

Accordingly, the gross written premiums rose to $41.84 billion, up 2.4 per cent thanks to P&C segment growth.

Life net inflows stood resilient at $6.23 billion. The decrease of 7.9 per cent was due to the savings line, consistent with Generali Group's strategy to reposition its Life business portfolio as well as specific in-force management actions.

|

| Generali Vietnam has contributed to the group’s performance with strong growth after more than 11 years of operation and outstanding achievements |

The protection and unit-linked lines grew at 7 per cent and 2.1 per cent, respectively.

Life technical provisions reached $418.7 billion, a slight decrease of 1.2 per cent against 2021 reflecting the performance of financial markets.

The group’s operating result continued to rise, reaching $3.13 billion, up 4.8 per cent, benefiting from the positive development of the Life, P&C, Holding, and other business segments.

The operating result of the Life segment grew strongly at 17.1 per cent, reflecting excellent technical profitability, also confirmed by the new business margin at 5.23 per cent, up 0.59 percentage points (pp).

The operating result of the P&C segment also picked up 3 per cent. The combined ratio stood at 92.5 per cent, up 2.8pp, reflecting the higher loss ratio and also the impact of hyperinflation in Argentina. Without considering this country, the combined ratio would have been 91.9 per cent compared to 89.4 per cent in H1 2021.

|

| Generali has quickly developed a strong network, a preeminent product suite, and excellent customer service with a leading RNPS score in Vietnam |

The operating result of the Asset and Wealth Management segment was $502.5 million, down 3.3 per cent, due to lower performance fees at Banca Generali, linked to the movement of financial markets. The asset management operating results increased by 6.2 per cent.

The operating results of the holding and other business segments grew, benefitting from the performance of the real estate business.

| The group reported a solid capital position, with the solvency ratio at 233 per cent compared to 227 per cent in 2021. |

The net result was $1.4 billion compared to $1.53 billion in H1 2021, impacted by impairments on Russian investments totalling $137.8 million.

The group's total assets under management were $634.7 billion, down 10.5 per cent compared to 2021, reflecting the performance of financial markets despite positive net inflows.

The group’s shareholders' equity stood at $19.05 billion, 34.9 per cent lower than in 2021. The change was due to the decrease in the available sale reserves, mainly deriving from the rise in interest rates on government and corporate bonds, and the payments for the 2021 dividend.

The group reported a solid capital position, with the solvency ratio at 233 per cent compared to 227 per cent in 2021.

|

| In Vietnam, Generali owns a preeminent and diverse product portfolio, including the recently launched VITA – Cho Con, which has continued to strengthen Generali Vietnam’s position as one of the leading investment-linked insurance product providers in Vietnam |

“Generali’s solid performance demonstrates that our focus on the implementation of the Lifetime Partner 24: Driving Growth strategic plan is the right way to deliver sustainable growth and increase operating profitability,” said Philippe Donnet, Generali Group CEO.

“We have been able to achieve these results in an increasingly uncertain geopolitical and macroeconomic context while always keeping our customers and their needs our top priority. In the months to come, we will continue to be fully committed to the execution of our 3-year plan as we reinforce our group's leadership as a global insurer and asset manager,” Donnet noted.

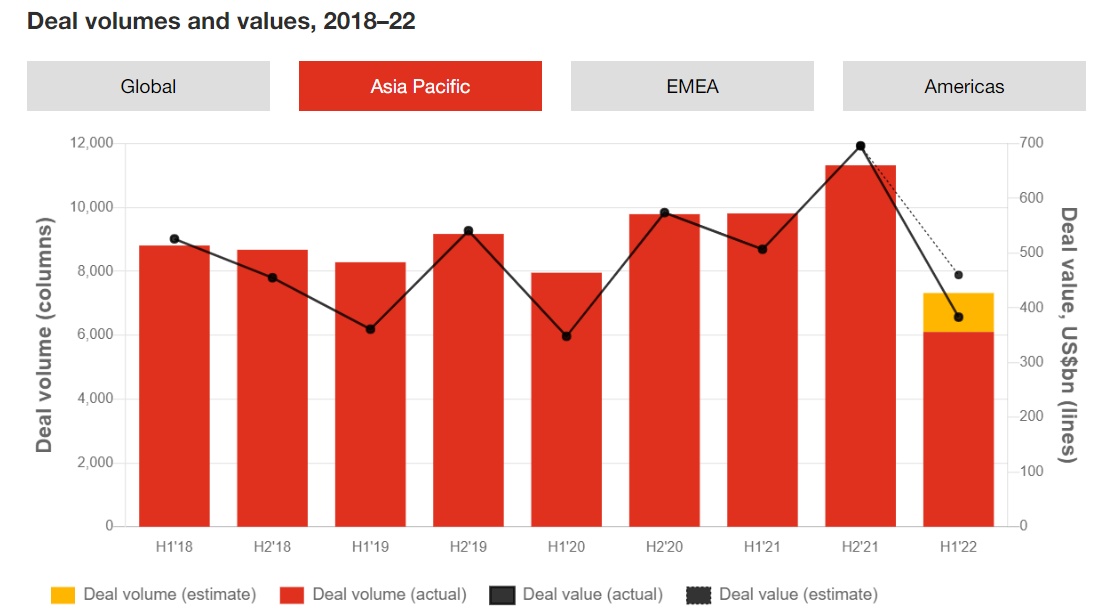

| Report depicting global M&A market performance in first half of 2022 PwC Vietnam on July 15 released a press statement reviewing global mergers and acquisitions (M&A) performance in the first half of 2022, noting that private equity and technology demand fueled deals during the period. |

| Decoding the change of position in the consumer finance market Mcredit's spectacular growth in 2021, as difficulties for the banking industry reached their peak due to the pandemic, surprised the market. |

Despite an evolving macroeconomic scenario, thanks to the business actions taken to recover and maintain profitability and the strategic initiatives launched, Generali Group confirmed its commitment to pursue sustainable growth, enhance its earnings profile, and lead innovation in order to achieve a compound annual growth rate in earnings per share between 6-8 per cent in the period 2021-2024, to generate net holding cash flow exceeding $8.5 billion in the 2022-2024 period.

The insurer also aims to distribute a cumulative dividend to shareholders for an amount of up to $5.6 billion in the same period.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- QBE Vietnam: 20-year journey of building trust and enabling resilience (November 20, 2025 | 14:25)

- Hanwha Life hosts training course in South Korea for Vietnamese fintech talents (November 20, 2025 | 09:51)

- Insurers accelerate post-typhoon recovery (October 28, 2025 | 15:31)

- Shinhan Life Vietnam builds growth on people strategy (October 07, 2025 | 09:45)

- Insurance sector initiates rapid response after Typhoon Bualoi devastation (October 03, 2025 | 18:25)

- Non-life insurers face mounting pressure after typhoon hits motor sector (October 02, 2025 | 18:59)

- Prudential Vietnam delivers responsible investment package (September 25, 2025 | 10:37)

- Insurers struggle to keep pace with EV rapid adoption (August 29, 2025 | 17:12)

- Non-life insurance market in sees bright spots in H1 despite rising challenges (August 28, 2025 | 16:21)

- Life insurance rebounds with renewed growth and trust (August 06, 2025 | 18:04)

Tag:

Tag:

Mobile Version

Mobile Version