Report depicting global M&A market performance in first half of 2022

According to PwC’s Global M&A Industry Trends: 2022 Mid-Year Update, M&A activity has slowed from its record-setting 2021 pace, with economic headwinds stunting deals in the first half of 2022.

However, activity has merely returned to 2019 levels and dealmaking is expected to play an important role in corporate growth strategies over the next six months,

The fresh report reads that at the start of 2022, dealmakers were riding high from the best year on record for global M&A, with more than 60,000 publicly disclosed deals breaking $5 trillion in value for the first time.

| Although M&A activity has slowed in the first half of 2022, it has merely reset to pre-pandemic levels, which averaged around 25,000 deals per half of the calendar year. |

Fast-forward to mid-2022, M&A activities continue to prosper despite growing headwinds, including rapidly accelerating inflation and interest rates, lower stock prices, and an energy crisis deepened by the Russia-Ukraine conflict.

Many of the factors that underpinned the record-breaking M&A market in late 2021 and the first half of 2022 – such as supply chain resilience, portfolio optimisation, environmental, social and governance, and, above all, the need for technology to digitalise business models – will remain influential for deal-making in the second half of 2022. But the approach to how these deals are done will require a new focus in an uncertain economic environment.

With inflation in many countries hitting a 40-year high, dealmakers will need to approach due diligence with a different lens- forecasting different inflation scenarios and considering implications on market share, price elasticity, customer and supplier relationships, and employee compensation and retention.

The report also indicates that workforce strategy needs to be a priority in any deal.

M&A trends in the first half of 2022

According to the report, although M&A activity has slowed in the first half of 2022, it has merely reset to pre-pandemic levels, which averaged around 25,000 deals per half of the calendar year.

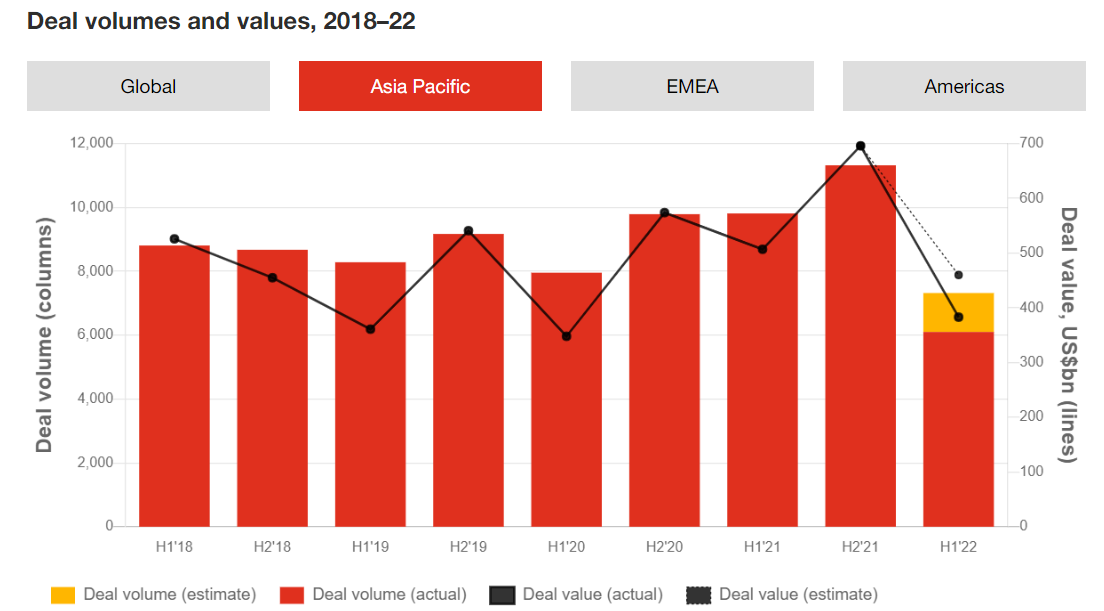

The M&A reset is being experienced across all major regions. Asia-Pacific has experienced the largest declines, with deal volume and values each more than 30 per cent below the 2021 peak, mainly due to macroeconomic headwinds and recent pandemic-related restrictions imposed across several major cities in China.

|

M&A values have also fallen back to similar levels to before the pandemic and deal values in the first half of 2022 of approximately $2 trillion are almost double those recorded in the first half of 2020 – a period which also experienced high levels of uncertainty around economic conditions.

The overall number of megadeals (with a value in excess of $5 billion) globally has declined by a third. However, in the first half of 2022, there were four deals with deal values in excess of $50 billion, compared to just one deal in the whole of 2021.

PE expands its share

The evolution of the private equity (PE) model has made it an engine for M&A, providing a plentiful source of deal-making capital.

Global PE dry powder reached a record $2.3 trillion in June 2022 – triple the amount which existed at the beginning of the global financial crisis. This growth in capital explains why PE’s share of M&A has increased from approximately one-third of total deal value five years ago, to almost half of total deal value today.

But PE is not immune from market volatility and growing uncertainty. Although PE investment has grown, rising inflation and interest rates have made it significantly harder to generate returns.

“Despite macroeconomic headwinds, 2022 will be another robust year for M&A transactions in Vietnam. M&A activities continue to attract a lot of attention from foreign investment funds,” said Tiong Hooi Ong, advisor and partner at PwC Vietnam.

“We're seeing an acceleration of strategic decisions to enhance portfolio optimisation, as dealmakers divest to free up capital to focus on acquiring capabilities and transforming core business areas through M&A.”

Tiong noted that with the supportive regulations and policies for the investors, the second half of 2022 is providing an opportunity for dealmakers to reassess strategy and act boldly.

Dealmakers are adapting to a new business climate. In which, short-term volatility in financial markets, inflationary pressures, rapidly rising interest rates, supply chain disruptions, and geopolitical tensions all appear to be developing into longer-term trends.

“That is the time for true leaders and best-in-class dealmakers to make bold moves and set the stage for the next five years, winning the targets that matter most to their business or portfolio. M&A could be the way to pursue opportunities that deliver value in a challenging economy,” said Tiong.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Nissha acquires majority stake in Vietnam medical device maker (January 26, 2026 | 15:40)

- BJC to spend $723 million acquiring MM Mega Market Vietnam (January 22, 2026 | 20:29)

- NamiTech raises $4 million in funding (January 20, 2026 | 16:33)

- Livzon subsidiary seeks control of Imexpharm (January 17, 2026 | 15:54)

- Consumer deals drive Vietnam’s M&A rebound in December (January 16, 2026 | 16:08)

- Southeast Asia tech funding rebounds on late-stage deals (January 08, 2026 | 10:35)

- DKSH to acquire Vietnamese healthcare distributor Biomedic (December 24, 2025 | 15:46)

- Central Retail refocuses Vietnam strategy with Nguyen Kim exit (December 24, 2025 | 15:01)

- RongViet Securities wins sixth consecutive M&A advisory award (December 22, 2025 | 17:30)

- Kido Group divests from ice cream and frozen foods (December 18, 2025 | 16:49)

Tag:

Tag:

Mobile Version

Mobile Version