Decoding the change of position in the consumer finance market

According to data from the Vietnam Banks Association, in 2021, the total credit balance of member companies almost did not grow compared to the end of 2020. Meanwhile, the average non-performing loans (NPL) ratio went up 9-10 per cent, much higher than 6 per cent in the same period last year.

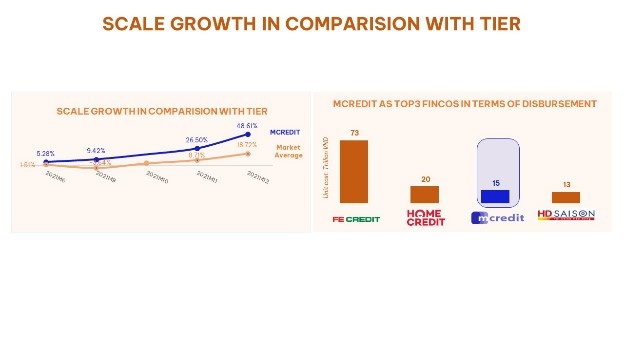

In that general picture, Mcredit’s business results were very impressive, the consumer loan spiked 148 per cent to reach $656.5 million and pre-tax profits amounted to $261.3 million, soaring 87.5 per cent compared to 2020.

Both its return on equity (ROE) and return on assets (ROA) improved markedly. Specifically, by the end of 2021, the company's ROA approximated 3 per cent, higher than that of other firms on an equal footing; while ROE hovered around 29 per cent, leaving quite a distance compared to industry average and 1.5 times higher than average ROE of the top five companies.

As one of the financial companies that actively responded to the State Bank of Vietnam’s call to exempt and reduce interest/fees for customers, Mcredit’s total operating income just inched up 17.78 per cent, which was relative to the 48.61 per cent growth in credit balance.

Despite that, Mcredit still recorded a 5 per cent higher net profit margin at the end of 2021 compared to the previous year, and higher than the market average of nearly 0.42 per cent.

From the fourth position in the consumer finance industry in 2018, by the end of 2021, Mcredit had a total asset scale of nearly $826 million, rising to the third position which previously belonged to HDsaison. With a market share of more than 9 per cent, Mcredit is approaching the second position held by Homecredit continuously for many years.

|

| Mcredit has grabbed the third position in the consumer finance market in Vietnam |

Mcredit's asset quality was also a bright spot on its income statement as the company's NPL decreased from 6.5 per cent in 2020 to 6.2 per cent in 2021.

In contrast to the general trend of the consumer finance industry, asset quality is going down quite quickly with the NPL ratio increasing by nearly 2.5 per cent in 2021 as the customers of consumer finance companies are very sensitive to COVID-19 impacts.

|

| In 2021, Mcredit has managed spectacular growth, efficiency, and asset quality |

Mcredit's asset quality was also a bright spot on its income statement as the company's NPL decreased from 6.5 per cent in 2020 to 6.2 per cent in 2021.

In contrast to the general trend of the consumer finance industry, asset quality is going down quite quickly with the NPL ratio increasing by nearly 2.5 per cent in 2021 as the customers of consumer finance companies are very sensitive to COVID-19 impacts.

|

| Technology and digital transformation are key to Mcredit’s changes |

A small example to see how banking processes and products have been standardised: Currently, it only takes customers three hours for a cash loan and 19 minutes for an instalment loan at Mcredit. Through the website and app, customers can use all of Mcredit's services conveniently.

Technology is key for the company to bolster compliance and accountability of employees, drastically improve customer experience when business processes are tracked on the system.

| Successful digital transformation enables Mcredit to launch a versatile and tailor-made product portfolio according to customer taste, so that Mcredit has a loyal customer base with many good product and services. |

In light of the company's webinar at the beginning of the year, Mcredit's labour productivity has been significantly improved. The profit earned per employee has escalated from $2,740 per person in 2019 to $9,300 million per person in 2021.

Mcredit 's cost-to-incomes ratio at the end of 2021 stood at 33 per cent, 4.2 per cent lower than the average top five companies in the industry. As a result, the company's net profit margin surged to 13.7 per cent from just 8.7 per cent in 2020.

Thanks to the support of technology and process standardisation, in the first quarter of 2022, Mcredit could well manage its asset portfolio and debt quality, with the NPL ratio shedding to approximately 6 per cent.

Outstanding advantage

Mcredit has distinct advantages that few consumer finance companies have, in which the biggest advantage is the customer base that Mcredit can harness in the ecosystem of its parent company MB Group – an ecosystem that provides almost all modern financial services and is close to international standards, from fund management, securities, banking to consumer finance, life and non-life insurance.

In 2022, Mcredit plans to approach more than 10 million existing customers of MB Bank and continue to grow strongly in the coming years leveraging well-conceived strategies and supportive policies from the parent bank.

In the first quarter of 2022, the company had acquired 300,000 new customers, bringing its total number of customers from 1.5 million by the end of 2021 to 1.8 million by March 31.

Successful digital transformation enables Mcredit to launch a versatile and tailor-made product portfolio according to customer taste, so that Mcredit has a loyal customer base with many good product and services. This is the business philosophy that has brought success to MB Bank and Shinsei Bank, which is being applied at Mcredit.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Raised ties reaffirm strategic trust (February 20, 2026 | 14:06)

- Sustained growth can translate into income gains (February 19, 2026 | 18:55)

- The vision to maintain a stable monetary policy (February 19, 2026 | 08:50)

- Banking sector faces data governance hurdles in AI transition (February 19, 2026 | 08:00)

- AI leading to shift in banking roles (February 18, 2026 | 19:54)

- Digital banking enters season of transformation (February 16, 2026 | 09:00)

- IFC to grant $150 million loan package for VPBank (February 13, 2026 | 09:00)

- Nam A Bank forms position as strategic member at VIFC through three key partnerships (February 12, 2026 | 16:39)

- Banks bolster risk buffers to safeguard asset quality amid credit expansion (February 12, 2026 | 11:00)

- VNPAY and NAPAS deepen cooperation on digital payments (February 11, 2026 | 18:21)

Tag:

Tag:

Mobile Version

Mobile Version