Typhoon Yagi a wake-up call for Vietnam’s insurance needs

Super Typhoon Yagi, which struck northern Vietnam on September 7, 2024, remains fresh in the minds of many. As one of the most powerful storms in decades, Yagi brought torrential rains, flooding, and landslides, causing extensive damage to roads, agricultural land, factories, and ports, including major facilities in Hanoi and Haiphong.

The typhoon tragically left more than 325 people dead or missing and severely impacted 1.6 million people across 26 provinces, destroying homes, cutting off essential resources like clean water and electricity, and resulting in economic losses exceeding VND81.5 trillion ($3.39 billion), double the initial estimates.

|

| Damaged buildings and debris on a street after Super Typhoon Yagi hit Halong, in Quang Ninh province, on September 8. Photo: MarsConnect |

This devastation highlighted the severe consequences of underpreparedness, underscoring the critical need for financial resilience. Many affected families and businesses lacked sufficient insurance coverage, leaving them vulnerable to the disaster’s financial aftermath. The typhoon serves as a wake-up call, emphasizing the role of insurance in safeguarding against unexpected events.

Growing importance of insurance

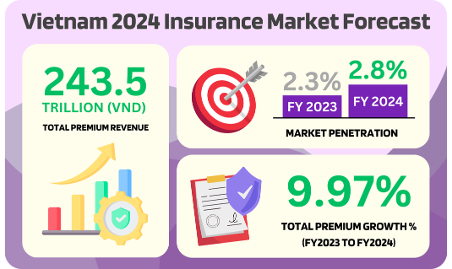

Typhoon Yagi has reinforced the need for greater insurance awareness and coverage in Vietnam. The insurance industry is experiencing growth, with premium revenue expected to reach VND243.5 trillion ($10.15 billion) in 2024, marking a 9.97 per cent increase from the previous year. However, insurance penetration remains low, with only 2.3 to 2.8 per cent of the population insured. This limited coverage exacerbates financial vulnerability, especially in a country frequently affected by natural disasters.

The life insurance sector, however, faced a setback in 2023, with revenues declining by 12.5 per cent due to high-profile scandals that eroded consumer trust. To rebuild confidence, regulatory reforms and increased transparency are essential. On the other hand, non-life insurance continues to grow, with projected growth of 12 per cent in 2024, driven by increased demand for health, property, and disaster coverage. Expanding insurance coverage is vital to foster financial resilience and mitigate the socio-economic impacts of future disasters. Strengthening consumer trust and increasing accessibility can enhance Vietnam’s financial stability, making individuals and businesses better equipped to recover from crises.

|

| Insurance Premiums and Market Forecast 2024. Photo: Marsconnect |

MarsConnect: simplifying insurance for a digital generation

In this landscape, MarsConnect is transforming the insurance market in Vietnam, making financial security more accessible, transparent, and tailored. By leveraging AI-driven technology, expert advisory services, and robust data security, MarsConnect aims to engage young professionals, families, and first-time insurance buyers. The platform offers more than just insurance solutions; it empowers users to build financial confidence and prioritize their security.

MarsConnect simplifies the process of selecting insurance by offering a centralised platform where users can compare, purchase, and manage policies from trusted providers like Bao Viet, AIA, and Sun Life. The user-friendly design makes insurance accessible, especially for newcomers to the industry.

The AI technology at MarsConnect’s core personalises recommendations based on each user’s income, lifestyle, and life stage, ensuring coverage that meets individual needs without unnecessary costs. This approach allows users to make informed decisions, optimising peace of mind and financial resilience. Recognising that insurance complexities can lead to scepticism, MarsConnect provides a personalised experience that builds trust, assuring users that their financial security is a priority.

MarsConnect also focuses on educating users about insurance fundamentals, with clear information on policies, premiums, and coverage options. This educational approach is particularly helpful for those new to insurance, empowering them to make proactive financial decisions confidently. By fostering understanding and engagement, MarsConnect builds lasting relationships with its users.

|

| Photo: MarsConnect |

Commitment to financial literacy and advisory services

MarsConnect is committed to enhancing financial literacy, offering educational resources on various insurance types, coverage specifics, and planning essentials. Users can explore content that guides them in choosing appropriate policies and understanding which coverages are critical at different life stages. By nurturing financial literacy, MarsConnect empowers users to make responsible decisions for their future.

The platform’s AI-driven features also help users navigate insurance options, gaining insights into their financial needs and learning to evaluate policies effectively. This aligns with MarsConnect’s mission to build a financially savvy community, supporting Vietnam’s broader financial resilience.

Beyond insurance, MarsConnect offers certified financial advisory services directly through the platform. Advisors registered with Vietnam’s Ministry of Finance provide unbiased, professional guidance, assisting users in setting and achieving their financial and insurance goals. This service is ideal for those new to insurance or seeking to deepen their financial knowledge. Users can compare advisors, select a suitable match, and receive tailored advice on policies and long-term plans. By combining insurance with expert financial support, MarsConnect enhances user confidence and reinforces trust.

As Vietnam’s middle class expands, so does the demand for accessible and reliable financial tools. MarsConnect is well-positioned to meet this demand, combining advanced technology with consumer insights. For investors, MarsConnect presents a promising opportunity to support a platform poised to capture a significant share of Vietnam’s evolving financial market. With a blend of AI technology, certified advisors, and plans for future expansion into wealth management, MarsConnect aims to redefine financial security in Vietnam.

In a world where financial security is paramount, MarsConnect goes beyond being an insurance platform–it’s a partner in financial empowerment and growth. Download MarsConnect today on the App Store or Google Play and take the first step towards a secure, informed future.

| Vietnam, RoK sign deal to implement bilateral agreement on social insurance Vietnam and the Republic of Korea (RoK) have signed an administrative deal on the implementation of a bilateral agreement on social insurance. |

| Income Insurance explores strategic partnership opportunities to expand in Vietnam Income Insurance, a composite insurance company in Singapore, is exploring potential partnership opportunities, including mergers and acquisitions (M&A), to expand its presence in Vietnam. |

| Vietnam life insurance payouts surge 35 per cent to $1.24 billion in H1 Life insurers in Vietnam disbursed $1.238 billion in claims in the first half of 2024, marking a 35 per cent increase on-year. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- QBE Vietnam: 20-year journey of building trust and enabling resilience (November 20, 2025 | 14:25)

- Hanwha Life hosts training course in South Korea for Vietnamese fintech talents (November 20, 2025 | 09:51)

- Insurers accelerate post-typhoon recovery (October 28, 2025 | 15:31)

- Shinhan Life Vietnam builds growth on people strategy (October 07, 2025 | 09:45)

- Insurance sector initiates rapid response after Typhoon Bualoi devastation (October 03, 2025 | 18:25)

- Non-life insurers face mounting pressure after typhoon hits motor sector (October 02, 2025 | 18:59)

- Prudential Vietnam delivers responsible investment package (September 25, 2025 | 10:37)

- Insurers struggle to keep pace with EV rapid adoption (August 29, 2025 | 17:12)

- Non-life insurance market in sees bright spots in H1 despite rising challenges (August 28, 2025 | 16:21)

- Life insurance rebounds with renewed growth and trust (August 06, 2025 | 18:04)

Mobile Version

Mobile Version