Focused access to funding can ensure stellar growth

The Vietnamese economy grew just over 5 per cent in 2023. What is your comment on this rate as compared to regional nations?

|

| Wanwisa Vorranikulkij, senior economist at the ASEAN +3 Macroeconomic Research Office based in Singapore |

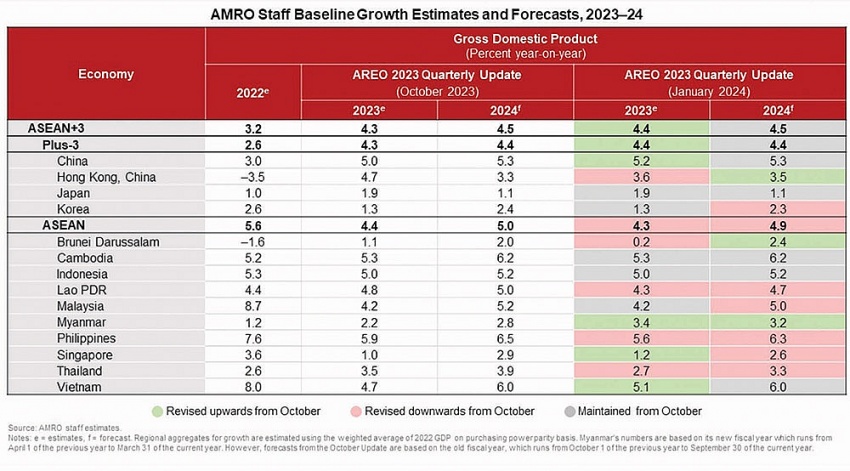

Vietnam’s economic growth weakened in 2023, falling short of the government’s target of 6.5 per cent.

Compared to other ASEAN countries, the 2023 growth remained on the high side. The growth development can be separated into two trajectories.

In the first half of 2023, the Vietnamese economy slowed down to 3.7 per cent on-year, primarily due to external headwinds and a downturn in the housing market.

Export-oriented industries, especially electronics and textiles, experienced subdued overseas orders. The construction sector also slowed down, reflecting sluggish activity in the housing market. Uncertainty in the employment outlook dampened consumer confidence and thus household consumption.

The Vietnamese economy bottomed out in the second half of 2023 and growth rose to 6.3 per cent on-year. A recovery of electronics exports led to the turnaround in exports growth. Business sentiment and employment gradually improved. Additionally, the expedited disbursement of capital investment also helped shore up growth.

The National Assembly has set a 2024 growth target of 6-6.5 per cent. What will be the key impetuses for reaching this?

We projected Vietnam’s economic growth to rise moderately to 6 per cent in 2024. Growth will be led by the continued normalisation of retail goods inventory in the US, the recovery of the global semiconductor market, and stronger demand from the EU.

We expect Vietnam to continue receiving more tourist arrivals, which would help boost consumption. Sustained inflows of foreign direct investment will also spur capital investment and employment.

Looking ahead, risks to the growth outlook are tilted to the downside. The main downside risk stems from external factors. Elevated inflation and tight monetary policy could potentially lead to a recession in the EU and the United States. Meanwhile, China may face weaker economic growth, dragged by a deepening and broadening of weakness in its property sector.

Domestically, the risks are related to excessive leverage by property developers. As a number of corporate bonds will be maturing this year, some developers could face financial distress amid lingering legal bottlenecks and uncertain business outlook. In addition, there are upside risks to consumer prices stemming from extreme weather affecting food production and depreciation of VND.

The Vietnamese government has been flexibly using monetary and fiscal policies in monitoring the economy. What are the effectiveness of these policies?

In light of external headwinds and financial distress in the residential property market, the current accommodative macroeconomic policy and fiscal stimulus are appropriate for supporting growth. There is scope to recalibrate existing support measures to provide targeted support and to further enhance their effectiveness.

Fiscal policy should play a major role in bolstering the economy. The boost to infrastructure development has offset impacts from external headwinds to some extent. Existing economic stimulus measures, in the form of tax and rental deferrals, have also eased corporate financial burdens to a certain extent. To enhance the effectiveness of fiscal policy, the stimulus measures can be recalibrated to support vulnerable households and informal workers.

The current accommodative monetary stance has alleviated the financial burden on micro, small, and medium-sized enterprises (MSMEs) and heavily indebted households. The policy has helped to bolster business and consumer confidence.

Amid the uncertain economic outlook, it is vital to ensure MSMEs have access to financing, and that sufficient funds are made available to productive sectors. The approval process of existing credit support programmes should be streamlined, while credit guarantee schemes to vulnerable MSMEs should be enhanced.

What is your take on the effectiveness of the ASEAN Free Trade Area and other free trade agreements (FTAs) for the Vietnamese performance, especially when it comes to exports?

At present, Vietnam is well-placed to benefit from the myriad of bilateral and multilateral FTAs which were signed in recent years, such as the EU-Vietnam FTA, the Comprehensive and Progressive Agreement for Trans-Pacific Partnership, and the Regional Comprehensive Economic Partnership.

The expanding number of FTAs have helped Vietnam attracted foreign direct investments, which have created numerous jobs, promoted domestic investment, and boosted exports.

|

| Vietnamese economy likely to expand by 6.5 per cent in 2024: Economist The Vietnamese economy is likely to expand by 6-6.5 per cent in the base scenario, with even recovery recorded in all sectors of agriculture, industry, construction and services, Dr. Can Van Luc, a member of the National Financial-Monetary Policy Advisory Council, has predicted. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- IP alterations shape asset strategies for local investors (January 22, 2026 | 10:00)

- 14th National Party Congress: Vietnam - positive factor for peace, sustainable development (January 22, 2026 | 09:46)

- Japanese legislator confident in CPV's role in advancing Vietnam’s growth (January 22, 2026 | 09:30)

- 14th National Party Congress: France-based scholar singles out institutional reform as key breakthrough (January 21, 2026 | 09:59)

- 14th National Party Congress: Promoting OV's role in driving sustainable development (January 20, 2026 | 09:31)

- 14th National Party Congress affirms Party’s leadership role, Vietnam’s right to self-determined development (January 20, 2026 | 09:27)

- Direction ahead for low-carbon development finance in Vietnam (January 14, 2026 | 09:58)

- Vietnam opens arms wide to talent with high-tech nous (December 23, 2025 | 09:00)

- Why global standards matter in digital world (December 18, 2025 | 15:42)

- Opportunities reshaped by disciplined capital aspects (December 08, 2025 | 10:05)

Tag:

Tag:

Mobile Version

Mobile Version