Expand credit to prevent usury, central bank asks

|

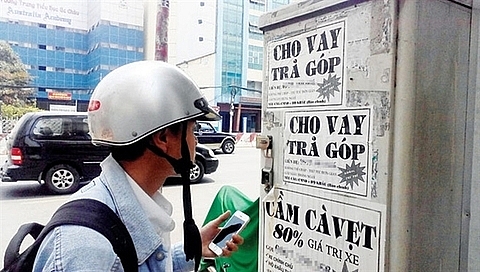

| A man reading an advertisement for lending services. The State Bank of Viet Nam has asked domestic credit institutions and foreign banks’ branches to expand credit for business, production and consumption as an effort to prevent usury. - Photo baodauthau.vn |

In a recently-issued Document No 10340/NHNN-TD, the Governor asked credit expansion to focus on production and business as well as prioritised sectors.

Banks must diversify their credit products with reasonable interest rates to meet the legitimate demand for production, business and consumption, the central bank said, asking simplification of administrative procedures to improve access to credit for enterprises and citizens.

The Governor asked the Bank for Agriculture and Rural Development to speed up the implementation of a consumer credit programme worth VND5 trillion (US$215.5 million).

The Bank for Social Policies would propose a pilot programme for consumer credit for approval with a focus on lending to poor, near-poor and ethnic minority households, according to the central bank.

Financial companies must ensure transparency in interest rates.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- Corporate bond market poised for stronger growth cycle (January 28, 2026 | 17:13)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

Mobile Version

Mobile Version