European blues colour local market

The VN-Index of Ho Chi Minh Stock Exchange (HoSE) sharply fell 4.8 points or 1.18 per cent to 401.03 points, weighed by strong selling pressures in middle of the session.

The VN-Index of Ho Chi Minh Stock Exchange (HoSE) sharply fell 4.8 points or 1.18 per cent to 401.03 points, weighed by strong selling pressures in middle of the session.

Decliners sharply amounted to 175 stocks today, overwhelming 36 up.

Blue-chip Vinamilk (VNM) lost up to VND4,000 or 2.82 per cent to VND138,000. Most the other major stocks ended lower or flat.

Real estate stocks led the losers, with Song Da Urban & Industrial Zone Investment and Development (SJS) hitting the floor, Ho Chi Minh City Infrastructure Investment (CII) and Hoang Anh Gia Lai (HAG) skidded.

Quoc Cuong Gia Lai (QCG), Investment and Trading of Real Estate (ITC), Development Investment Construction (DIG) all saw sharp loses of nearly 4 per cent. Licogi 16 (LCG) also lost 2.61 per cent.

Some major producing stocks like Hoa Phat Group (HPG), Hau Giang Pharmaceutical (DHG), Vinacafé Bien Hoa (VCF) strongly dropped. Meanwhile, Kinh Do Corp. (KDC) slightly gained and FPT Corp. (FPT) ended flat.

Meanwhile, financial shares ended mixed with Military Bank (MBB) up 1.72 per cent and Sacombank (STB) adding 0.74 per cent. Eximbank (EIB) ended flat, while other stocks skidded.

Bond yields on Italian 10-year notes rose to as high as 7 per cent today, triggering fears about bailouts in the nation. Responding to the news, global markets tumbled this morning.

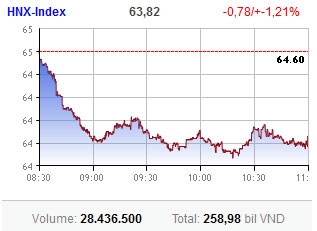

The Hanoi Stock Exchange (HNX) also shed 0.65 points or 1.01 per cent to close at 63.95 points, after up to 191 stocks declining on the bourse.

Liquidity remained low with the total volume standing at 25.3 million shares worth VND512 billion ($24.7 million) on the HoSE, with MBB and Saigon Securities Inc. (SSI) the most active at 1.2 million shares matched each.

Trading volume on the HNX hit 28.4 million shares, worth VND259 billion ($12.5 million).

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- Corporate bond market poised for stronger growth cycle (January 28, 2026 | 17:13)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

Mobile Version

Mobile Version