Deputy PM’s conclusions on interest rate support package

Hanoi - The Government Office has issued an announcement on Deputy Prime Minister Le Minh Khai’s conclusions at a meeting on interest rate support package in accordance with the Government’s Decree No.31/2022/ND-CP dated May 20.

|

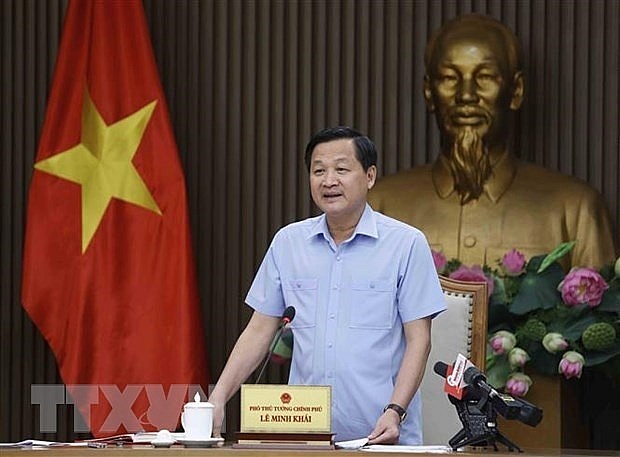

| Deputy Prime Minister Le Minh Khai (Photo: VNA) |

The announcement said after nearly three months, the disbursement of the package remains limited.

The Deputy PM assigned the State Bank of Vietnam (SBV) to work closely with ministries and agencies concerned to review the Decree, the SBV’s Circular and guidelines, ensuring they are in line with the National Assembly’s Resolution No.43/2022/QH15 and the Government’s Report on fiscal and monetary policies in support of the socio-economic recovery and development programme.

In case any too strict regulations are discovered, they must report to competent agencies for revision.

He called for raising awareness of commercial banks, businesses, cooperatives and business households about the package, as well as establishing inter-sectoral working groups led by the SBV to grasp situation at commercial banks and tackle difficulties faced by them during the process.

| Interest rate support package has little effect on stock market As securities and real estate sectors are not on the list to receive support, the 2 percent interest rate support package's positive effects on the stock market are not strong. |

| Vietnam's credit growth expands by over 17 percent Vietnam’s credit growth as of June 9 expanded by 17.09 percent against the same period last year, Deputy Governor of the State Bank of Vietnam (SBV) Dao Minh Tu said on June 15. |

| Big banks hike deposit interest rates Large banks are starting to join the deposit interest rate hike race along with small- and medium-sized banks due to rising capital demand pressure after a long time staying out of the game. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Private capital funds as cornerstone of IFC plans (February 20, 2026 | 14:38)

- Priorities for building credibility and momentum within Vietnamese IFCs (February 20, 2026 | 14:29)

- How Hong Kong can bridge critical financial centre gaps (February 20, 2026 | 14:22)

- All global experiences useful for Vietnam’s international financial hub (February 20, 2026 | 14:16)

- Raised ties reaffirm strategic trust (February 20, 2026 | 14:06)

- Sustained growth can translate into income gains (February 19, 2026 | 18:55)

- The vision to maintain a stable monetary policy (February 19, 2026 | 08:50)

- Banking sector faces data governance hurdles in AI transition (February 19, 2026 | 08:00)

- AI leading to shift in banking roles (February 18, 2026 | 19:54)

- Digital banking enters season of transformation (February 16, 2026 | 09:00)

Tag:

Tag:

Mobile Version

Mobile Version